关键词 > FINANCE251

FINANCE 251: Financial Management Semester One, 2024

发布时间:2024-05-15

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINANCE 251: Financial Management

Semester One, 2024 (1243)

Assignment PART 1

Instructions:

This is a Group assignment (Part 1) which also includes an Individual component (Part 2).

There are two outputs for this assignment – Part 1: a written business report (identified in Tasks 1 to 5) and Part 2: a written memorandum.

Part 1 of this assignment is worth a maximum of 100 marks and contributes up to 20% of your overall mark for the course.

A Marking Rubric is attached (on the penultimate page) that identifies the way in which marks will be allocated for Part 1 of the assignment.

Part 1: The word-limit for the group report is 1,500 words, excluding tables, diagrams etc. This word limit is a maximum, not a target. The due date for this report is 11.59pm on Friday 17th May 2024. You must submit your completed assignment on or before this date.

Late Submissions: Any assignment that is submitted late will be subject to a penalty, equivalent to 10% of the total marks available for the assignment, per day. No late assignments will be accepted after 11.59pm on Monday 20th May 2024.

You are required to present some of your answers using excel. Please refer to https://www.learninghub.ac.nz/maths/excel/getting-started-with-excel/ for guidance on using excel.

The final requirement in the assessment is to write a report to the CFO of EROAD. Marks will be awarded for the format of your answer. Please refer to https://www.learninghub.ac.nz/report- writing/ for guidance on report writing.

Where a question requires calculations, you should clearly show these calculations. In the event of an answer being incorrect partial marks may be awarded where workings are show.

This is an assessment item and no further assistance or information about this assignment will be provided by the FINANCE 251 teaching team.

CASE STUDY: EROAD

EROAD Limited is a New Zealand-based technology company that specializes in providing fleet management, compliance, and electronic road user charging solutions for the transport and logistics industry. It was founded in 2009 by Steven Newman and Brian Michie. The company is headquartered in Auckland, New Zealand, and dual-listed on the Australian Stock Exchange (ASX), and New Zealand Exchange (NZX). Its US business is based in Portland, Oregon, serving customers with vehicles operating in every US mainland state.

EROAD's journey began with the development of electronic road user charging (RUC) systems, which allowed for automated and accurate tracking of road usage taxes for heavy vehicles. This innovation helped streamline compliance processes for fleet operators, reducing administrative burdens and errors. As EROAD continued to grow, it expanded its operations beyond New Zealand, venturing into the Australian market in 2012. The company's expansion was fuelled by increasing demand for its innovative solutions and a growing recognition of the importance of technology in the transportation industry.

In 2014, EROAD listed on the New Zealand Stock Exchange (NZX) under the symbol ERD, raising $46million capital to support its expansion and development of new products and services. As the company continued to grow, it expanded its offerings to include electronic logging devices (ELD) and fleet management solutions. These offerings not only enhanced compliance but also improved operational efficiency and safety for its customers.

By 2017, more than 50% of heavy transport RUC was collected electronically, representing a rapid transition to e-commerce on a voluntary, industry-led basis, due to the cost-savings and benefits to customers. In 2020 EROAD was listed on the ASX and raised $50 million via a $42 million underwritten placement at $3.90 a share, together with an $8 million share purchase plan.

In December 2021 following THE New Zealand Commerce Commission’s decision to grant clearance for the acquisition, EROAD announced that it had acquired 100% of Coretex Limited a provider of vertically specialized enterprise-grade telematics solutions in North America, Australia and New Zealand.

Steven Newman, CEO of EROAD announced at the time: “We have consistently stated that acquisitions would be part of our global growth strategy. To accelerate growth, any acquisition target needed to deliver increased capability, improved customer experiences and access to additional market verticals.”

The Investment Opportunity

The London congestion charge is a fee charged on most cars and motor vehicles being driven within the Congestion Charge Zone in Central London. Inspired by Singapore's Electronic Road Pricing (ERP) system, the charge was first introduced in 2003. The London charge zone is one of the largest congestion charge zones in the world. The charge not only helps to reduce high traffic flow in the city streets, but also reduces air and noise pollution in the central London area and raises investment funds for London's transport system.

