关键词 > IB2D30

IB2D30 Accounting in Practice 2022-2023

发布时间:2024-06-11

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

|

Module Code |

IB2D30 |

|

Module Title |

Accounting in Practice |

|

Exam Paper Code |

IB2D30_A |

|

Exam Paper Title |

IB2D30_ Accounting in Practice _Exam Paper January 2022-2023 |

|

Duration |

2 hours |

|

Exam Paper Type |

Fixed time - Open Book |

Question 1:

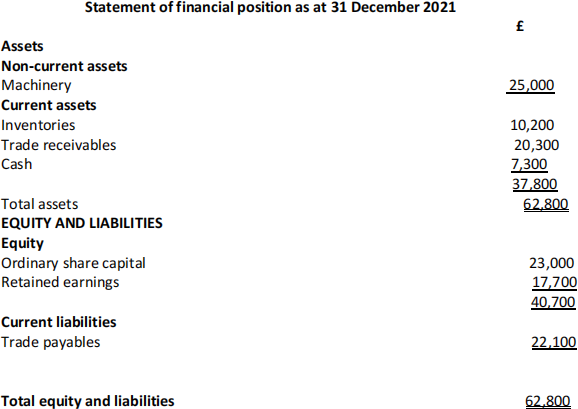

The following is the statement of financial position of Felix Ltd. As at 31 December 2021:

During 2020, the following transactions took place:

1. The owner withdrew equity in the form of cash of £20,000.

2. Premises were rented at an annual rental of £15,000. During the year, rent of £12,000 was paid to the owner of the premises.

3. Rates on the premises were paid during the year for the period £2,000.

4. Wages totaling to £20,200 were paid during the year. At the end of the year, the business owed £960 of wages.

5. Electricity bills for the four quarters of the year were paid, totaling £3,200.

6. Inventories totaling £111,200 were boughton credit.

7. Inventories totaling £12,000 were bought for cash.

8. Sales revenue on credit totaled £225,000 (cost £111,500).

9. Cash sales revenue totaled £50,000 (cost £22,000).

10. Receipts from trade receivables totaled £190,000.

11. Payments to trade payables totaled £120,000.

12. Machine maintenance expenses paid totaled £16,200.

13. Depreciation is charged 10% straight line, the machinery originally cost £50,000.

Required:

a) Prepare an income statement for the year ended 31 December 2022 and a statement of financial position as at that date. (20 marks)

b) Explain why profit is not equal to cash generated from operation. (20 marks)

Question 2

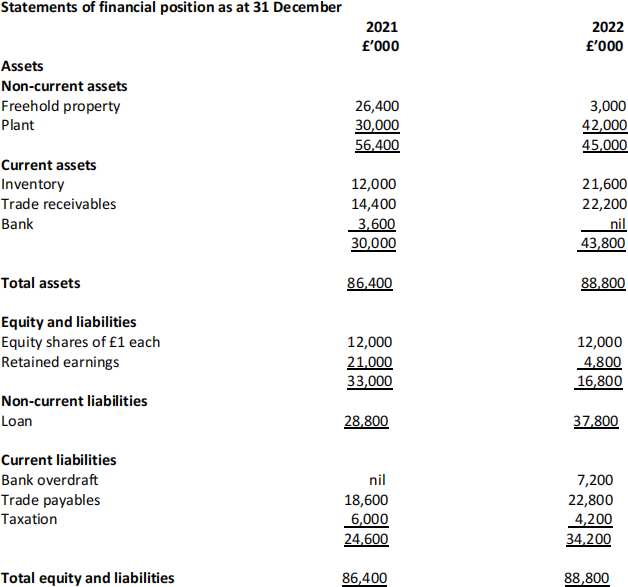

Pear PLC acquired a new piece of plant during 2022 to automate some processes. Some freehold properties were also sold during the year. Pear PLC financial statements for the year ended 31 December 2021 and 2022 areas follows:

The following financial ratios for year ending 31 December 2021 (which can betaken as correct) have been calculated using the above financial statements:

Return on year end capital employed (ROCE) 12·2%

Gross profit margin 12·5%

Operating profit margin 10·5%

Current ratio 1·2

Closing inventory holding period 70 days

Trade receivables’ collection period 73 days

Trade payables’ payment period (using cost of sales) 108 days

Gearing 47%

a) Calculate ROCE, Gross Profit Margin, Operating Profit Margin, Current Ratio, Quick Ratio, Receivables’ Collection Period, Inventory Holding Period, Payables’ Payment period and Gearing Ratios for 2022. (15 marks)

b) Comment on the changes. (5 marks)

Question 3

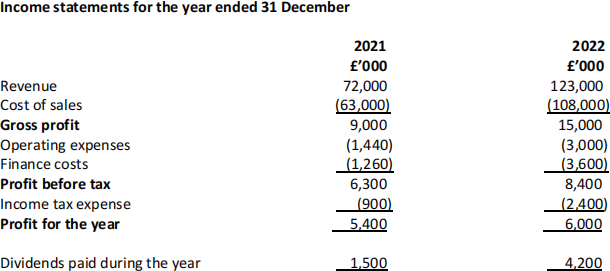

a) Calculate overhead absorption rates for each department using following methods:

i) A machine hour rate in the weaving department

ii) A direct labour hour rate for proofing department

iii) A direct hour rate for finishing department. (15 marks)

b) Why is it important to calculate the cost of a product? (5 marks)

Question 4

Speed Ltd is considering whether to replace one of its existing machines to produce an important component, PS2, more efficiently. So far, £15,000 has been spent on a feasibility study. You have been provided with the following information:

(1) Initial cost of the new machine £20,000

Estimated life 5 years

Estimated residual value after five years £10,000

(2) The company uses straight-line depreciation for all its machines.

(3) The estimated savings to Speed Ltd from replacement of the machine are estimated to be:

i. 500 man hours of maintenance labour per year.

ii. 10 man hours per year for each 10,000 units of PS2 produced.

iii. Wages are estimated to be £34 per hour,

(4) The expected output of PS2 is 200,000 units in the first year, rising by 20,000 per year thereafter. Selling price per unit is £20. Material costs per unitas £8.

(5) The company’s cost of capital is 12% per year.

Assume that all cash flows concerned arise at the end of the year, except as indicated above.

Required:

Advise the directors of Speed Ltd whether the machine should be purchased. Present your main calculations in the form of a table. All computations should be to the nearest whole number. (20 marks)

![]()

![]()