Intermediate Microeconomics, ECON 20002

Student Number:

University of Melbourne

Department of Economics

Intermediate Microeconomics, ECON 20002

Final Examination (Semester 1, 2015)

Time Allowed: TWO Hours Reading Time: 15 minutes

This examination paper contributes 60 percent to the assessment in ECON 20002.

This paper consists of three sections with 10 multiple-choice questions and 4 short-answer questions. This exam has 10 pages. This paper is not to be removed from the exami-nation room. Please insert the examination paper in the back of your answer booklet at the end of the examination. A copy will be held in the Baillieu Library.

Authorised materials: Foreign Language/English Dictionary and non-programmable cal-culator.

Section A

There are 10 multiple-choice questions in this section worth a total of 20 marks. Answer ALL questions. The suggested time allocation for this section is 25 minutes.

• Colour in the small circle in the appropriate space with a 2B pencil on the response sheet. Please follow the sample response sheet for details required on the formal response sheet. The response sheet should be inserted in the back of the examination script book at the end of the examination. For the multiple choice questions, you may use the examination script books to draw diagrams, or make notes to help you. These notes will not be taken into account for your assessment.

Section B

There are 2 short-answer questions in this section worth a total of 40 marks. Answer ALL questions using the script book provided. The suggested time allocation for this section is 45 minutes.

Section C

There are 2 short-answer questions in this section worth a total of 40 marks. Answer ALL questions using the script book provided. The suggested time allocation for this section is 50 minutes.

Section A: There are TEN multiple-choice questions in this section. Answer all questions using the computer response sheet. The response sheet should be inserted in the back of the examination script book at the end of the examination. [20 marks]

Question A1:

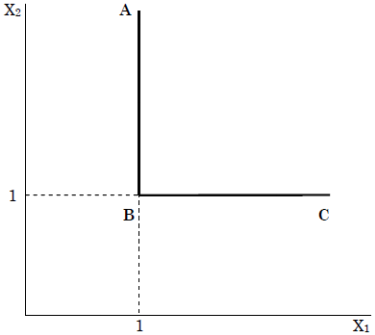

[2 marks] Suppose a consumer considers two goods ( and

and  ) to be perfect comple-ments. Her indifference curve for these two goods are L-shaped, as illustrated above. Consider the horizontal segment of the indifference curve, BC. We know that in this horizontal segment, it is the case that

) to be perfect comple-ments. Her indifference curve for these two goods are L-shaped, as illustrated above. Consider the horizontal segment of the indifference curve, BC. We know that in this horizontal segment, it is the case that

a) the MRS of

for

is undefined.

b) the MRS of

for

is infinity.

c) the MRS of

for

is zero.

d) the MRS of

for

is 1.

e) none of the above are true.

Question A2:

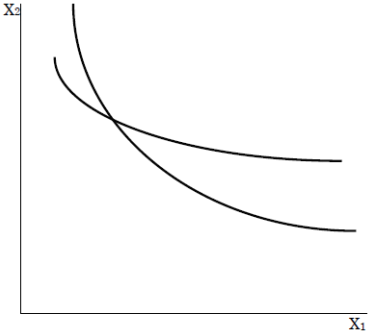

[2 marks] The figure above illustrates two indifference curves for a consumer who has preferences over two goods:  and

and  . Which of the following assumptions about con-sumer preferences do her preferences violate?

. Which of the following assumptions about con-sumer preferences do her preferences violate?

a) diminishing marginal rate of substitution of

for

.

b) more is better.

c) completeness.

d) all of the above.

e) convexity.

Question A3:

[2 marks] A firm uses two factors of production. Irrespective of how much of each factor is used, both factors always have positive marginal products. Which of the following statements are necessarily true?

a) isoquants are relevant only in the long run.

b) isoquants have negative slope.

c) isoquants are convex.

d) isoquants are vertical.

e) none of the above.

Question A4:

[2 marks] Suppose that a semiconductor chip factory uses only labour to produce output. Consider the following statements when answering this question.