In 2013 the Ultra Low Emission Discount (ULED) introduced more stringent emission standards that limited the free access to the congestion charge zone and in 2019 the Ultra Low Emission Zone (ULEZ) was introduced, which applies 24/7 to vehicles which do not meet the emissions standards.

Enforcement is primarily based on automatic number-plate recognition (ANPR) which has proven to be problematic. Transport for London (TfL) is responsible for the charge but the system has been operated on a day-to-day basis by IBM since 2009. EROAD has seen an opportunity to expand into this market through the acquisition of IBM’s operating subsidiary Highway Analytics Limited (HAL) that is responsible for management of the London congestion charge scheme.

After your study at the University of Auckland you have been employed by EROAD as part of its finance team where you will be reporting directly to Margaret Warrington CFO of EROAD. Your job is to analyse the financial viability of the acquisition of HAL and, in particular, advise Margaret on the appropriate price to pay IBM for the business.

Please note: EROAD is a real New Zealand company but the details of the case are entirely fictitious. For the purposes of this assignment all figures are quoted in NZ$.

You have gathered the following detail to assist in your analysis:

Financial Information Tables:

Table 1 – Market Revenue Estimates

The London congestion charge is expected to produce NZ$500 million equivalent for TfL in the 2024- 2025 financial year and this is expected to grow by 5% annually. HAL’s revenue for operating the system is 10% of total charges collected (you can assume this is the value for Y1).

HAL’s

Table 2 – Operating Estimates

The current contract between HAL and TfL expires in 5 years-time. During this time period the following operating costs are expected:

Cost of Goods Sold are expected to be 90% of revenue.

Fixed costs of production (excluding depreciation) are expected to be $5,000,000 p.a. PPE will be depreciated on a straight-line basis at $3,000,000 p.a.

At the end of the initial 5-year period it HAL has first-option to renew the contract with TfL. This right of renewal occurs every five years. In this respect it is assumed that the contract will simply be “rolled over” perpetually. To simplify things you have decided to assume that the annual free cash flows to the firm will increase at a modest rate of 2% annually.

Table 3 – Economic and other data

The company tax rate is 28%

Assume tax in any year is payable in full at the end of that year.

Assume that tax rebates can be off-set against other division profits and represent a cash inflow in the same year they occur.

Borrowing rate for EROAD – 10.00% p.a. The risk-free rate is currently 3.50%p.a.

The expected market return is currently around 10%.

Table 4 - Company Information

You have been able to collect financial information and returns data for HAL which is contained in the spreadsheet accompanying this assignment. Because both companies operate in the same market, they are both likely to have the same equity beta.

EROAD intends to undertake a further round of fundraising to finance this project. The fundraising will consist of two parts:

· Equity: EROAD will complete a private placement of new shares

· Debt: EROAD will borrow the balance of funding required.

Once both funding rounds have been completed EROAD’s Debt to Equity (D/E) ratio is expected to be 25%.

Tasks:

1. Determine HAL/EROAD’s equity beta and therefore EROAD’s WACC that is applicable for use in your financial analysis. (Show all your workings and round your WACC calculation upwards to the nearest half percent). (10 marks)

2. Prepare an excel table calculating all HAL’s cash-flows over the first five years (display whole dollar amounts only), and calculate the appropriate Terminal Value of the company. (20 marks)

3. Calculate the maximum value (NPV) of HAL to EROAD based on your findings. (5 marks)

4. You are unsure of the reliability of your estimates and want to know how sensitive the price is to volatility in a number of areas. Select three variables that you consider will have the biggest impact on EROAD’s investment decision. Use your spreadsheet to conduct a sensitivity analysis on the project by separately changing each of these variables and comment on the impact of each on the valuation of HAL. (15 marks)

