Class Project Math 5660 Spring, 2021

Math 5660

Spring, 2021

Class Project

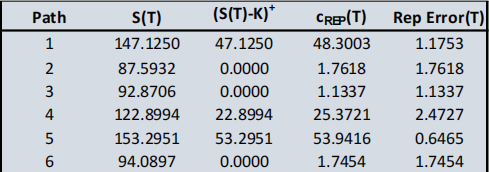

Dynamic Replication: Brownian Motion Simulation of the Replication of Risk

This project utilizes either a Microsoft Excel spreadsheet, with coding in VBA, or a pure programming language of your choice, R, SAS, MATLAB, et cetera. You are welcome to work together in small groups; however you must turn in your own version of your assignment. Please don’t collaborate with students from past semesters.

The purpose is to tie together a number of relevant financial topics related to the Replication of Risk and Monte Carlo simulation.

1. Simulate an arbitrary number of Geometric Brownian Motion pathways. That is, we can choose arbitrarily many paths. Each path depends on a set of random numbers, a constant volatility, default-free rates (no dividends). This is a simulation for the underlying, S(t) up until a terminal time T.

2. Along each pathway, model the following:

a) Value of a vanilla Black-Scholes European call option on S, with a strike K.

Also model the delta of this option at each time step

b) Value of a Cash-or-Nothing call option with strike K, and its delta

c) Value of an Asset-or-Nothing call option with strike K and its delta

These items will serve as a “known value” which we will try to approximate with our replication trades.

3. Replicate the long call options by simulated trading the underlying. Also make sure you keep track of cash. In other words, construct a replicating portfolio. At each time step, make an appropriate trade that serves to adjust your delta (position in the underlying stock), all the while earning interest on credits or paying interest on debits.

C = ΔS + B

derivative price = (# of shares) ($ per share) + cash account

4. In the case of each derivative, for each simulated pathway, set aside the terminal value of the replicating portfolio, the terminal value of the underlying and the terminal value of the call option. The difference of the portfolio and the call option is “replicating error.”

Deliverables:

For each of the specified options (vanilla, cash or nothing, asset or nothing), produce the following exhibits:

1) Make a plot of the distribution of replicating errors. Analyze (describe in words) the distribution of replicating errors.

2) Make a plot of the value of the replicating portfolio at time T versus S(T). Analyze this plot.

3) Make a plot of the value of the theoretical Black-Scholes call option at time T versus S(T). Analyze this plot.

2021-04-08