关键词 > EC2066

EC2066 Microeconomics

发布时间:2024-05-16

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EC2066 Microeconomics

SECTION A

Answer all FIVE questions from this section (8 marks each).

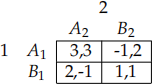

1. Consider the following simultaneous move game with two players.

Find all Nash equilibria of the game above. Relate the equilibria of the game informally to the phenomenon of runs on banks that are solvent.

2. Highways are built using tax revenue. Therefore asking taxpayers to pay a toll to drive on a highway reduces efficiency. Is this true or false? Explain your answer carefully.

3. A risk neutral principal employs an agent to work on a project that can yield a high profit or a zero profit. High effort (eH) by the agent makes high profit more likely compared to low effort (eL).The agent’s utility function is u (w) - c (e) where w is the wage paid to the agent, e is the effort level, and c (e) is the cost of effort, where c (eH) > c (eL) > 0.

Suppose the principal can observe the agent’s effort level, and suppose u\ (w) > 0, u\\ (w) < 0.

In this case, the best policy for the principal is to pay the agent a wage that is independent of the profit level. Is this true or false? Explain your answer carefully.

4. If the price elasticity of supply is zero, while the absolute value of demandelas- ticity is strictly positive and finite, a per-unit tax of t on consumers will (a) lower the market price by t and (b) create a deadweight loss. Is (a) true or false? Is (b) true or false? You must explain your answer using a suitable diagram.

5. Externalities would not lead to market failures if all relevant markets were present. Is this true? If true, what might cause some markets to not be present? Explain using any result from your course, and provide relevant examples.

SECTION B

Answer THREE questions from this section (20 marks each).

6. In a competitive market for corn, the demand function is Q = 30 - P and the supply function is Q = P - 10, where Q denotes quantity and P denotes price.

(a) To raise the earnings of corn producers, the government announces a sup- port price PS = 25. This is a minimum price guaranteed by the govern- ment. If this is higher than the market price, the government buys up all excess supply at the support price. Calculate the producer surplus under the price support policy. How much do producers gain under the policy? [7 marks]

(b) Instead of a price support, suppose the government announces a per-unit subsidy of s to suppliers. Calculate the producer surplus under the sub- sidy. Using this,calculate the value of s for which the producer surplus is the same as in part (b). [6 marks]

(c) Suppose one of the two policies must be chosen. Based on economic con- siderations, which of the two policies above would you recommend? Ex- plain your answer carefully, using any appropriate calculations, diagrams or arguments. Can you recommend any policy (other than the two policies above) that would generate the same producer surplus as in part (a), but not create any deadweight loss? [7 marks]

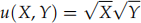

7. An agent consumes good X and a composite of all other goods Y. The agent’s preferences are represented by the utility function

The price of Y is 1, and the price of good X is p. The agent has an income of M > 0.

Suppose M = 144. Suppose initially the price of X is 16, and then the price falls to 9.

(a) Calculate the total price effect of the fallin price on the demand for X. [5 marks]

(b) Calculate the income effect and substitution effect of the fallin price on the demand for X. [5 marks]

(c) Calculate the compensating variation of the price change. [5 marks]

(d) Now suppose the agent’s utility function is u (X, Y) = X2 + Y2. Calculate the income effect and substitution effect of the fallin price on the demand for X in this case. Explain the intuition for your result. (Hint: If you have the correct intuition, the result would follow immediately.) [5 marks]

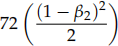

8. Two firms each produce an output of 10 units. The production process for each firm generates 72 units of pollution. Firm 1 can reduce pollution to 72 β1 units, where 0 < β1 < 1, by incurring a cost of

while firm 2 can achieve a reduction to 72 β2 units, where 0 < β2 < 1, by incurring a cost of

Suppose a regulator sets an overall cap at 72 units of pollution and allocates 36 units of pollution rights to each firm.

