关键词 > MA2405/3405/7405

MA2405/3405/7405 Actuarial Modelling 2 / Actuarial Products & Liabilities

发布时间:2021-05-20

MA2405/3405/7405

All Candidates

Semester 2 Examinations 2020

|

DO NOT OPEN THE QUESTION PAPER UNTIL INSTRUCTED TO DO SO BY

THE CHIEF INVIGILATOR

|

|

|

School

|

MATHEMATICS AND ACTUARIAL SCIENCE

|

|

Module Code

|

MA2405/3405/7405

|

|

Module Title

|

Actuarial Modelling 2 / Actuarial Products & Liabilities

|

|

Exam Duration

|

2 hours + 45 minutes upload time

|

| CHECK YOU HAVE THE CORRECT QUESTION PAPER | |

|

Number of Pages

|

5

|

|

Number of Questions

|

4

|

|

Instructions to Candidates

|

Answer all questions.

|

| FOR THIS EXAM YOU ARE ALLOWED TO USE THE FOLLOWING: | |

|

Calculators

|

Yes

|

|

Books/Statutes provided by the University

|

Formulae and Tables for Actuarial Examinations

|

|

Are students permitted to bring their own

Books/Statutes/Notes?

|

Yes

|

|

Additional Stationery

|

Yes |

1. (a) Define  fully in words.

fully in words.

Calculate  using AM92 life table and the interest rate of 4%. [4 marks]

using AM92 life table and the interest rate of 4%. [4 marks]

(b) Describe the method of constant force of mortality.

Calculate the probability that a life aged 85.5 exact will die within 2.75 years using the constant force of mortality, assuming that ELT15 (Males) life table applies.

[6 marks]

(c) An insurance company issues a special 20-year term assurance policy to a life aged 50 exact. Under this policy a sum assured of £120,000 is paid on death but only on death from age 55 exact up to the end of the term. On death between age 50 and 55 the benefit is equal to the total premiums paid without interest. All payments on death are made at the end of the year of death. The premiums are paid annually in advance for the full 20 year term or until the death of the policyholder if earlier.

Calculate the annual premium payable.

Basis: Mortality AM92 Ultimate, interest rates of 4% per annum, no expenses.

[15 marks]

Total: 25 marks

2. (a) A married couple, the husband aged 55 exact and the wife aged 50 exact, take out a last survivor level annuity of £12,000 per annum, paid continuously. They pay a lump sum premium at the start of the policy.

Calculate the gross premium payable, assuming:

• initial expenses of £150 plus 55% of the gross premium,

• ongoing expenses of 3% of the annual annuity benefit, paid continuously,

• PMA92C20 for the husband and PFA92C20 for the wife,

• interest rate of 4%.

[7 marks]

(b) A life aged 50 exact takes out a with-profits 10-year endowment assurance policy with initial sum assured of £12,000. The reversionary bonus is awarded at a compound rate of 1.923% per year from the second year onwards. If death occurs during the term, the sum assured is paid at the end of the year of death. The survival benefit is the same as the death benefit paid on death in the final year of the policy. Calculate the annual net premium assuming AM92 Select mortality rates and the interest rate of 6% per annum.

[9 marks]

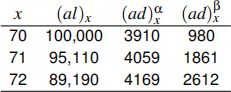

(c) A certain population is subject to 2 causes of decrement: α and β. Below shows the extract of the multiple decrement table for ages x = 70, 71, 72.

Construct the single decrement tables for each cause of decrement (assuming the other one was not operating) for ages x = 70, 71, 72 (and include the number of survivors at age 73).

[9 marks]

Total: 25 marks

3. (a) State the random variables for the following expected values:

(i)

(ii)

(iii)

(iv)

[2 marks]

(b) On 1 January 2015 a life office issues a 10-year decreasing term assurance policy to a group of lives aged 24 exact.

The initial sum assured is £120,000 and the amount decreases by £6,000 per an-num. The sum assured is paid at the end of the year of death.

Premiums are payable annually in advance on each policy. The initial annual net Premium is P and the amount reduces by 10%P at the beginning of the subsequent years.

(i) Calculate the initial annual net premium P for each policy using the basis below.

[9 marks]

(ii) Determine the prospective net premium reserve for each policy in force at the end of the year 2019 using the same basis.

[9 marks]

(iii) At the start of the year 2019, there were 6,000 policies in force. During the year, 4 policyholders died. Calculate the mortality profit or loss for this portfolio of business for the year 2019.

[5 marks]

Basis:

Interest 4% per annum

Mortality AM92 Select

Expenses Nil

Total: 25 marks

4. (a) Define what is meant by direct expenses and overhead expenses.

Classify the following costs as overheads or direct:

(i) Company’s contribution to employees’ pension

(ii) Commission payments to brokers

(iii) Bonus payable to sales manager on completion of target new business levels

(iv) Head office canteen workers’ salaries

(v) Cost for medical checks as part of the underwriting process

(vi) Office rent

[5 marks]

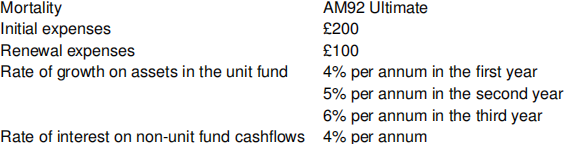

(b) A life insurance company issues a 3-year unit-linked endowment assurance contract to a male life aged 50 exact under which level premiums of £6,000 per annum are payable in advance. In the first year, 95% of the premium is allocated to units and 90% in the second and third year. The units are subject to a bid-offer spread of 5% and an annual management charge of 2% of the bid value of the units is deducted at the end of each year.

If the policyholder dies during the term of the policy, the death benefit of £13,000 or the bid value of the units after the deduction of the management charge, whichever is higher, is payable at the end of the year of death. On survival to the end of the term, the bid value of the units plus a bonus of £1,200 is payable.

The policyholder is not allowed to surrender the policy.

The company uses the following assumptions in its profit test of this contract:

(i) Calculate the values of the unit fund at the end of each year.

[10 marks]

(ii) Calculate the profit vector on the sterling fund assuming that the company does not hold non-unit reserves.

[10 marks]

Total: 25 marks