I. A semiconductor chip factory uses a technology where the average product of labour is constant for all employment levels. This technology obeys the law of diminishing returns.

II. A semiconductor chip factory uses a technology where the marginal product of labour rises, then is constant and finally falls as employment increases. This technology obeys the law of diminishing returns for some levels of labour.

a) I is true and II is false.

b) I is false and II is true.

c) Both I and II are true.

d) Both I and II are false.

e) more information is needed to answer this question.

Question A5:

[2 marks] A plant uses machinery and waste water to produce steel with steel production being an increasing function of each input. The owner of the plant wants to maintain an output of 10,000 tons a day, even though the government has just imposed a $100 per gallon tax on using waste water. Suppose that the rental rate of machinery remains unchanged. For this cost minimizing plant, the reduction in the amount of waste water use that results from the imposition of this tax depends on

a) the ratio of the marginal product of waste water to the marginal product of machinery.

b) the cost to the firm of using waste water before the tax was put in place.

c) the rental rate of machinery.

d) all of the above.

e) none of the above.

Question A6:

[2 marks] Consider a perfectly competitive firm in the short run. Let this firm’s marginal cost (MC) have the property that MC = 0 if output is zero. If this firm’s marginal cost always increases with output, then at the profit maximizing output level, producer surplus is

a) zero because marginal costs equal marginal revenue.

b) zero because price equals marginal costs.

c) positive because price exceeds average variable costs.

d) positive because price exceeds average total costs.

e) positive because revenues are increasing faster than variable costs.

Question A7:

[2 marks] Consider a consumer choosing between two goods  and

and  where her indif-ference curve for both goods is convex. Further, assume that

where her indif-ference curve for both goods is convex. Further, assume that  and

and  are the prices of

are the prices of  and

and  respectively and I is her income. Suppose that with

respectively and I is her income. Suppose that with  = 1,

= 1,  = 2, and I = 10, she chooses an optimal basket, A, with

= 2, and I = 10, she chooses an optimal basket, A, with  = (2, 4). Now consider a second basket, B, with

= (2, 4). Now consider a second basket, B, with  = (3, 3.5). Which of the following statements is necessarily true?

= (3, 3.5). Which of the following statements is necessarily true?

a) basket A cannot be an optimal choice at the prices and income stated above.

b) the consumer prefers A to B.

c) the consumer prefers B to A.

d) the consumer is indifferent between the two baskets.

e) we need more information to rank A and B.

Question A8:

[2 marks] A perfectly competitive hardware manufacturer has total revenue of $85 mil-lion, total variable costs of $45 million, and fixed costs of $10 million. What is the firm’s producer surplus?

a) $85 million

b) $70 million

c) $40 million

d) $30 million

e) $50 million

Question A9:

[2 marks] Consider the following statements when answering this question.

I. With convex isoquants, a firm’s expansion path cannot be negatively sloped.

II. If a firm uses only two factors of production, one of whose marginal product becomes negative when its use exceeds a certain level, then a cost-minimizing firm’s expansion path will have vertical or horizontal segments.

a) I is true and II is false.

b) I is false and II is true.

c) Both I and II are true.

d) Both I and II are false.

e) more information is needed to answer this question.

Question A10:

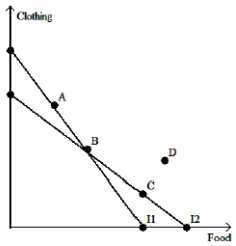

[2 marks] Consider the figure above that depicts two budget lines, I1 and I2, along with four possible consumption baskets. Suppose that a consumer chooses A on budget line I1 and B on budget line I2. Which of the following rankings describes the consumer’s preferences (first is highest ranked and last is lowest ranked)?

a) A-B-C-D

b) A-D-B-C

c) A-B-D-C

d) We do not have enough information to rank all four baskets.

e) D-A-B-C

Section B: There are TWO short-answer questions in this section each worth 20 marks. Answer ALL questions using the script book provided. [40 marks]

Question B1:

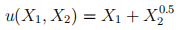

Consider an individual with preferences defined over two goods,  and

and  . This indi-vidual has preferences that can be represented by the following utility function:

. This indi-vidual has preferences that can be represented by the following utility function:

Let

= 4 and

= 2. In addition, suppose this individual has an income of $120.

