关键词 > 110.309

110.309 ADVANCED FINANCIAL ACCOUNTING SEMESTER ONE 2023

发布时间:2024-06-10

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EXAMINATION FOR

110.309 ADVANCED FINANCIAL ACCOUNTING

SEMESTER ONE 2023

SECTION A: FOREIGN CURRENCY

Scenario Information

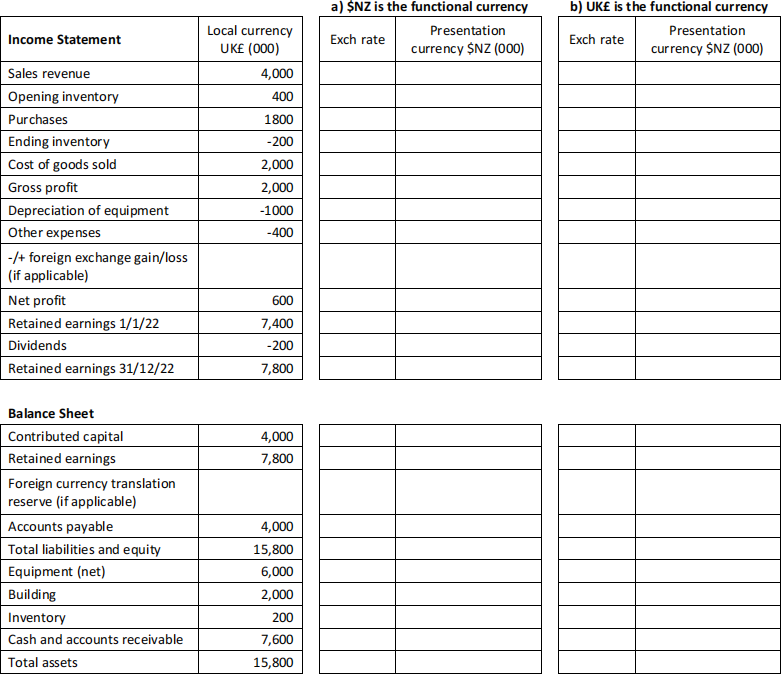

You are the group accountant at Fern Ltd (Fern),a New Zealand company and are about to translate the financial statements of Rose Ltd (Rose),a wholly owned subsidiary of Fern.

Fern acquired all the issued shares of Rose, located in London, United Kingdom on 1 January 2022. Rose prepares its financial statements using its local currency, the UK pound (UK£). The balance sheet of Rose Ltd on 1 January 2022 is as follows:

UK£ 000

Contributed Capital 4,000

Retained Earnings 7,400

Accounts Payable 2,000

Total Liabilities and Equity 13,400

Equipment (net) 7,000

Inventory 400

Cash and accounts receivable 6,000

Total Assets 13,400

The financial statements of Rose at 31 December 2022, the fiscal year end, are provided in the Excel spreadsheet in this examination paper.

Additional information:

• Relevant exchange rates were as follows:

1 January 2022: UK£1.00 = NZ$2.00

1 October 2022: UK£1.00 = NZ$1.70

1 December 2022: UK£1.00 = NZ$1.80

31 December 2022: UK£1.00 = NZ$1.90

Average 2022: UK£1.00 = NZ$1.85

• Dividends were declared and paid on 1 October 2022.

• The opening inventory was on hand at the time of the acquisition of Rose. The closing inventory was acquired on 1 December 2022.

• All of the Equipment was on hand at the time of the acquisition.

• The building was acquired on 31 December 2022.

• Sales, purchases, and other expenses were incurred evenly throughout 2022.

Question 1

Refer to the scenario information in Section A and answer the following question:

Using the Excel spreadsheet template file provided, translate the financial statements of Rose for the year ended 31 December 2022 into New Zealand dollars (NZ$), assuming:

a. The NZ dollar is the functional currency of Rose. (10 marks)

b. The UK pound (UK£) is the functional currency of Rose. (10 marks)

[TOTAL = 20 MARKS]

SECTION B: FINANCIAL INSTRUMENTS Question 2

On 1 July 2022 Brown Ltd issues convertible bonds with a face value of $12 million. The convertible bonds have a 10-year term and mature on 30 June 2032. Interest is payable annually in arrears, i.e., on 30 June each year, and the coupon rate of interest is 6% p.a. At around the same point in time, companies with a similar credit rating issue debt security without a conversion option with a coupon rate of 8% p.a., payable annually.

Required

a. Explain why the coupon rate to holders of the convertible bonds is less than the rate of return offered to investors in the debt securities of other similar companies. (3 marks)

b. Calculate the debt and equity components of the convertible bonds on 1 July 2022. (Show all your workings and round all amounts to the nearest dollar) (6 marks)

c. Provide the appropriate journal entries to record the issue of the convertible bonds on 1 July 2022 (4marks)

d. Provide the appropriate journal entries if all bondholderselect to convert the bonds to ordinary shares at the end of the third year, i.e., 30 June 2025. (7 marks) [TOTAL = 20 MARKS]

SECTION C: ACCOUNTING AND CULTURE/DIVERSITY Question 3

A recent article argues that we need a new definition of accounting. The authors conclude “A broader, clearer, more realistic and ‘game-changing’ definition of accounting, which portrays the discipline as a social and moral practice, as well as a technical practice is an essential step to take.”

