MF 728 Fixed Income

MF 728

Fixed Income

Take-Home Midterm

Professors Chris Kelliher & Eugene Sorets

March 24, 2021

Name (please print):

Section:

Signature:

Please work alone. You may refer to standard books and you may reuse the code from your own homeworks. Each problem may have more than one solution. Please provide only one and explain all your steps and choices.

Please upload this exam as you normally upload a homework, together with the code you write by 9am Thursday, March 25th.

In the code, please mark clearly which (sub)problem each piece of code refers to.

If you need clarification of a question please email both of us simultaneously at [email protected] and [email protected].

In addition, we will be on Zoom (our usual class meeting) between 7:30am and 10:30am Wednesday in case there are questions about the exam.

Enjoy and good luck!

Eugene and Chris.

Problem 1 (35 points) Yield Curve Construction

(a) (15 points) Write a series of functions that take a vector of prices of zero coupon bonds with distinct maturities and extracts the following rates:

(a) Zero Rates from today until time T

(b) Spot Rates from today until time T

(c) Instantaneous, Continuously Compounded Forward Rates from time t to T

(d) Semi-Annually Compounded Forward Rates from time t to T

(e) Par Swap Rates from time t to T

t and T should be inputs to the functions. You may write the functions in Python, or use pseudo-code.

(b) (12 points) Consider a 5y fixed-for-floating swap that you enter paying fixed.

(a) What is the present value of the swap entered at the par swap rate?

(b) Given that you are paying fixed on the swap, do you make or lose money if rates increase?

(c) Write a function or pseudocode that computes the value of a contract struck at fixed coupon C after the instantaneous forwards in ((a)c) increase by δ basis points in parallel. Assume that C was the par swap rate prior to the shift in the instan-taneous forwards.

(c) (8 points) Consider the following instruments:

• Long Position in Coupon Paying Bond with maturity 5-years

• Long Position in Zero-Coupon Bond with maturity 5-years

• Receiving Fixed in 30y Swap

(a) Rank the expected change in value of these positions from highest (most positive) to lowest (most negative) from a parallel shift of the curve up by 5 basis points.

(b) Rank the absolute expected change in value of these positions from highest (most positive) to lowest (most negative) from a bullish steepener where short end rates cause the curve to steepen.

Explain why you chose the rankings that you did.

Problem 2 (30 points) Interest Rate Derivatives

(a) (6 points) Match each of the following exotic options to the most appropriate model below (use each model only once):

Bermudan Swaption

Vanilla Swaption

At-the-Money Cap

Eurodollar Future (including the inherent Convexity Correction)

For each answer describe why this choice is optimal.

(a) SABR/LMM

(b) Hull-White Short Rate Model

(c) Black’s Model for the Underlying Rate

(d) SABR Model for the Underlying Rate

(b) (6 Points) Write a function that calculates the normal implied volatility of a swaption given a price in the annuity numeraire. You may use Python or provide pseudocode.

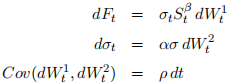

(c) (6 points) Consider the SABR stochastic volatility model:

(a) List the model parameters and explain them in plain language.

(b) Under these dynamics, which parameter(s) would you shift in order to:

• Shift the volatility surface up in parallel.

• Add more negative skewness to the distribution of FT .

• Increase the kurtosis of the distribution of FT .

Please specify which parameter(s) you want to shift as well as the direction they should be shifted

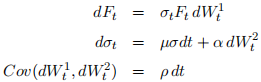

(d) (6 points) Consider the dynamics of the following stochastic volatility model:

Calculate the expected change in σ0 that would correspond to a given change in F0 that you could use to compute a smile-adjusted delta.

NOTE: You do not need to compute the smile-adjusted delta, only estimate δσ0. You may assume the shift to F0 takes place over one-day.

(e) (6 points) Consider an investor who buys a 3-year no call 30 year Bermudan swaption and sells a 3y27y swaption at the same, at-the-money strike of 5%.

Without modeling the Berm, plot an estimated payoff diagram of the underlying struc-ture. (HINT: What happens to the holder of this position if rates approach 0 and 10% at the first exercise date of the Berm respectively. What if they don’t move?)

Problem 3 (35 points) Suppose a company HTZ issues a 5 year bond with a 4% coupon, paid biannually (twice a year). The current market price of the bond is $10 and the risk-free interest rate is constant at 1%.

Suppose the expected recovery is zero, i.e., R = 0%, and the spreads are

Assume that, as usual, the CDS payments are quarterly.

(a) (6 Points) Compute the quarterly survival curve out to 5 years. Be explicit about the assumptions you are making.

(b) (3 Points) Using survival probabilities from (a), show how would you value a single payment at time t that is conditional on survival of HTZ until time t.

(c) (5 points) Consider the bond above that pays a 2% coupon twice a year (meaning the annual coupon is 4% and is paid in two installments). Show how you would value this coupon bond on HTZ? Provide the bond’s present value.

(d) (5 points) Is the market price above or below the value? What you do if it is above or below?

(e) (5 Points) Suppose that you own $10M notional (face value) of the bond. How much of the CDS should you buy to offset as much of the bond’s risk as possible? Please specify the maturity, notional, and the spread of the CDS contract.

(f) (6 Points) Create a table of all the cashflows both of the bond and of the CDS.

(g) (5 Points) Can you think of any remaining risks to your portfolio? What can go wrong?

2021-03-26