关键词 > MTH6154/MTH6154P

MTH6154 /MTH6154P: Financial Mathematics I Main Examination period 2023

发布时间:2023-12-26

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Main Examination period 2023 – January – Semester A

MTH6154 /MTH6154P: Financial Mathematics I

Question 1 [23 marks].

(a) Suppose you put £1500 in a bank account with nominal interest rate 1.2% and make no withdrawals. How much money will be in the account 6 years later if the interest is compounded monthly? State your answer to the nearest pence. [3]

(b) Suppose a bank account has a nominal interest rate of 4.4% compounded semi-annually. Find the effective interest rate reff to three significant figures. [3]

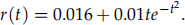

(c) Suppose that for time t ≥ 0 the instantaneous interest rate of a bank account is given by

(i) Determine the yield curve r(t). [4]

(ii) Determine  . [3]

. [3]

(d) Suppose that Bank A offers deposits and loans continuously compounded with discount factor DA(t) and that Bank B offers deposits and loans continuously compounded with discount factor DB(t). Moreover, suppose that

DA(1)DA(2) > DB(3).

Show that an arbitrage opportunity exists. [10]

Question 2 [8 marks].

Consider the cash flow (a1, a2, a3) = (−2, 1, −1), where ai is the payment at the beginning of year i for i = 0, 1, 2.

(a) Show that this cash flow does not have an Internal Rate of Return. [5]

(b) Why is this cash flow not subject to the theorem proved in lectures about the existence of an Internal Rate of Return r satisfying −1 < r < ∞. [3]

Question 3 [9 marks].

A 2-year bond has face value £700,000 semi-annual coupons at rate 3% per annum, and is redeemable at half par. The current rate of interest is 3% compounded continuously.

(a) Determine the coupon and redemption payments in pounds. [4]

(b) Determine the no-arbitrage price of the bond to the nearest pound. [5]

Question 4 [10 marks].

Consider the three cash flow streams of the form (a1, a2, a3) where ai is the amount of money in thousands of pounds received at the end of year i for i = 0, 1, 2:

x = (2, 2, 2)

y = (a, 2, 2)

z = (2, 2, a),

where a > 2. Interest is 3% compounded continuously. Order x, y, and z from smallest effective duration to largest effective duration. Justify your answer. [10]

Question 5 [14 marks].

Suppose that in the fixed interest rate model the interest rate compounded yearly has the continuous distribution R ∼ Uniform(1.3%, 2.7%).

(a) Determine the probability that £200 accumulates to less than £210 after three years? State your answer as a decimal to three significant figures. [5]

(b) Find the expected present value of a payment of £10,000 received five years from now. State your answer to the nearest pound. [6]

(c) Find the present value of a payment of £10,000 received five years from now if interest is not random any more, but is compounded yearly at rate E(R), where E denotes expected value. State your answer to the nearest pound. [3]

Question 6 [8 marks].

(a) Assume that Corner Bank quotes spot rate rate s8 = 1.5% and forward rate f8,10 = 1.9%. Find the spot rate s10. State your answer as a percentage to three significant figures. [4]

(b) Suppose that the price of 100 6-year zero-coupon bonds each paying £1 is £96 and that the price of 120 8-year zero-coupon bonds each paying £1 is £105. Assuming there is no-arbitrage, find the forward rate f6,8. State your answer as a percentage to three significant figures. [4]

Question 7 [8 marks].

A company issues new shares to fund a new manufacturing plant. Explain the meaning of the Arbitrage Theorem with respect to the price of the new shares. [8]

Question 8 [20 marks].

A share price is modelled via a two-period binomial model with initial stock price S = 250, up/down multiplication factors u = 1.2 and d = 0.8, and interest rate 3.2% compounded continuously.

(a) Verify that the no-arbitrage assumption is valid in this model. [3]

(b) Find the risk-neutral probabilities of up and down movements in the share price. State your answers to three significant figures. [4]

(c) Find the no-arbitrage price of a European call option on the share with strike K = 200 and expiry date T = 2. State your answer to the nearest pence. [7]

(d) Suppose that we let the strike price K vary and keep the other parameters the same. What is the smallest value of K for which the call would has value zero?

Explain your answer. [6]