关键词 > Excel代写

HW-2

发布时间:2023-06-14

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

HW-2

Question 1: Compound Interest

It is a US Treasury market’s convention to use semi-annual compounding rate in quoting bond yields and in calculating bonds’ price. However, some corporate and sovereign bonds pay coupons at an annual frequency. n geSo it is useful to review the impact of different compounding periods. Ineral, given the quoted APR r, you may want to compound m times per year for N years.

a. Write down the formula for the value of an initial investment, $A, compounding weekly at rate r for 10 years.

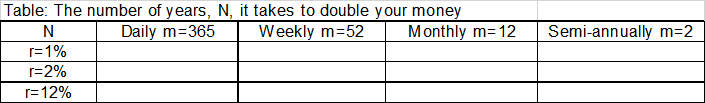

b. How many years (T ) does it take to double your money under different assumptions for the compounding frequency (m) and interest rate (r)?

c. Fill out the table below using daily, weekly, monthly, and semi-annual compounding; and annual interest rates of 1%, 2%, and 12% percent. Write down the general formula for the answer.

d. What APR, when compounded semi-annually, yields the same amount of money after one year as a 5% annual rate (compounded annually) yields after one year?

The following Questions(Q.2 -Q.5) are demonstrating the tremendously important roles that interest rate and credit ratings play in defining our wellbeing

Question 2: Wharton or Rutgers MBA? See appendix bellow.

Given: a 23 years old person considers to choose a two year MBA program, then he/she plan to work for 40 years and then retire. That person can will borrow at Rate Z (specified below) the whole cost of the program at the MBA graduation date (at age 25) and make $125K per annum for next 40 years if person graduates from Wharton MBA or $X per annum if person graduate from Rutgers MBA.

Wharton program cost is $140K; Rutgers cost is $50K for an in-state candidate of $50K and $85K for an out-of-state candidate

Q 2.1 In the table below calculate which program is financially better for you if you live in NJ;

|

X |

15% Borrowing Rate Z |

|

115 |

|

|

100 |

|

|

90 |

|

Q 2.2 Now which program is financially better if you live outside of NJ

|

X |

Borrowing Rate Z |

Borrowing Rate Z |

Borrowing Rate Z |

|

|

5% |

10% |

15% |

|

115 |

|

|

|

|

100 |

|

|

|

|

90 |

|

|

|

Q 2.3 How would your answers change if the post-graduation annual real income in all cases would grow at 5% per annum?

No need to recalculate the tables – just indicate the direction of change

[Actual numbers for 2014: Wharton (UPenn) has a higher average post-graduation salary: ($125,000 vs. $93,035); Rutgers has a lower in-state total program cost: ($52,305 vs. $141,740); and a lower out-of-state total program cost: ($86,301 vs. $141,740)]

Question 3: Calculate the rate the Rent-Way charges

The RentWay company advertises itself as “Rent to own program”. For example, you can rent a $180 TV , and pay $8 a week for 78 weeks, then the TV becomes your property . The going rate for good borrowers at the time was 8% per annum .

Calculate the interest rate that you are charged if you get the a TV thru the RentWay company ?

Can you explain why these rates are required and paid .

To help you answering the last question , assume that all RentWay renters are belonging to one the following two groups: group 1 ( bad credits) rents the TV , never pays a penny back and does not return the TV; group 2 ( good credits) rents the TV , pays $8 for 78 weeks.

Can you estimate what is the proportion of group 2 customers among the RentWay clients?

Question 4: Lord and Chauffer

An English lord buys every year a new top hat for ₤10. After a year of use, the hat it is not fit for a lord; so he sells it to his chauffer for ₤5.This repeats itself every year. Observation: a lord wears a new top hat for ₤5 and his chauffer wears a used top hat for ₤5. Funny. But maybe educational as well.

Assume

1. That a new top hat was bought on 1/1/20XX [and the old top hat was delivered to the chauffer];

2. That this scenario will be repeated in perpetuity!

On 1/1/20XX ( after buying a new hat and transferring the old one to chauffer, the lord has an option to pay ₤200 for the manufacturer’s agreement to deliver in perpetuity a new top hat on every 1/1. [The going interest rate for manufacturers and lords is 5% p/a.].

