关键词 > IB2D90

IB2D90 Finance in Practice Exam Paper Summer 2022-23

发布时间:2024-05-10

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

|

UNIVERSITY OF WARWICK |

|

|

Department |

Warwick Business School |

|

Level |

2 |

|

Module Code |

IB2D90 |

|

Module Title |

Finance in Practice |

|

Exam Paper Code |

IB2D90_A |

|

Exam Paper Title |

IB2D90_ Finance in Practice_Exam Paper [Summer] 2022-23 |

|

Duration |

2 hours |

|

Exam Paper Type |

Fixed time – Open Book |

SECTION A

Answer ALL questions in this section. Each question is worth 5 marks.

For numerical questions, please round decimal numbers to 2 decimal points and if you think there is missing information necessary to answer the question, you can make your own assumptions, provided that you state your assumptions clearly in your answers.

[Question A1]

“IRR will not exist in situations where NPV is positive for all values of the discount rate. Thus, in these situations, the IRR rule cannot be used”. Is this statement true or false? In no more than 10 lines, please justify your answer. [5 marks]

[Question A2]

“A zero-coupon bond is less sensitive to the interest rate changes than a 5% coupon bond with the same time to maturity”. Is this statement true or false? In no more than 10 lines, please justify your answer. [5 marks]

[Question A3]

In no more than 10 lines, please use your own words to discuss the implications of investors’ personal taxes on dividend policy of the company. [5 marks]

[Question A4]

In no more than 10 lines, please use your own words to discuss the concept of market efficiency, the basic forms of market efficiency and a brief example of each form of market efficiency. [5 marks]

[Question A5]

In no more than 10 lines, discuss the payoff of the holder of a European call option, and the put-call parity. [5 marks]

SECTION B

Answer ALL questions in this section.

For numerical questions, please round decimal numbers to 2 decimal points and if you think there is missing information necessary to answer the question, you can make your own assumptions, provided that you state your assumptions clearly in your answers.

[Question B1]

Consider the following projects A-D, with cash flows given in million $s.

|

Project |

Time (years) |

β (beta) |

r (discount rate) |

NPV |

|||||

|

0 |

1 |

2 |

3 |

4 |

5 |

||||

|

A |

-110 |

25 |

25 |

25 |

25 |

25 |

? |

7.60% |

? |

|

B |

-130 |

40 |

40 |

50 |

40 |

0 |

0.8 |

? |

? |

|

C |

-90 |

274 |

-110 |

? |

0 |

0 |

1.2 |

? |

13.38 |

|

D |

-60 |

75 |

0 |

0 |

0 |

0 |

? |

? |

9.45 |

The negative cash flow at time 0 (today) is the required initial investment for each of the projects. The other numbers for years 1 to 5 are the expected cash flows to be received at the stated times; e.g. the 50 million for project B is expected three years from now. If a cash flow is negative, it means an additional amount is expected to be invested. Assume an annual risk-free rate of 2%, and a market return of 8%. Round all your answers to 2 decimals.

(a) Determine the information that is missing in the table, denoted by question marks. [8 marks]

(b) For project C, recalculate the NPV for the discount rates of -133.813%, -1.191%, and 139.448% while using the year-3 cash flow you calculated in part (a). What do we learn about the IRR (internal rate of return) of the project from these numbers and why is it important? [4 marks]

(c) Calculate the profitability index (PI) for projects with positive NPV, and determine the ranking of the projects based on this. Comment on the applicability of PI for capital budgeting. [3 marks]

(d) Based on the table with the completed information, describe the optimal investment strategy if only one project can be taken. Explain your reasoning briefly. [3 marks]

(e) What is the optimal investment strategy if any number of projects can be taken, but you have only $190 million available for investments at time 0? How is your answer related to part (c)? [4 marks]

(f) What is the payback time (PT) for projects A, B, and D? Comment on the use of payback time to make capital budgeting decisions. [3 marks]

[Question B2]

a) Briefly explain (in no more than 7 lines) why risk averse investors expect to earn higher returns for the same level of risk than risk neutral investors. [3 marks]

Suppose you are a junior fund-manager who advises two investors: Laura and Richard. The investors can invest only in two assets: the stock of GoGrow and T-Bills. They can go long or short sell these assets, if they prefer. You estimate the market beta of GoGrow to be 1.2. Assume that T-bills generate 4% per year and the expected return on S&P 500 is 8.7%.

