关键词 > MATH4090/7049

MATH4090/7049: Computation in financial mathematics

发布时间:2021-10-14

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH4090/7049: Computation in financial mathematics

Assignment 4

Semester II 2021

Submission instructions:

● Submit onto Blackboard softcopy (i.e. scanned copy) of (i) your assignment, as well as (ii) Matlab code by 5:00pm 29 October 2021. Hardcopies are not required.

● You also need to upload all Matlab files onto Blackboard.

General coding instructions:

● You are allowed to reuse any code developed in tutorials.

● An assignment question may have specific programming instructions which you are required to follow. Failure to do so will result in a loss of 50% of the questions’s total marks.

● For programming questions that require you to submit tables of results, you are not required to write Matlab code to produce the tables. Handwritten tables of results are acceptable.

Notation: “Lx.y” refers to [Lecture x, Slide y]

Assignment Questions

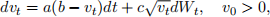

Question 1. (10 marks) Consider the risk-neutral dynamics

where a, b, and c are positive constants.

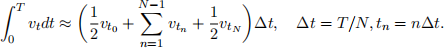

(a) (5 marks) Give an ordinary Monte Carlo algorithm to estimate

where E[·] denotes the expectation operator under the associated risk-neutral measure.2 In your algorithm, use M as the number of samples. If a timestepping method is employed, use N as the number of time intervals, with time points tn = n∆t, n = 0, 1, . . . , N, and ∆t = T /N.

Hint: You can use the composite trapezoidal rule:

Here, vt generically denotes an integrand.

(b) (5 marks) Implementation of the above algorithm. Real values of the model parameters are to be added soon.

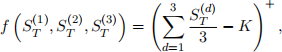

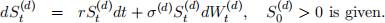

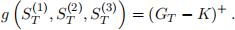

2. (12 marks) Consider a T-maturity basket option that is based on three underlyings whose time-t prices are denoted by  , d = 1, . . . , 3. The payoff of the option at time T is given by

, d = 1, . . . , 3. The payoff of the option at time T is given by

where K > 0 is the strike. Assume that  , d = 1, . . . , 3.

, d = 1, . . . , 3.

Here, the constant interest rate r = 0.02, and the constant volatilities are  = 0.3,

= 0.3,  = 0.2, and

= 0.2, and  = 0.4. The time-0 prices of the underlying assets are

= 0.4. The time-0 prices of the underlying assets are  = 100,

= 100,  = 110,

= 110,  = 90. The Brownian motions

= 90. The Brownian motions  and

and  have correlations ρij, where ρ12 = 0.8, ρ23 = 0.5, and ρ13 = 0.4.

have correlations ρij, where ρ12 = 0.8, ρ23 = 0.5, and ρ13 = 0.4.

We denote by Ct the time t price of this option.

a. (7 marks) Present an antithetic Monte Carlo (MC) algorithm to estimate C0. In your al-gorithm, use M as the number of paths for each underlying asset and use Euler timestep-ping with a total of N uniform timesteps.

Implement in Matlab the above algorithm. Use the parameters M =

, N = 100, T = 0.5, and K = 110. Report the antithetic MC estimate

and the standard error.

b. (5 marks) Let

and consider the “geometric basket” option with payoff given by

Let

be the time-0 price of a geometric basket option with payoff

There exists a closed-form expression for

, which is given in the provided Matlab function exact_geo_basket3(·). (You need to understand correctly how this function works before using it in your code.)

Using a geometric basket option as a control variate, implement a control variate MC technique to estimate C0. Use the same parameters as in Part (a). Report

as discussed in class. Report the asymptotically valid standard error