Lord offers the chauffer to pay ₤100 (i.e., half) for the right to get the used top hats in perpetuity instead of paying the annual ₤5. [ He pays half anyway, right?]

The chauffer tells that he is ready to pay for the “ used top hats” perpetuity ₤50; otherwise he plans to buy the used ones for ₤5 every year in perpetuity.

Does it make sense? Is the chauffer trying to “hard barging” or he knows something about his borrowing costs?

Draw from this example conclusion about who buys new items (e.g., cars) and who buys them [much cheaper] second hand.

Question 5: What is the cheapest way to drive a Lincoln?

You consider leasing a Lincoln for 24 months. Two payment options: you can either pay upfront $11,200 or choose 24 monthly installments of $539 [with first payment in a month of the lease date]. You can borrow/lend at 12% (monthly compounding) from a bank. Should you prepay the lease or take the installment plan? Use formula for sum of annuities. Think what is the per-period interest rate that applies here.

Now assume that you can borrow/lend at 18% (monthly compounding) from a bank. Should you prepay the lease or take the installment plan?

Question 6: You Borrow $1B on Feb 24 for a month at 12% interest rate. Ho wmuch do you pay back after one month?( it looks simple- but it is not!)

Appendix

WSJ, Aug. 10, 2021 Is Graduate School Worth the Cost?

Students weigh tuition, debt and job prospects to assess the value of an advanced degree in their fields.

It’s getting harder to justify getting a Ph.D. in history. Take the job market, or lack thereof. The National Science Foundation’s survey of earned doctorates found that in 2019 U.S. institutions granted 912 history Ph.D.s. Yet, according to a report that same year by the American Historical Association, there were only 515 unique job postings for tenure-track faculty vacancies. Chances are a professorship in your field won’t await you at the end of the road. The aspiring academics among us should be realistic about that and consider alternative careers in secondary education, journalism and public policy, among others.

The doctorate is also expensive. Some schools offer funding packages that defray all or some of the cost, but this is not guaranteed. Students who pay their own way will often emerge with considerable debt. Even those lucky enough to emerge with a tenure-track position probably won’t be raking in the dough. The average assistant professor made a little more than $82,000 in 2019-20 according to the American Association of University Professors, and I’d wager that figure is lower still for history professors. Then there’s the opportunity cost. Why fritter away five-plus years chasing a credential only to end up with a job you could have gotten without it? You’ve lost time that could have been better spent elsewhere.

Would-be history Ph.D.s owe it to themselves to look at the data. Our discipline might not like them, but the numbers never lie. —Daniel J. Samet, University of Texas at Austin, history (Ph.D.)

Expected Value

The returns to a graduate degree are highly variable. The Wharton School’s two-year executive M.B.A. program costs $210,900, but more than 90% of graduates receive full-time offers, and their average salary is around $150,000. The average student who took out federal student loans for a master’s in film at Columbia University, by contrast, owed $181,000 and, two years after graduating, half of them have a salary of less than $30,000.

Before applying to a graduate program, it’s worth thinking carefully about the payoff. Knowledge for knowledge’s sake is a noble pursuit, but not if it cripples you financially.

At the University of Wisconsin, Madison, a master’s in economics costs $38,917 a year in tuition and fees. This isn’t chump change, but the skills it provides are versatile and valued in the marketplace. According to PayScale, the median salary of economics M.A. graduates in the U.S. is $114,000 across a range of careers. Given the expected payoff, an economics graduate degree is worth the cost.

Debt for Most, Jobs for Some

Law school isn’t cheap. The average graduate owes around $145,000 in debt, and high-salary jobs predominantly go to graduates of the most elite schools. I wouldn’t be precluded from obtaining such a job with a law degree from, say, a university outside the top 15, but the statistics suggest it would be harder. I want to go to law school, but whether the degree would be worth it financially or not depends greatly on where I get accepted and what job I ultimately plan to pursue.

That’s the financial side of things. But if a specific, nonlucrative law job like public defender is your dream, pursuing it may be well worth the cost