b) Laura is risk averse. She does not want to hold a portfolio with beta exceeding 0.6. What proportions of her wealth should she invest in T-bills and in the stock of GoGrow, if she also wishes to maximize her expected return? What rate of return can she expect? [6 marks]

c) Richard is less risk-averse, so he wants to hold a portfolio with beta not exceeding 1.4. What proportions of his wealth should he invest in T-bills and in the stock of GoGrow, if he also wishes to maximize his expected return? What rate of return can he expect? [3 marks]

d) Stock Boom and stock Fun, both have a beta of 1.4. The expected return on the market portfolio is 10%, and the risk-free rate is 4%. The standard deviation of the return of Boom is 62%, of Fun is 48%, and of the market portfolio is 2x% (with x being the last digit of your student ID – if your student ID ends with 0, the standard deviation of the market portfolio is 20%). The correlation between the returns of Boom and Fun is 0.25. Answer the following questions, showing all relevant calculations.

I. What is the expected return on each stock according to the CAPM? Briefly comment on the economic intuition that underpins your answer. [2 marks]

II. What is the correlation between each of these stocks with the market portfolio? [2 marks]

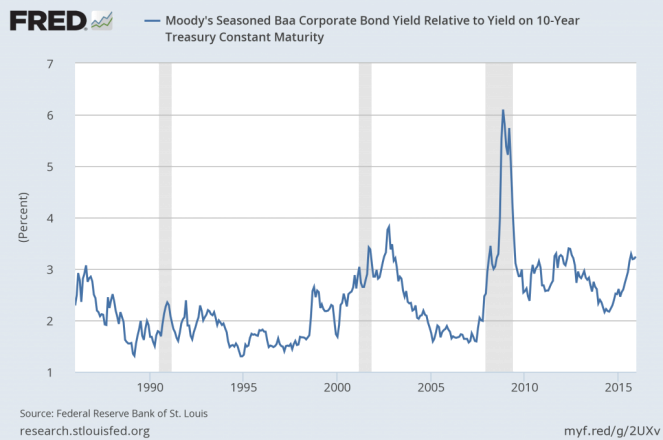

e) The graph below depicts the spread in the yield to maturity on 10-year zero-coupon Corporate Bonds, minus the yield to maturity on 10-year zero coupon U.S. government bonds (treasuries), from 1980-2015. Discuss what is the economic intuition that underpins the behaviour of this spread.

[5 marks]

f) Assume that a N-year zero coupon bond has no default risk, and promises to pay £X at maturity. Its yield to maturity is constant, at y%. Draw a graph to show what the price of this bond would look like, from the time it is issued, to expiration. Briefly discuss the economic intuition that underpins this graph.

[We do not need any calculations here, only showing how the price function looks like suffices. Remember to label your axis]. [4 marks]

[Question B3]

Suppose the company Keloton sold 500 two-year convertible bonds without coupons at the beginning of 2023. Each bond has the face value of £2,000, and was told at £(1900 + 10x) where x is the 6th digit of your student ID. For example, if your ID is 2208796 then please work on this question with the price of £1900 + 10 × 9 = £1990 per bond. Although these bonds do not pay coupons, they could be converted into the company’s equity shares at the end of 2024 when the bonds mature. Each bond can be converted into 20 shares of equity. Before the issuance of these corporate bonds, Keloton was all-equity financed and had 30,000 outstanding shares of equity.

a) Use a table to represent the value of convertible bonds and the value of equity if the firm value is 0, £0.5 million, £1 million, £1.5 million, £ 2 million, £ 3 million, £4 million, £ 5 million, £6 million on December 31st, 2024. [6 marks]

b) Draw a payoff diagram for the convertible bonds, as well as for the equity that was issued before the bonds. [5 marks]

c) A typical zero-coupon bond would be issued at a deep discount — say 50 cents or 60 cents on the dollar — and then “accrete” upwards to a 100 cent payout at maturity. However, the convertibles from Keloton were sold as “zero-coupons” near par with almost no accretion feature. Why do you think investors might be interested in buying these zero coupon bonds near par? Do you think this hybrid financial claim is more like a call option or a put option, and why do you think so? [4 marks]

d) Describe the control rights of the company if the firm value is £0.8 million at the end of 2024. What if the firm value is £2 million instead? [2 marks]

e) Suppose an investor bought Keloton’s equity in 2022, when the share price was quoted at £50.6/share as the ask price and £50.3/share as the bid price, and sells her shares when the price is quoted at £125.5/share as the ask price at the start of 2025, with the bid-ask spread of £0.5/share. What is the return (in percentage) for this investor? What information do you need to calculate the rate of return for an investor that bought the convertible bonds? [8 marks]