(Carnegie, G. Parker, L. and Tsahuridu, E. (2023). Do we need a new Definition of Accounting?”. Acuity, 10(1), pg.13.)

Required

Discuss the above quote, with reference to the influence of environmental/institutional and cultural factors on accounting. In your discussion you are expected to raise at least two well- reasoned points from each of the following (i.e., four points in all):

• Institutional factors that influence accounting;

• Hofstede’s ‘cultural dimensions’ which may influence accounting.

You should also end with an overall conclusion which relates culture, accounting standards and recent events/ developments concerning corporate reporting on sustainability.

[TOTAL = 10 MARKS]

SECTION D: GROUP/CONSOLIDATIONS Question 4

AUCKLAND Ltd acquired 90% of the equity in WELLINGTON Ltd on 1 April 2021 for $400,000 cash. On that date, the Statement of Financial Position of WELLINGTON Ltd showed:

|

Current Assets |

180,000 |

|

Land |

150,000 |

|

Other Assets |

70,000 |

|

Total Assets |

400,000 |

|

Liabilities |

110,000 |

|

Contributed Capital |

200,000 |

|

Retained Earnings |

90,000 |

|

Total Liabilities |

400,000 |

All assets and liabilities were statedata fair value, except for the land which had fair value of $250,000. WELLINGTON Ltd did not revalue that land before the acquisition. The tax rate for consolidation adjustments is 30%.

Assume that non-controlling interest (NCI) is to be calculated using the proportionate-share of the subsidiary’s identifiable net assets (i.e., partial goodwill) method.

WELLINGTON’s profit for the year ended 31 March 2023 was $65,000. No dividends were declared or paid. Retained earnings at 31 March 2022 were $155,000. Contributed capital has not changed since the acquisition.

During the year ended 31 March 2023, the following transactions and events occurred:

1. WELLINGTON sold inventory to AUCKLAND for $110,000, which had cost WELLINGTON $80,000. Half of the goods were still in AUCKLAND’s inventory at the end of the year, and AUCKLAND had paid WELLINGTON in full for the goods. WELLINGTON had not sold any inventory to AUCKLAND previously.

2. AUCKLAND did not sell any goods to WELLINGTON in the current period, but in the previous year AUCKLAND sold goods to WELLINGTON for $220,000, which had cost AUCKLAND $170,000. 25% of those goods were in WELLINGTON’s inventory at 31 March 2022, but all of them had been sold to outside customers by 31 March 2023.

3. AUCKLAND charged management fees of $45,000 to WELLINGTON each year (paid in full during the year).

Required

a. Prepare and present the consolidation journal entries at acquisition date. (8 marks)

b. Prepare and present the adjusting entries required by the transactions/events listed as 1, 2, and 3 for the consolidated accounts for the year ended 31 March 2023, before considering any NCI (Note: You should consider the effect of tax in your answers). (10 marks)

c. Compute and state the amount of NCI in WELLINGTON’s profit for the year ended 31 March 2023. (2 marks)

[TOTAL = 20 MARKS]

SECTION E: SUSTAINABILITY & CLIMATE CHANGE REPORTING/ACCOUNTING THEORIES

Question 5

Sustainability & climate change reporting

“Our Integrated Report is designed to report on how our resources contribute through our retail value creation model to deliver our vision to make sustainable living easy and affordable for everyone. This is demonstrated through the six capitals ….

This Integrated Report has been prepared using the International Integrated Reporting Council’s International Integrated Reporting

Required

Briefly discuss why the aim of Integrated Reporting, as stated in the quote, leads to a narrow focus in financial reporting just like the traditional financial reporting does. (5 marks)

Question 6

Accounting theories

Briefly discuss, based on Legitimacy Theory, three implications for an organisation that fails to comply with the expectations held by society. (5 marks)

[TOTAL = 10 MARKS]

SECTION F: SEGMENT REPORTING AND RELATED PARTY DISCLOSURE Question 7

Segment Reporting

The following segment information is presented for Cadiz Limited. This information is regularly reviewed by the Board of directors of Cadiz Limited.

|

Segments |

Revenue ($000) |

Profit/ (Loss) ($000) |

Segment Assets ($000) |

|

Property |

350 |

130 |

950 |

|

Transport |

150 |

30 |

400 |

|

Education |

70 |

20 |

120 |

|

Electrical |

45 |

(15) |

80 |

|

Total |

615 |

165 |

1550 |

Required:

Determine which divisions must be reported separately as segments in accordance with NZ IFRS 8. (6 marks)

Question 8

Related Party Disclosure

In accordance with NZ IAS 24, explain FOUR conditions for an entity to be classified as related to areporting entity. (4 marks)

[TOTAL = 10 MARKS]

SECTION G: ACCOUNTING FOR AGRICULTURE Question 9

Explain, using an example, what a biological asset is? Your example should be expanded to illustrate how the biological asset differs from its related agricultural produce or processed products. (4 marks)

Question 10

What particular attributes of biological assets differentiate them from other assets? (6 marks) [TOTAL = 10 MARKS]