5. Write a report to Margaret Warrington, Chief Financial Officer of EROAD, summarising your findings. Identify the purchase price range through which the investment opportunity is financially viable to EROAD. Recommend whether EROAD should or should not proceed and clearly justify your recommendation based on your findings. (50 marks)

FINANCE 251 Assignment Part 1 Group Report Marking Rubric

|

|

Advanced A– to A+ |

Proficient B– to B+ |

Developing C– to C+ |

Below Standard D |

|

Report |

||||

|

Report Structure 5% of total |

Follows required report format as outlined in writing guide and fully employs APA 7 referencing. |

Mainly follows required report format as outlined in writing guide and mainly employs APA 7 referencing. |

Inconsistently follows required report format as outlined in writing guide or only partially employs APA 7 referencing. |

Does not follow required report format as outlined in writing guide and does not employ APA 7 referencing. |

|

Content depth 20% of total |

Content demonstrates relevant technical depth and insight supported by strong evidence. |

Content mainly demonstrates relevant technical depth and insight supported by evidence |

Content demonstrates some relevant technical depth and insight not supported by sufficient evidence |

Content demonstrates very little technical depth or insight and is not supported by evidence |

|

Links to appendices 10% of total |

Consistent and clear links to appendices to support findings. |

Clear links to appendices |

Inconsistent or unclear links to appendices |

No links to appendices |

|

Recommendation 15% of total |

Clear recommendation and strong justification |

Recommendation satisfactory and reasonably justified |

Inadequate recommendation and justification |

Incorrect or missing |

|

Appendix |

||||

|

Beta and WACC 10% of total |

All relevant data referred to Correct application of data Correct calculation/justification. |

Not all relevant data referred to or incorrect application of data or incorrect calculation or justification. |

Not all relevant data referred to and incorrect application of data and incorrect calculation and justification. |

Inappropriate data used or missing No attempt made at calculation or justification. |

|

Spreadsheet 20% of total |

Appropriate layout Correct treatment of variables Correct calculations. |

Mainly appropriate layout Correct treatment of most variables Correct calculations. |

Inappropriate but readable layout Correct treatment of some variables Some correct calculations. |

Inappropriate layout Incorrect treatment or missing variables Incorrect calculations. |

|

Sensitivity Analysis 15% of total |

Three appropriate variables selected + All calculations correct + Clear and detailed analysis provided. |

Three variables selected. + calculations correct. + Good analysis provided. |

Inappropriate variables selected. and/or not all calculations correct. and/or analysis provided was not clear. |

Missing |

|

Value 5% of total |

calculations correct. |

Some errors in the calculations |

Major errors in the calculations |

Missing |

Notes:

1. Your excel spreadsheet from Task 2. Together with calculations from Task 1. and Task 3. should appear as appendices/attachments to your report. The spreadsheet and calculations should be used to support the discussion and recommendations in your report.

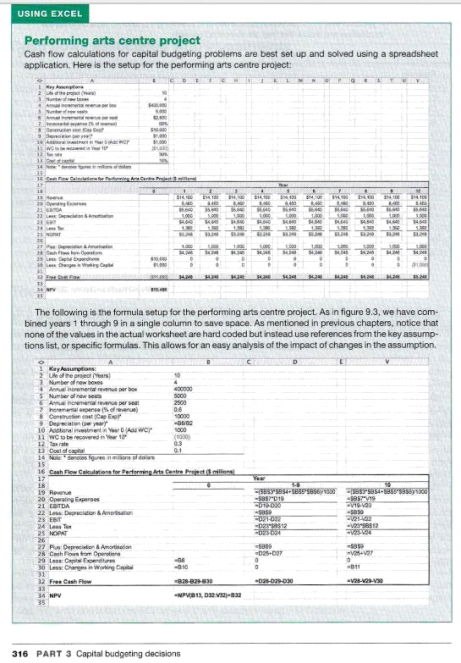

2. The table showing the project’s cash flows in Task 1. must be laid out in the same way as the “Performing arts centre project” excel example on page 316 of the course textbook. An image of this page from the textbook is presented below for those students who do not have a copy or access to a copy of the text.

|