关键词 > ETC3530/ETC5353

ETC3530/ETC5353 Contingencies in Insurance and Pensions

发布时间:2021-09-05

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ETC3530/ETC5353

Contingencies in Insurance and Pensions

Assignment

Pricing tool

1 Objective

An insurance company selling a wide range of life insurance products wishes to provide its front office with a pricing tool to be used for sales. The actuarial team came up with a preliminary template which is available on the following link:

https://hamzahanbali.shinyapps.io/pricingtool/

This template was designed using R software, with the package shiny for the development and the package rsconnect for the deployment. However, it does not include all the contracts the company offers, and the front office requested a better one constructed using similar software.

Your task is to build a pricing tool for this insurance company. The tool must provide the premium and the yearly evolution (graphically) of the yearly prospective reserve at future times for different values of the interest rate (minimum of 0% and maximum of 50%), and different starting ages (integer ages from 20 to 100 at policy issue). Note that 100 is not necessarily the last age, but it is the maximum age at which the company sells contracts.

The contracts are sold to two groups of policyholders. The mortality of the first group (x) follows AM92 Ultimate mortality, and has already been included in the template. The mortality of the second group (y) was not incorporated in the preliminary tool. It is derived from that of the first group, with  This means that the value of

This means that the value of  at age 20 corresponds to the value of

at age 20 corresponds to the value of  at age 20 − 3 = 17.

at age 20 − 3 = 17.

Minimum features:

The pricing tool that you propose must contain at least the following features:

● Single or level annual premiums, paid throughout the term,

● The policyholder can choose among a pure endowment, a term assurance or an endowment assurance,

● The assured sum is payable either at the end of the year of death or immediately on death.

These minimum requirements are for the first group of policyholders (i.e. those with the standard AM92 Ultimate mortality), and it should be possible to select the term of the contract and the sum assured.

Variable benefit contracts:

For the same group of policyholders whose mortality obeys the standard AM92, the company wants to include the following contracts which are not included in the existing template:

● Both whole life and term assurances with payment either at the end of the year of death or immediately on death, which include a simple bonus vesting at the start of each year including the first year,

● Endowment assurance with death benefit payable either at the end of the year of death or immediately on death, which includes a simple bonus vesting at the start of each year including the first year,

● Both whole life and term annuities payable in arrears, where annuity payments increase at a compound rate from the second year onward reflecting inflation (inflation-indexed annuity),

For products where the payments are increasing, the user of the tool should be able to select separately the initial amount, as well as the rate of bonus for assurances and the rate of inflation for annuities. The range of values for the rates of increase for all these products should be [0, 50%].

Expenses:

An additional requested improvement of the tool given in the template consists in including the expenses. The company wants the expenses to be set as follows:

● Initial expenses in percent of the gross premium, applicable for both single and level premiums,

● Premium expenses (excluding the first year) in percent of the gross premium, and incurred yearly as long as the premium is paid,

● Claim expenses in percent of the benefit amount,

and the gross premium reserve must take into account these expenses. Note that premium expenses are paid from the second premium onward.

Extension to policyholders (y):

The company wishes to make all the above features available for both groups of policyholders. This means that the tool should allow the user to choose whether the policyholder belongs to group (x) or to group (y).

Joint life products:

Furthermore, this insurance company wants to include products written by couples. All couples purchasing a contract from this company are such that the mortality from the first is similar to that of group (x), and the mortality of the second is similar to that of group (y). The following contracts should be included in both the pricing and the reserving:

● Joint whole life assurance with payment either at the end of the year of death or immediately on the triggering death, which includes a simple bonus vesting at the start of each year including the first year,

● Joint term life assurance with payment either at the end of the year of death or immediately on the triggering death, which includes a simple bonus vesting at the start of each year including the first year,

● Joint whole life annuity payable in arrears, where annuity payments increase at a compound rate from the second year onward reflecting inflation,

● Joint term life annuity payable in arrears, where annuity payments increase at a compound rate from the second year onward reflecting inflation.

The range of values for the rates of increase for all these products should be [0, 50%].

Analysis and recommendations:

You are also expected to analyse the impact of changing the mortality table from (x) to (y) on the reserves of single-life assurance products and on the reserves of single-life annuity products.

For the analysis, select your preferred value(s) of the interest rate, the expenses, the age(s), the increase(s) and the term(s). Report graphically, in a concise way, for each product (assurance vs. annuity) the evolution of the reserves. Discuss the impact of the change of the mortality table from (x) to (y). Finally, taking into account the element of prudence in the pricing, provide a recommendation on the choice of the appropriate mortality table ((x) vs. (y)) for each class of products.

The pricing tool can use the usual approximations for integrals.

2 Instructions

● This is an individual assignment, and R packages can be used.

● Submit a PDF file containing:

(a) your name and student number

(b) a short text (UP TO 200 WORDS) describing the features of the pricing tool,

(c) the link to the shiny pricing tool

(d) in a separate section, a text (UP TO 300 WORDS) containing the analysis and recom-mendations.

● Separately, submit the R script containing the code used for designing the tool, in a ‘.R’ format.

● There is a significant number of students in this unit. Thus, providing the grades and feedback may take some time. Please help the teaching team by submitting your work according to these instructions.

● Consultation times will be scheduled to provide support in R. Note that it is usually hard for the teaching team to provide help when you send an R code by email, because it is necessary to have some context and to test the code in order to identify potential issues. Thus, for a more efficient feedback, it is strongly recommended to attend consultations.

3 Useful resources

The following information is also available on Moodle:

● AM92 mortality table copy-pasted in an R script:

https://lms.monash.edu/mod/resource/view.php?id=8782306

● shiny tutorial:

https://lms.monash.edu/mod/url/view.php?id=8782307

● Pdf file on how to start using shiny:

https://lms.monash.edu/mod/resource/view.php?id=9162779

More resources on how to use R can be found on Moodle, as well as in a video recorded for this unit that focuses on using R for annuities and assurances.

4 Grading

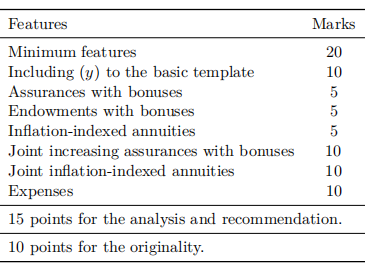

● The details regarding the assessment of the tool are given in the table below. For each product, the full mark is given when both the premium and the reserve are correctly calculated.

● Originality is taken into account for up to 10 points, with 0/10 if the layout of your tool is similar to that of the template. Think of this tool as being presented to the manager of the marketing team, or to a client, so make it user-friendly. Some desirable features include hiding input variables which are not necessary for a given product (e.g. once you choose a single life annuity, all input related to assurances and joint life products would disappear).

● The report in the PDF file is graded on 15, where the grading takes into account all elements (a) to (d) described in Section 2.

● The maximum number of points is 100.

● Penalties: up to 10 points for not submitting the work in the requested format, and 2.5 points per-day for late submissions.