关键词 > Accounting

Advanced Accounting II (AAII) Assignment–1

发布时间:2024-06-26

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Advanced Accounting II (AAII) Assignment–1

AAII Assignment–1 Questions

Part I: Consolidation and Equity Accounting (70 marks)

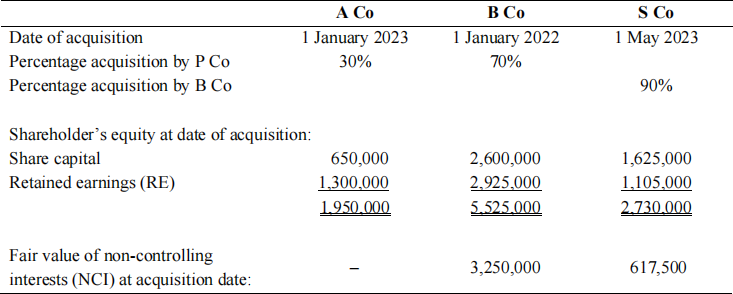

The details of acquisition of A Co, B Co, and S co are shown below.

The fair value (FV) and book value (BV) of net identifiable assets of each company at the date of acquisition are shown below:

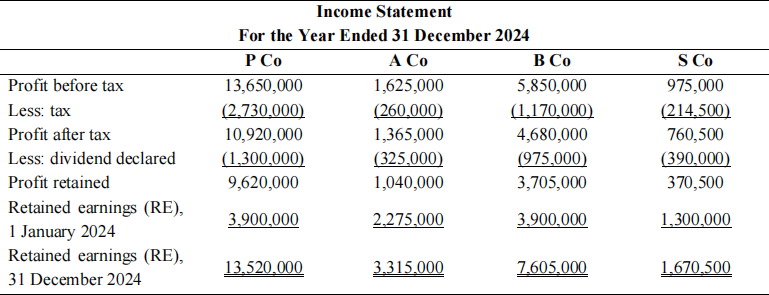

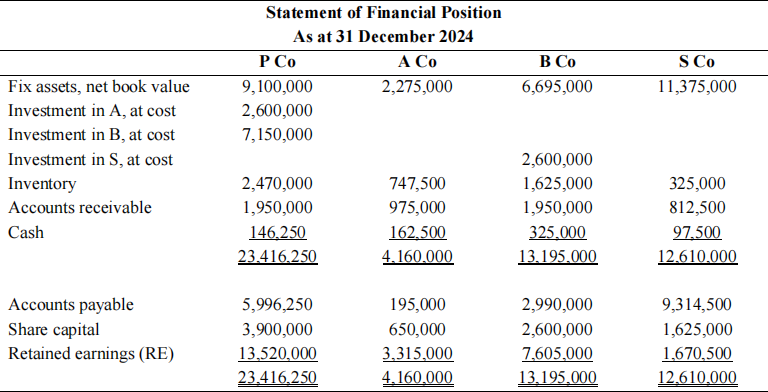

The financial statements of P Co, A Co, Y Co, and Z Co for the year ended 31 December 2024 are shown below:

Additional information:

a) Inventory of B Co at the acquisition date was disposed of in 2023, while inventory of S Co was disposed of in January 2024.

b) The intangible asset of A Co at the date of acquisition had no definite useful life and was tested for impairment on an annual basis. So far, there is no impairment loss arose for the intangible asset.

c) On 1 January 2024, A Co transferred a fixed asset to P Co at a transfer price of $500,000. The original cost of this asset was $600,000 and its accumulated depreciation (using straight-line depreciation method and no residual value) was $200,000 at the date of transfer. The original useful life of the asset was six years and the remaining life as at 1 January 2024 was four years.

d) In May 2023, B Co transferred inventory to A Co at an invoiced price of $650,000. The original cost of the inventory was $455,000.

|

Percentage resold to third parties during 2023 |

20% |

|

Percentage resold to third parties during 2024 |

50% |

|

Percentage unsold as at end of 2024 |

30% |

e) Assume a tax rate of 20%

Required:

1) Prepare the following consolidation and equity accounting entries for P Co and its subseries and associate for the year ended 31 December 2024. (50 marks)

. CJE1: Elimination of investment in B Co;

. CJE2: Adjustment of sale of B Co’s under-valued inventory;

. CJE3: Tax effects of CJE2;

. CJE4: Allocation of share of post-acquisition RE to B Co’s NCI;

. CJE5: Adjustment for NCI’s share of unrealized profit in the beginning RE (sale from B Co to A Co);

. CJE6: Elimination of dividend declared by B Co;

. CJE7: Allocation of current year profit (after tax) to NCI of B Co;

. CJE8: Elimination of investment in S Co;

. CJE9: Allocation of post-acquisition RE to total NCI of S Co;

. CJE10: Adjustment of excess cost of sales on S Co’s over-valued inventory;

. CJE11: Tax effects of CJE10;

. CJE12: Elimination of dividend declared by S Co;

. CJE13: Allocation of current year profit (after tax) to total NCI of S Co;

. EA1: Recognition of share of post-acquisition RE of A Co;

. EA2: Adjustment for unrealized profit (after tax) in the beginning RE of A Co;

. EA3: Reclassification of dividend income as a reduction of investment in A Co;

. EA4: Recognition of share of current year profit (after tax) of A Co.

2) Perform an analytical check of the year-end balances of:

i. Non-controlling interests;

ii. Investment in Associate. (10 marks)

3) Prepare the consolidation worksheets for P Co, B Co, and S Co for the year ended 31 December 2024. (10 marks)

Part II: Short-Answer Questions (30 marks)

a) Referring to Question Part I, Additional Information (d), you are required to explain how gross profits are created through intercompany inventory transfers (including both upstream and downstream sales), and what accounting treatments are needed to record these gross profits? (15 marks)

b) A subsidiary sells land the parent company at a significant gain. The parent company holds the land for three years and then sells it to an outside party, also for a gain. You are required to explain how should the two events be recorded in the group’s consolidated financial statements? (15 marks)