关键词 > Excel代写

Linear Econometrics for Finance - Fall II

发布时间:2023-12-29

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Linear Econometrics for Finance - Fall II

Regression, predictability and robust standard errors

• It is standard to predict stock returns using financial ratios, like the dividend-to-price ratio or the book-to-market ratio. We will also discuss the economic justification underlying this approach.

• The file predict.xls contains monthly data on returns on the value-weighted market port-folio, the t-bill rate, the dividend-to-price ratio (dyny), and the book-to-market ratio (bmdy).

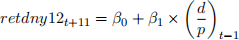

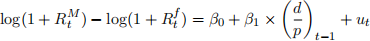

• We will run a baseline regression of the excess continuously-compounded return (with respect to the risk-free rate) of the value-weighted market portfolio on the past dividend-to-price ratio. The regression is:

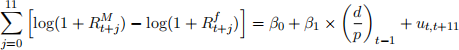

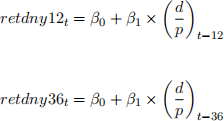

• We will also consider the same regression, but rather than predicting monthly excess returns, we will predict yearly excess returns using:

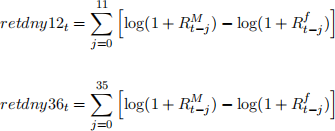

• We will also consider predicting 3-year excess returns, and specifications with the addition of the book-to-market ratio.

• We will test a typical conclusion drawn in the literature (and in the industry) that yearly and longer horizons’ returns are easier to predict than monthly returns.

Regression specification

• In the Excel file predictR.xls, the variables retdny12 and retdny36 are computed as:

• Therefore, as specified in the relevant questions in the Notebook file, you run the regres-sions:

• The regression specified in the background information is just shifted 12 months forward, that is: