ST226-Actuarial Investigations: Financial

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ST226-Actuarial Investigations: Financial

Assessment questions

The quantities below have been calculated in R, assuming a law of mortality. Some might be useful in answering question 7.

1p35 = 0.9694722,

19.040p35 = 0.914211, 20p35 = 0.9083064,

19.040p40 = 0.8741374, 20p40 = 0.870672,

10p50 = 0.8593929, 10p60 = 0.7126066,

When r = 0.03 :

![]() 35 = 22.998,

35 = 22.998, ![]() 40 = 21.57178,

40 = 21.57178, ![]() 50 = 18.28045,

50 = 18.28045, ![]() 55 = 16.44243,

55 = 16.44243, ![]() 60 = 14.51358,

60 = 14.51358, ![]() 70 = 10.57216, When r = 0.05 :

70 = 10.57216, When r = 0.05 :

![]() 35 = 16.82576,

35 = 16.82576, ![]() 36 = 16.69378,

36 = 16.69378,

![]() 40 = 16.11557,

40 = 16.11557, ![]() 50 = 14.28896,

50 = 14.28896, ![]() 55 = 13.16385,

55 = 13.16385, ![]() 60 = 11.90734,

60 = 11.90734, ![]() 70 = 9.108347 When r = 0.1 :

70 = 9.108347 When r = 0.1 :

![]() 35 = 9.546849,

35 = 9.546849, ![]() 40 = 9.377594,

40 = 9.377594, ![]() 50 = 8.843199,

50 = 8.843199, ![]() 55 = 8.447757,

55 = 8.447757, ![]() 60 = 7.94915,

60 = 7.94915, ![]() 70 = 6.626241

70 = 6.626241

1. (a) Let the nominal interest rate per annum payable every 3 months be 0.12. Calculate the nominal interest rate per annum payable every 6 months and the present value of an annuity certain of 1 per annum payable monthly in advance for 10 years, where the nominal interest rate is payable every month.

[4 marks]

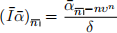

(b) Prove that the present value of a linearly continuously increasing annuity certain of 1 per annum paid continuously for n years is given by

(c) An annuity certain is payable continuously in [0, n]. The rate of payment of the annuity at time t (0 < t < n) is t per unit time. Under an effective interest rate of 5% per year, the present value of the annuity at time t = 0 is equal to 50% of the total cash which will be paid in [0, n]. Show that n = 22.37 (note that due to rounding the results might slightly differ).

[5 marks] [Total: 13 marks]

2. A fast fashion chain is opening a large new outlet with an initial cost of £2, 000, 000. There will also be a rent of £100, 000 per annum payable quarterly in advance for 10 years, in- creasing after the tenth year to £150, 000 per annum over a further 10 years also payable quarterly in advance. The net revenue taking into account all costs other than rent will be £400, 000 in the first year increasing by 2% at the beginning of each subsequent year (i.e. it will become £408, 000 in the second year, £416, 160 in the third year and so on). The rev- enue is received continuously throughout each year. In 20 years’ time the outlet will close and will have no further value. Calculate the net present value of the project using a force of interest of 5% per annum.

[Total: 10 marks]

3. A fund had a value of £450, 000 on 1 April 2017. A net cash flow of £75, 000 was received on 1 April 2018 and a further £150, 000 on 1 April 2019. The value of the fund on 31 March 2018 was £465, 000 and £525, 000 on 31 March 2019.

(a) Calculate the value of the fund on 31 March 2020 so that the money weighted rate of return earned on the fund between 1 April 2017 and 31 March 2020 is 2% per annum.

[3 marks]

(b) Calculate the time weighted rate of return earned on the fund over the same period as above (between 1 April 2017 and 31 March 2020).

[3 marks]

(b) Compare (without additional computations) the money weighted rate of return and

the time weighted rate of return. Explain why are they different/similar.

[2 marks] [Total: 8 marks]

4. A loan of £10, 000 is to be repaid by equal monthly instalments in arrears over 10 years. The amount of the monthly payment is calculated on the basis of an interest rate of 2% per month effective.

(a) Find the monthly repayment.

(b) Find the total capital repaid and interest paid in

(i) the first year

(ii) the final year

[6 marks]

(c) After which monthly repayment is the outstanding loan first less than £5, 000?

[4 marks]

(d) For which monthly repayment does the capital repaid first exceed half of the interest content?

[4 marks] [Total: 16 marks]

5. Consider the variable force of interest δ(t) = 0.01t.

(a) Calculate the value of a 3-year zero-coupon bond.

[4 marks]

(b) Calculate the implied 2-year forward rate in 2 years’ time.

[4 marks]

(c) Calculate the value of a continuous perpetuity of 1 per annum.

[5 marks] [Total: 13 marks]

6. An investor is liable to tax on interest at 20% and on capital gains at 30%. She buys a 10-year bond redeemable at par with an annual coupon of 5% (payable in arrears). The nominal value of the bond is 100. The price, which she pays, is calculated such that she obtains an effective net annual yield of 5% if she holds the bond to redemption. Immediately after the fifth coupon payment she sells the bond and she calculates that she obtained a net effective yield of 5.5%.

(a) Calculate the price at which she purchased the bond.

[6 marks]

(b) Calculate the price at which she sold the bond.

[6 marks] [Total: 12 marks]

7. Consider a 20-year endowment assurance issued to a life aged 35, where the sum as- sured of £100, 000 is payable either immediately upon death or at time 20 if the insured is alive, whichever comes first. Premiums are payable continuously. The insurer incurs initial expenses of 3% of the basic sum insured and 20% of the first year’s premium. The insurer also incurs renewal expenses of 3% of the second and subsequent premiums. Using the values provided at the beginning of the paper and an effective force of interest 5% per year do the following:

(a) Write down the equation of value (in actuarial notation) for the gross annual premium. [4 marks]

(b) Calculate the gross annual premium.

[7 marks]

(c) Calculate the standard deviation of the above endowment assurance.

[8 marks]

(d) Find the probability that the contract makes a profit.

[9 marks] [ Total: 28 marks]

2022-01-04