关键词 > 115.112

115.112 Accounting for Business Assessment 3 Business Financial Evaluation Semester 2, 2023

发布时间:2023-09-26

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

School of Accountancy

115.112 Accounting for Business

Assessment 3

Business Financial Evaluation

Semester 2, 2023

ASSESSMENT 3 INSTRUCTIONS

The assessment will be in two parts:

Part A: Analysing financial statements using Power BI (asoftware application) and a financial discussion.

Part B: Evaluating and reporting on Iwi financial performance using the TDB Advisory Ltd Iwi Investment Report (2022).

How to approach this Assessment

• Please read all instructions before starting the assessment.

• Study the relevant material in the textbook and other study material and make sure you understand the concepts covered.

Before attempting Part A of the Assessment 3

1. Download Power BI Desktop OR access Power BI through Massey’s Flexible Learning environment as discussed on the following page.

2. Download the following file from Stream under the Assessment 3 files folder and save it on your device:

115.112 Data Assessment 3.xlsx

3. Access the material provided for Power BI training under the Assessment Resources section:

• Power BI Recording – a quick run through using the application.

• Data visualisation slides – useful resource for requirement (ii) and (iii).

• ‘ How to access Flexible Learning environment from anywhere’ for students that are not Microsoft users.

4. Attempt Part A.

5. You can attempt Part A without the training material if you have prior knowledge of the Power BI application.

Power BI Desktop Download for Microsoft users

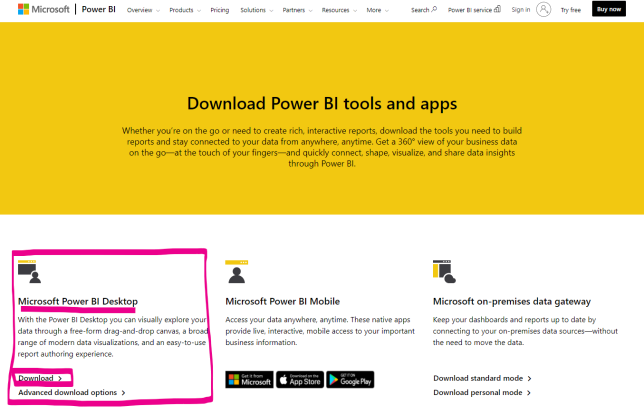

Part A of this assessment requires you to complete tasks using Power BI Desktop (It is a free to use program). Please follow this link to download the program:

Download the ‘Microsoft Power BI Desktop’ version as highlighted in purple below in the screen shot from the Microsoft website:

• After downloading and opening the application, you will be asked to log in. DO

NOT ATTEMPT TO LOG IN USING YOUR MASSEY CREDENTIALS OR ANY OTHER CREDENTIALS. You can use the application without logging in. Opt out of logging in, by closing the dialogue box.

• You are now ready to upload the Excel file (see point 2 on page 2).

Power BI Desktop usage for non-Microsoft users (Apple etc.)

If you are unable to download Power BI Desktop to your computer, you can access the program by remotely accessing Massey’s Flexible Learning environment. You will find the complete instructions under the Assessment Resources section on the Stream site. The file is called, ‘How to access Flexible Learning environment from anywhere’ .

Submitting the Assessment files

• The assessment will result in 2 separate files: one Power BI file and one Word file.

• You MUST submit the Power BI file in the correct file format with the suffix of .pbix. DO NOT submit it as a .pdf or as a .pbit file.

• Submit both files in the provided submission point for Assessment 3.

• Follow the instructions “Submitting Assessments to Stream Assignment boxes” , which is available under the Assessment section on Stream. Stream records the submission date and time. You will find the policies re extensions and late submis- sions under the Assessment section, too. Penalties will be applied to late submis- sions for which an extension has not been granted.

• Use the following naming convention for the files that you create: use your Last Name and Student ID number as the name of the file [Do not change the file extension or you (and the marker) will not be able to use the file]. For example, if your Last Name is Smith and your Student ID number is 88888888; your files will be Smith88888888.pbix and Smith88888888.docx.

• Once you have started working on an assessment you should make backups. It pays to rename different versions of your work. A simple way to do this is to use the Save as file instruction and add a number or letter to the end of the file name. (This allows you to go back to an earlier version.)

![]() ASSESSMENT BRIEF

ASSESSMENT BRIEF

PART A - Financial Statements Evaluation:

You are newly appointed as a trainee, financial analyst at Growth Fund Ltd, a financial consultancy firm. You have been tasked to analyse the financial statements of the top six international technology companies. Another trainee has already downloaded the financial statements of the companies and have compiled the data in a spreadsheet. In the spreadsheet there are the following sheets:

1. 2022 (all six companies)

2. 2023 (all six companies)

In the 2022 and 2023 financial data sheets, there are columns for the relevant Income Statement and Balance Sheet items required for calculating the financial analysis ratios. All amounts, for all six companies, are presented in NZ dollars.