(a) Suppose each firm must reduce pollution to the number of units of allo- cated pollution rights. What is the total cost of reducing pollution to the overall cap? [6 marks]

(b) Suppose pollution rights could be reallocated across firms so that 1 reduces pollution to 72 β1 and 2 reduces pollution to 72 β2 where β1 and β2 are positive numbers and β1 + β2 = 1. In this case, what would be the lowest cost of reducing pollution to the overall cap? Do you get a corner solution? Explain the intuition for your answer. [8 marks]

(c) Suppose the firms can trade pollution rights between themselves, and the price of a unit of pollution right is p. For what values of p is it possible to achieve the lowest cost of reducing pollution as derived in part (b)? [6 marks]

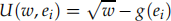

9. Consider the following exchange economy. There are two goods, tea and coffee, and two consumers, 1 and 2.

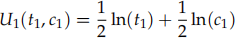

Consumer 1 has utility function

where t1 and c1 are the amounts of tea and coffee (respectively) that Consumer

1 consumes. Similarly, Consumer 2 has utility function

where t2 and c2 denote the amounts of tea and coffee (respectively) that Con- sumer 2 consumes. Consumer 1 is endowed with 25 units of tea and 15 units of coffee. Consumer 2 is endowed with 15 units of tea and 55 units of coffee.

Suppose the price of coffee is normalised to 1, and let p denote the price of tea.

(a) Derive the competitive equilibrium price of tea, and the equilibrium allo- cation of tea and coffee. [7 marks]

(b) Derive the contract curve for this economy as a function of c1 and t1. Using this, explain whether the equilibrium allocation derived in part (a) is effi- cient. If we change the preferences so that the marginal rate of substitution of consumer 1 changes, would the resulting equilibrium allocation still be efficient? What general result supports your conclusion? [7 marks]

(c) If we can redistribute endowments suitably, is it possible to sustain the al- location with t1 = 1, c1 = 5 as an equilibrium? Explain, using any relevant result from your course to support your arguments. [6 marks]

SECTION A

Answer all FIVE questions from this section (8 marks each).

1. In the signalling model of education, separating equilibria in which education acts as a signal of ability would break down if the costs of acquiring education are equal for individuals with different abilities. Is this true or false? Explain your answer.

2. The utility function of a consumer over two goods x andy is given by

u(x, y) = 20ln x + 2y

The price of y is 1. Let p denote the price of x. The consumer has an income of M > 10. The consumer’s price elasticity of demand for x has a lower absolute value compared to the income elasticity of demand for y. Is this true or false? Explain by calculating both elasticities.

3. A society consists of 3 identical individuals who derive utility from a public good. The public good can be provided at a constant marginal cost of 2. Let xi denote the level of public good provision by i, where i = 1,2,3. Let X = x1 + x2 + x3 be the total provision. The net beneit enjoyed by individual i from providing xi units of the public good is given by

U(xi, X) = 4ln X - 2xi

where i = 1,2. Is the total provision X* under individual optimisation higher or lower than the socially optimal level of provision X0? Explain the intuition for your result.

4. If the price of a factor of production rises, a proit maximising irm might use more of that factor. Is this true or false? Explain your answer by drawing com- parison for consumer choice for a Giffen good.

5. Consider an economy with two goods, A and B. Suppose the price of good A is p and let the price of good B be 1. There is a large number of identical consumers. The indifference curves of consumers have the usual shape with diminishing marginal rate of substitution between the two goods. Suppose the government must raise a tax revenue of R, and can do this either by imposing a per-unit tax of ton good A, or by imposing a lump-sum tax T on each consumer. Which policy would the consumers prefer? Explain your reasoning carefully, using any appropriate diagram, and explain the intuition behind your result.

SECTION B

Answer THREE questions from this section (20 marks each).

