关键词 > ECON23950

ECON 23950: Problem Set 4

发布时间:2024-06-18

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 23950: Problem Set 4

1 MIU Model

We are going study the money-in-the-utility model with capital accumulation. Suppose that the representative household is infinitely-lived and cares about the lifetime utility

subject to the budget constraint

where wt represents real wage and rt k rental price of capital. We assume that the household owns capital and rents it out at price r k . The household can save in the form of capital (I − t), nominal bonds (Bt+1), or money (Mt+1). mt ≡ Mt/Pt represents real monetary balance. The real (nominal) rate of return on bonds from period t−1 to t is rt (Rt). Capital stock follows the following evolution

The economy starts at time zero, and the representative household is endowed with K0 and M0, but no initial debt.

The representative firm has the following production technology (Cobb-Douglas)

and maximizes the period-by-period profit, taking as given the wage and rental price of capital.

Suppose the government levies lump sum taxes Tt

, issues nominal debt Bt

, and raises seigniorage income St = Mt+1 − Mt to finance exogenously determined sequence of  There is no government production. The household takes

There is no government production. The household takes  as given.

as given.

1. Set up the household’s maximization problem in a Lagrangian form. Carefully describe what his choices are.

2. Derive the FOCs.

3. Derive three optimality condtions: (1) MRS between consumption and labor, (2) MRS between consumption and real money, and (3) MRS between current and future con-sumption (EE). Interpret them.

4. Set up the firm’s maximization problem and derive the FOCs.

5. Define the competitive equilibrium of this economy. In other words, describe the market-clearing conditions, the endogenous variables that need to be solved for, and the equations to be used for the solution.

6. Suppose the economy is at a steady state equilibrium so that Kt+1 = Kt = K, Ct+1 = Ct = C, Lt+1 = Lt = L, Gt+1 = Gt = G, Mt+1 = (1 + µ)Mt . Solve for all the endogenous variables of this economy as functions of exogenous variables. (Hint: You may want to solve for capital-labor ratio first, using the Euler equation.) Note that the general price level is now endogenous and (nominal) money supply is exogenous. (Another Hint: Mt = (1 + µ)Mt−1 = (1 + µ) tM0.)

7. Suppose now for simplicity that µ = 0. Does a one-time increase in money supply affect consumption, labor, capital, output, and price? How? Why or why not? Explain intuitively. (Do not explain your math but describe what is going on in the model and explain what economic forces are driving the results.)

8. Suppose now that µ > 0. Does an increase in the rate of money growth today af-fect consumption, labor, capital, and output and price? How? Explain your results intuitively.

9. Do the propositions of monetary neutrality and super-neutrality hold in general? Dis-cuss the effects of (1) rewriting the utility function such that it is not additively sepa-rable between C, m, and L and (2) replacing lump sum taxes with proportional income taxes.

2 Macroeconomic Data - Money

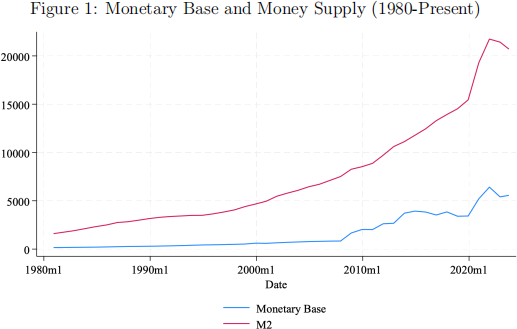

Go to the Federal Reserve Bank of St. Louis Fred database (fred.stlouisfed.org). Display data series of monetary base (BOGMBASE) and M2 (WM2NS) on a same diagram from 1980 to present.

1. Define monetary base and M2. What are the fundamental differences between the two measures of money?

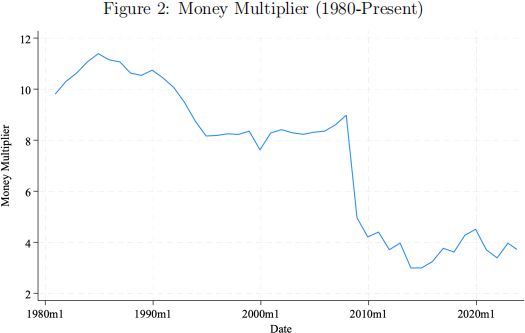

2. Compute money multiplier by dividing M2 by monetary base. What does money multiplier measure in words?

3. Comment on how the money multiplier behaved after the global financial crisis and after the pandemic.

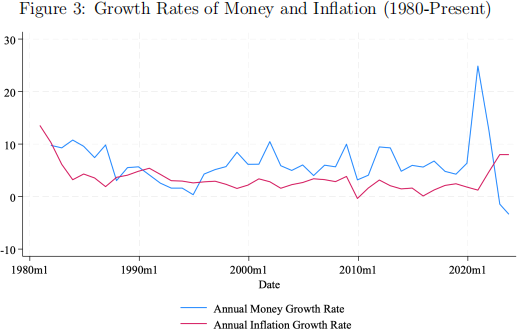

4. Do you see any time-series correlation between monetary growth rate and inflation in the US? Show relevant diagrams and discuss.

3 Friedman on the Role of Monetary Policy

Friedman (1968) is a classic paper on the subject and includes a lot of history of thoughts on monetary policy. You will find it interesting to see how this paper, after almost half a century later, is still very relevant in thinking about current issues such as inflation/price/NGDP targeting, commitment, rules vs. discretion, etc. This paper nicely lays some groundwork for the subjects we cover for the rest of the quarter. Enjoy reading it and answer the following questions:

1. What is “liquidity preference” or a “liquidity trap?”(p2, 6)

2. What is Friedman’s view on the role played by monetary policy in causing the Great Depression?

3. Why can’t the Fed control the rate of interest for a long period? (p6-7)

4. Why is it better to look at the rate of change of the quantity of money, rather than interest rates, to gauge how tight or easy monetary policy is? (p7)

5. What is the “Phillips Curve?” Why is Friedman skeptical about the long run relation-ship between unemployment and inflation? (p9-11)

6. This speech was given in December 1967. What happened to the US economy in the 1970s? Was Friedman’s prediction about the Phillips Curve right?