Required:

In Power BI:

Upload the data from the provided Excel file, ‘ 115.112 Data Assessment 3.xlsx’ . Load the ‘2022’ and ‘2023’ sheets from this file. Use the information in the data sheets in Power BI to calculate the following ratios for the six companies for 2023: (See Appendix A for the formulas, p. 8; Use the amounts as they are provided.):

(i)

a) Profit Margin

b) Gross Profit Percentage

c) Return on Total Assets

d) Return on Owners’ Equity

e) Inventory Turnover

f) Number of Days in Selling Period

g) Accounts Receivable Turnover (Assume all sales are on credit) h) Number of Days in Collection Period

i) Current Ratio

j) Quick Ratio

k) Debt Ratio

l) Interest Coverage

m) Sales % Increase

Tips:

• Use the ‘New Column’ function in the ‘Data view’ in Power BI to create a new calculated column for each of the ratios.

• Ensure you are in the 2023 sheet when calculating the 2023 ratios. (13 marks)

(ii) Present the 2023 ratios in relevant tables in your Power BI file to compare the six companies, using the ‘Report view’ . The tables must express profitability, efficiency, liquidity and financial gearing appropriately. (16 marks)

(iii) Create appropriate graphs in your Power BI file for the 2023 ratios to compare the six companies, using the ‘Report view’ . The graphs must express profitability, efficiency, liquidity and financial gearing appropriately. (16 marks)

In a Word document:

(iv) Your manager looked at the tables and graphs you prepared in Power BI and has further requested you to evaluate company B in terms of efficiency and liquidity.

• Compare company B’s 2023 results with its results for 2022.

• Compare company B’s 2023 results with the results of the other five companies for 2023.

To justify your explanations, use relevant 2023 ratios from requirement (i) and the 2022 ratios of company B, as provided below:

|

Ratio |

2022 |

|

Inventory turnover |

51.29 times |

|

Days in selling period |

7.12 days |

|

Accounts receivable turnover |

7.15 times |

|

Days in collection period |

51.02 days |

|

Current ratio |

3.92 |

|

Quick ratio |

3.89 |

(24 marks)

PART B - Accounting Information for Māori Business:

In a Word document: [Use the same file as for requirement (iv)]

To answer the following question, use the TDB Report (2022), which can be accessed here:

(v) Discuss and compare the investment performance (Assets and net worth, Return on Assets, and Net Asset per Member) of each of two iwi, Ngāi Tahu and Ngāpuhi. Include a comparison between Ngāti Awa and Ngāti Pāhauwera. (27 marks)

(vi) References for requirement (v). (4 marks)

Presentation of discussion requirements:

• Answer (iv), (v), and (vi) in the same Word file.

• Answers should be well reasoned and comprehensive.

• Your answer for (iv) should range from 400 to 500 words.

o Do not copy the tables and visualisations from (i), (ii) and (iii) into the Word document as part of your discussion. Just refer to the ratio amounts.

o References are not required.

• Your answer for (v) should range from 400 to 500 words. This does not include the references.

o Consult the provided study material and the TDB report (2021) for information. It is also advisable to add to this material from other literature, e.g., websites from the internet (e.g., each iwi’s website)

o References are required. Apply the APA 7th ed. method of referencing. For a handy online, interactive tool,click here.

• The discussions of (iv) and (v) do not need to be presented in the form of reports or essays.

• A good way to limit word usage is by using bullet points.

APPENDIX A: ANALYSIS RATIOS FOR USE WITH CUNNINGHAM

|

TYPE OF RATIO |

REFERENCE 4th ed. |

|

||

|

PROFITABILITY |

Chapter & Page |

|

||

|

1 Profit Margin |

Ch. 7 p.280 |

Net Income x 100 Net Sales |

||

|

2 |

Gross Profit Percentage |

Ch. 7 p.281 |

Gross Profit x 100 Net Sales |

|

|

3 |

Return Assets |

on Total |

Ch.8 p.325 |

(Net Income + Interest Expense) x 100 Average Total Assets |

|

4 |

Return Equity |

on Owner’s |

Ch.8 p.326 |

Net Income x 100 Average Owner’s Equity |

|

EFFICIENCY |

|

|

||

|

5 Inventory Turnover |

Ch. 8 p.327 |

Cost of Goods Sold Average Inventory |

||

|

6 |

Number of Days in Selling Period |

Ch. 8 p.328 |

365 Inventory Turnover |

|

|

7 |

Accounts Receivable Turnover ‘assume all sales are credit sales’ |

Ch. 8 p.328 |

Net Credit Sales Average Accounts Receivable |

|

|

8 |

Number of Days in Collection Period |

Ch.8 p.329 |

365 Accounts Receivable Turnover |

|

|

LIQUIDITY |

|

|

||

|

9 Current Ratio |

Ch. 8 p.320 |

Current Assets Current Liabilities |

||

|

10 Quick Ratio |

Ch.8 p.320 |

Quick Assets Current Liabilities Where Quick Assets = Cash + Accounts Receivable + Short Term Marketable Securities + Short Term Notes Receivable |

||

|

FINANCIAL GEARING |

|

|

||

|

11 Debt Ratio |

Ch. 8 p.321 |

Total Liabilities x 100 Total Assets |

||

|

12 Interest Coverage |

Not in text |

Net Income + Interest Expense Interest Expense |

||

|

OTHER |

|

|

||

|

13 Sales % Increase |

Not in text |

(Sales Year 2 – Sales Year 1) x 100 Sales Year 1 |

||