CAS EC536 Economics of Organization PROBLEM SET 1

CAS EC536

Spring 2021

Economics of Organization

PROBLEM SET 1

Due: noon Thursday February 11 at [email protected]

1. a) Consider the principal-agent problem discussed in lecture, with the constraint that s = 0. The purpose of this problem is to derive the payoff (utility) possibility frontier. Data for the problem: Principal’s utility is E(y − w), Agent’s utility is Ew − a2/2, y = a +  , where E

, where E = 0., w = by.

= 0., w = by.

a) Suppose that What effort level a does the Agent choose if she accepts a contract with s = 0 and bonus rate b? What utility level does the she derive from this the contract expressed as a function of b?

b) What utility does the Principal derive this contract, also expressed as a function of b?

c) Now solve for b in terms of the Agent’s utility u. Use that to express the Principal ’s payoff v as a function of u.

d) Graph the payoff possibility set (v as a function of u). Label points on it corresponding to b = 0, b = 1/4, b = 1/2, b = 3/4, b = 1.

e) What is the optimal contract if we are only interested in the total value of the enterprise comprising Principal and Agent? What is optimal for the Principal, if the agent’s outside option is worth (i) 0? (ii)1/8? (iii) 1/16? (iv) 9/32?

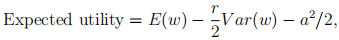

2. Consider a principal-agent model in which the principal is the risk-neutral owner of a firm, while the agent is the firm’s manager who has pref-erences defined on the mean and the variance of his income w and on his effort level e as follows:

where r > 0 and effort can be any nonnegative number.

The output y is given by

where  is a random variable with mean zero and variance σ2. Assume that the utility value of the manager’s outside option is 0.

is a random variable with mean zero and variance σ2. Assume that the utility value of the manager’s outside option is 0.

(a) Suppose that a were observable so that a contract in which payments to the manager are made if and only if he chooses a contractually specified effort level a∗ . What level of a∗ is optimal for the owner to specify in the contract? How should he structure compensation? (i.e. should it depend on y? how should it depend on a?).

(b) Suppose that effort is not observable and that the compensation scheme must assume the following linear form: w = s+by. Proceed similarly to how we did in class to derive the optimal linear compensation scheme (i.e., the values of s, b and a — from the owner’s point of view) when effort is not observable. (Hint: first derive the value of a the manager will choose, given a compensation scheme, and plug this value into the firm’s problem, which now entails choosing only s and b.)

(c) Given some intuition for how the bonus rate derived in part (b) de-pends on r and σ2? What about the effort level a?

(d) Compute the manager’s expected compensation Es + by using the expressions in part (b). How does it depend on the riskiness of the job? How does this square with the idea of “compensating differentials,” wherein that riskier jobs ought to be compensated with higher wages? Explain.

2021-03-15