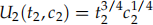

6. (a) For the following extensive-form game:

i. Identify the pure and mixed strategy Nash Equilibria. [8 marks]

ii. Is the set of pure and mixed strategy Subgame Perfect Nashequilibria of the game different from the set of equilibria identiied in part (a)? Explain (a couple of sentences should sufice). [6 marks]

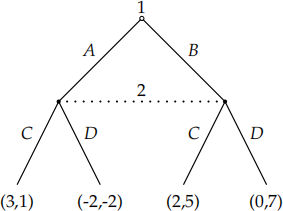

(b) Consider the simultaneous-move game below with two players, 1 and 2. Each player has two pure strategies. If a player plays both strategies with strictly positive probability, we call it a strictly mixed strategy for that player. Show that there is no Nash equilibrium in which both 1 and 2 play

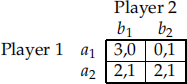

7. A risk-neutral principal hires an agent to work on a project at wage w. The agent’s utility function is

where g(ei) is the disutility associated with the effort level ei exerted on the project.

The agent can choose one of two possible effort levels, e1 ore2, with associated disutility levels g(e1 ) = 4, and g(e2 ) = 2.5. If the agent chooses effort level e1, the project yields 100 with probability 1/2, and 0 with probability 1/2. If he chooses e2, the project yields 100 with probability 1/4 and 0 with probability 3/4.

The reservation utility of the agent is 0.

(a) If effort is observable, which effort level should the principal implement? Derive the best wage contract that implements this effort. Does this involve sharing risk with the agent? Explain your answer. [6 marks]

(b) If effort is not observable, which effort level should the principal imple- ment? What is the best wage contract that implements this effort? [7 marks]

(c) Suppose an insurance company observes the wage contract offered to the agent in part (b), and knows the probabilities associated with each wage level, and assumes these to be ixed. Suppose the insurance company offers the agent full insurance at a premium of 24 (the premium is paid by the agent to the insurance company whether the wage is high or low, and the insurance company covers the loss in income if the wage is low). Would the agent accept this, and would the insurance company make a proit from this? [7 marks]

8. Suppose there are two identical irms in an industry who compete by setting quantities. The output of irm 1 is denoted by q1 and that of irm 2 is denoted by q2. Each irm faces a constant marginal cost of 3. Let Q denote total output, i.e. Q = q1 + q2. The inverse demand curve in the market is given by

P = 15 - Q

(a) Find the Cournot-Nash equilibrium quantity produced by each irm and the market price. [5 marks]

(b) If the irms could collude, what would be the total output in the mar- ket? Assuming each irm produces half of the collusive output, what is the proit of each irm? [5 marks]

(c) Suppose each irm produces half of the collusive output identiied in part (b). Firm 1 considers a deviation from this arrangement. What would be the best deviating output ofirm 1 and its deviation proit? [5 marks]

(d) Suppose irms interact repeatedly over an ininite horizon, and irms have a common discount factor δ ∈ (0,1). Specify a trigger strategy for each irm to sustain the collusive arrangement as an equilibrium outcome. Cal- culate the minimum value of δ for which such a trigger strategy can sustain collusion as an equilibrium in the repeated interaction. [5 marks]

9. A monopolist produces a good at a constant marginal cost of 4. Suppose the monopolist is able to practice irst-degree price discrimination (FDPD). The (in- verse) market demand function for the good is given by

P = 10 - bQ

where P is price, Q is quantity and b > 0 is a constant. Let DL(Q) denote the deadweight loss at quantity Q, and let CS(Q) denote the consumer surplus at Q.

(a) Under FDPD, the marginal revenue function of the monopolist is the same

as the market demand function. Is this true or false? Explain carefully. [8 marks]

(b) Let Q* be the monopolist’s optimal quantity under FDPD. Calculate the value of CS(Q* ) - DL(Q* ). [7 marks]

(c) Suppose a regulator imposes a per-unit tax of t on the monopolist andre- distributes tax revenue to consumers, so that tax revenue becomes part of consumer surplus. Let Qt(*) be the monopolist’s optimal quantity under FDPD given a per-unit tax of t. Calculate the value of t that maximises CS(Qt(*)) - DL(Qt(*)). [5 marks]