关键词 > Python代写

Mechanism Design & Information Problem 2: First Price Auction Spring 2024

发布时间:2024-01-26

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Mechanism Design & Information

Problem 2: First Price Auction

Spring 2024

First Price Auction

In a first-price auction, each bidder simultaneously writes his name and a number on a slip of paper and submits the papers to an auctioneer. The auctioneer then turns over all of the papers. The bidder who wrote down the highest number is given the item and pays the amount written on his slip to the auctioneer.

Setting

Who are the players? Two bidders: Ann and Bob.

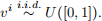

Information and types: Each player’s type, vi , i ∈ {A, B} represents his or her value for the seller’s good. Each player knows their type, but not the one of their opponent. Ann knows vA but not vB , and Bob knows vB but not vA . We will assume that vA and vB are independently and identically distributed:

What is the action space? Given her type, each player submits a sealed bid. Both Ann and Bob choose a real number depending on their type. So AA = AB = R+ .

A strategy is a mapping from types to actions: bi : [0, 1] → R+ , vi → bi (vi ).

Outcome: An outcome of the Bayesian Game is an allocation rule, qi , that specifies who gets the good depending on the bids, and a payment, pi , which also depends on the bids submitted by Ann and Bob.

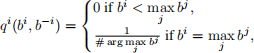

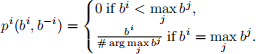

For the sealed bid first price auction,q and p take the following forms:

and

Payoffs: Given this outcome, each player’s payoff is:

ui (bi , b −i , vi ) = vi qi (bi , b −i ) − pi (bi , b −i ), i ∈ {A, B}.

Thus, each player’s payoff is their value for the good multiplied by their probability of getting it minus any payment. Crucially, each buyer’s payoff depends only on their value. The other bidder’s value for the item is irrelevant. So, we are interested in the private value sealed bid first price auction.

Question 1. Suppose that Bob’s strategy is given by a known strictly increasing bid function bB (v). What is Ann’s expected payoff from placing a bid b ∈ R?

Question 2. Suppose that bB (v) = αv for some α > 0. What is Ann’s best response?

Hint: Ann’s best response is the strategy that associates to each valuevA ∈ [0, 1] the bid bA (v) that maximizes her expected payoff given that Bob’s strategy is bB (v) = αv.

Question 3. What is Bob’s best response to Ann’s strategy derived in Question 2? Argue that this pair of strategies constitute a BNE.

Question 4. What is the seller’s revenue in this equilibrium?

Bonus question (HARD). Show that the equilibrium is unique.