ECOS2002 Assignment 1

ECOS2002

Assignment 1

Due: Week 4

1. Class survey Go to Canvas and answer the questions in the Economic Growth and Expectations of Inflation Quiz.

2. Data Exercise Go to

https://www.rug.nl/ggdc/historicaldevelopment/maddison/releases/maddison-project-database-2020

and download the Maddison Dataset.

(a) Find the value of GDP per capita for Australia and China in 1820 and 2018. Calculate the average annual growth rate for the two countries

(b) Find the value of GDP per capita for Australia and China in 1990. Calculate the average annual growth rate between 1990 and 2018

(c) Using the rule of 70, approximately how many years will it take for GDP per capita to double in Australia if GDP per capita growth continues at the 1990-2018 pace? How many years will it take for China’s GDP per capita to double?

3. Immigration in the Simple Model of Production: Using graphs, show the effect of decreased immigration (L ⇓) due to a pandemic, for example, on output, real wages, and real rental rates. Explain your answer.

4. Immigration in the Solow-Swan Model:

(a) What is the effect of decreased immigration on the steady state level of capi-tal? Explain your answer.

(b) What is the effect of decreased immigration on steady state GDP per capita? Explain your answer.

5. Real Wages and Capital Accumulation: The pandemic has caused many com-panies and individuals to increase investment in video conferencing technologies such as Zoom. This investment has increased the capital stock.

(a) Using the simple model of production, graph the effect of an increase in the capital stock on the real wage.

(b) Now using the Solow-Swan model, consider an increase in investment/saving (s ⇑). What does such an increase imply for real wages in steady state? Explain your answer. (Hint: Think about how the Solow-Swan model and the simple model of production are related.)

(c) Using the Solow-Swan model, draw a picture of what the transition path of real wages would look like between the low investment rate steady state and the high investment rate steady state when s ⇑.

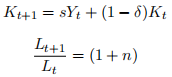

6. Consider the following equations

(a) Define in words what equation (2) means.

(b) Divide equation (1) by Lt and use equation (2) to express the capital accumu-lation equation in per worker variables (kt = Kt/Lt and yt = Yt/Lt). Show your work. (This question has a bit of trick to it. Note that Lt+1/Lt+1 = 1 and pay careful attention to the time subscripts.)

(c) Now substitute in the production function into your answer for (b) and cal-culate the steady state for capital per worker. How does capital depend on (1 + n) on the balanced growth path? Show your work.

2021-03-18