(a) [3 marks] Write down the expression for this consumer’s marginal rate of substitution of  for

for  (

( ). Identify the distinguishing feature of this particular

). Identify the distinguishing feature of this particular  .

.

(b) [6 marks] Calculate the optimal basket of  and

and  and fully illustrate this optimal choice in a diagram with

and fully illustrate this optimal choice in a diagram with  on the horizontal axis.

on the horizontal axis.

(c) [4 marks] Suppose the government introduces a $2 tax on the consumption of each unit of  but

but  remains tax-free. Calculate the new optimal basket of

remains tax-free. Calculate the new optimal basket of  and

and  . Illustrate this new optimal choice in your diagram above.

. Illustrate this new optimal choice in your diagram above.

(d) [7 marks] Calculate the compensating variation needed to return this consumer to her original utility level.

Question B2:

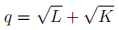

Consider a firm that uses capital (K) and labour (L) to produce output (q) according to the following long-run production function:

(a) [4 marks] Use the tangency condition to derive an expression for this firm’s expansion path.

(b) [8 marks] Let the price of each unit of labour be w and the (rental) price for each unit of capital be r = 1. Determine the cost-minimizing labour input and the cost-minimizing capital input for an output of q0. (Hint: you should not assume a particular value for w)

(c) [2 marks] Find this firm’s long-run total cost function.

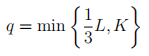

(d) [6 marks] Suppose instead that this firm’s long-run production function is

Assume that wages and rental rates are w and 1 respectively. Derive the long-run total cost function for an output of q0 in this case.

Section C: There are TWO short-answer questions in this section each worth 20 marks. Answer ALL questions using the script book provided. [40 marks]

Question C1:

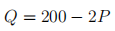

Consider a firm that is a monopolist in the market for good X. The demand for X is

where P is the price of X and Q is the total quantity demanded. The monopolist’s total cost function is

where C represents total costs.

(a) [7 marks] What is the monopolist’s profit maximizing output? What is the price at this output? Fully illustrate this optimal output and price in an appropriate diagram.

(b) [7 marks] What output and price maximizes the sum of consumer surplus and pro-ducer surplus? Explain your answer. Add this output and price to your diagram in part (a).

(c) [6 marks] Suppose that the monopolist is able to charge the price in (a) rather than the price in (b). What is the resulting difference in consumer surplus, producer surplus, and total welfare?

Question C2:

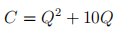

Consider a risk-averse individual with an initial wealth of 100 and a utility function of the form

where W represents the payoff from a particular outcome. Suppose that this individual faces a loss of L with probability 0.5. To reduce her risk, she would like to purchase an insurance policy that gives her a payment of B if she suffers the loss. Suppose that the cost of the policy is equal to the the premium, M.

(a) [2 marks] Assuming that the insurance policy is actuarially fair, what is the premium that insurance companies will charge?

(b) [2 marks] Use all of the information above to write down an expression for this indi-vidual’s expected utility with the actuarially fair insurance.

(c) [6 marks] Let the individual’s objective be to choose the optimal insurance payment, B. What is the optimal B?

(d) [7 marks] Suppose that for each dollar of benefit paid out, an insurance company incurs an additional fraction λ > 0 as an administrative cost. The insurance company passes this cost on to the buyer by reducing the benefit paid by a fraction λ. What is the individual’s optimal B in this case? How does it compare to your answer in part (c)? You can assume that the the insurance industry is competitive and the premium will be actuarially fair.

(e) [3 marks] Now let L = 40. Will this individual prefer having an insurance policy where λ is greater than zero to not having insurance at all? Explain.

END OF EXAMINATION

2021-03-11