关键词 > AS.640.440

AS.640.440 Financial Economics

发布时间:2021-05-18

AS.640.440 Financial Economics

Final Examination

1. (35) Consider a variation of the Glosten-Milgrom sequential trade model where the asset’s value  can take three values. Suppose that the true value of stock in Trident Corporation can be, with equal probability, either

can take three values. Suppose that the true value of stock in Trident Corporation can be, with equal probability, either  ,

,  , or some middle value

, or some middle value  .

.

Let  of the traders be informed insiders, while the remaining

of the traders be informed insiders, while the remaining  are uninformed noise traders. Assume as always that informed traders always buy when

are uninformed noise traders. Assume as always that informed traders always buy when  =

=  and sell when

and sell when  =

=  , while uninformed traders buy or sell with equal probability.

, while uninformed traders buy or sell with equal probability.

The focus of this problem is the traders’ behavior when  =

=  .

.

(a) (5) Draw the tree diagram, leaving uncertain the action of informed traders when

=

.

(b) (5) Show that there is no value of

for which informed traders randomize between buying and selling.

(c) (10) Suppose that informed traders always buy when

=

.

i. (3) Calculate the conditional probabilities of a buy order at each value

can take and the uncondi-tional probability of a buy.

ii. (3) Using Bayes’ rule, calculate the posterior probabilities of

taking on each value conditional on a buy, and compute the ask price as a function of

.

iii. (4) Find the informed trader’s payoff when

=

and use this to find the lowest value of

at which the trader is willing to buy.

(d) (10) Now suppose the informed traders always sell when

=

.

i. (3) Calculate the conditional probabilities of a sell order at each value

can take and the uncondi-tional probability of a sell.

ii. (3) Using Bayes’ rule, calculate the posterior probabilities of

taking on each value conditional on a sell, and compute the bid price as a function of

.

iii. (4) Find the informed trader’s payoff when

=

and use this to find the highest value of

at which the trader is willing to sell.

(e) (5) What happens if

satisfies neither of the bounds you found above?

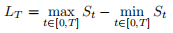

2. (40) Consider a special type of lookback option whose payoff at maturity is given by the difference between the maximum and minimum stock prices attained over the life of the option.

Consider pricing this option using the binomial model. Let the current price of stock in Hindsight Inc. be S0 = 216 and consider an option maturing in n = T = 3 periods, so that ∆t = 1 per period. Suppose for the sake of simplicity that the risk free rate is r = 0, and that each period the stock price either doubles u = 2, or falls by half  .

.

(a) (5) Calculate the risk neutral probability of an uptick p.

(b) (5) An important property of lookback options not shared by vanilla calls and puts is that they are path dependent. That is, their payoffs depend not only on the final stock price but on how the price moved over the life of the option.

Show that this option is path dependent, that is, find two price paths that end at the same price.

(c) (15) Draw the stock price tree. Note that there are

possible price paths, in contrast to the n+1 = 4 different final prices.

(d) (15) Using backward induction, calculate the initial price of this option.

3. (25) Let Rocksteady Industries be an all-equity firm in a Modigliani-Miller world with 500 shares outstanding and a cost of equity of rE = 0.15. Suppose that it has announced a dividend of 12 per share equal to its expected annual earnings.

(a) (5) Calculate the stock price and total value of the firm.

(b) (5) Suppose that Rocksteady realizes lower than expected of earnings of 3, 000, but does not expect this to impact its future cash flows. It does not want to reduce its dividend, and decides to issue new shares to make up the difference. How many new shares will be issued and at what price? What is the payoff to existing shareholders?

(c) (5) Suppose that Debbie owns 100 shares and disagrees with the firm’s policy of maintaining a dividend of 12, preferring instead to receive a lower payout than have her shares diluted. What could she do to achieve her desired outcome?

(d) (5) Now suppose that Rocksteady instead realizes higher than expected earnings of 9, 000. It decides to keep the dividend at 12 and use the remainder to buy back shares. How many shares will be repurchased and at what price? What is the payoff to the remaining shareholders?

(e) (5) Once again, Debbie is dissatisfied by the firm’s policy and would have preferred a proportionally higher dividend to the buyback. How many shares should she sell back to the firm to replicate her desired outcome?