MATH2545: Financial Mathematics: Markets (Year 2020/21) Graham Murphy

MATH2545: Financial Mathematics: Markets (Year 2020/21) Graham Murphy

Assignment 1

This assignment contributes 5% of your overall module mark.

Your solutions to these problems must be your own work. You risk losing all credit for the assignment if this is not the case. You must include your name, your student ID and the module code on your script. You must also complete an academic integrity form and upload this with your solutions.

The deadline for this assignment is 3pm Thursday 4 March 2021. Scripts must be sub-mitted via Gradescope (in the Submit my Work area of the module area on Minerva). Late submission up to one week after the deadline will be accepted, but late submissions will be penalised 25% of your mark. Late submissions after 3pm Thursday 11 March 2021 will not be marked at all.

Once marking is complete, it is your responsibility to check for your mark on Minerva. You must do this as soon as possible after marks are released.

1. (i) A utility function has the form

where a, b ∈ R. Assuming w > 0 and

, is U(w) ever suitable for a non-satiated and risk-averse investor? If it is, state the range of values of w this holds for as a function of a and b. You must include your working.

(ii) Give an example of a utility function with DARA. Show all your working.

(iii) An investor has IRRA. Would this investor prefer a fair gamble or to do nothing? Provide a short explanation of your answer.

2. A market consists of two risky assets and no risk-free asset. Let

and

denote the return on each of the risky assets. Using market data the following have been estimated:

where

denotes the correlation coefficient for

and

.

(i) Given that an investor is targeting a total expected return of µ = 0.125 on a portfolio, what is the minimum variance that can be achieved?

(ii) Determine the global minimum variance portfolio and the expected return and variance of return on this portfolio.

(iii) Using your answers to parts (i) and (ii) make a rough sketch of the minimum-variance set in µ - σ space. You should indicate the efficient frontier and the global minimum variance portfolio.

3. Assume that a risk-free money market account is added to the market described in Q2. The continuously compounded rate of return on the money market account is 0% per period. Use the method of Lagrange multipliers to determine the proportions of wealth invested in the three assets available for the minimum variance portfolio with expected return µ. You answer must express the proportions as a function of µ. Using your answer, or otherwise, determine the composition of the market portfolio.

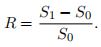

4. Suppose we have a risky asset with random return R. We have defined R to be,

Now we introduce the log-return, which is defined as

. In this question, assume that

.

(i) Show that

.

(ii) Calculate

for an investment of

. Remember that if

then

is lognormally distributed with parameters µ and

. You may use that for a standard normal random variable

, where

denotes the CDF.

2021-03-01