MA3801 Market Microstructure and Trading Theory

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MA3801

Market Microstructure and Trading Theory

1. The following questions are related to trading. [25]

(i) A market maker forecasts that the travel industry stocks would have a price in- crease due to the release from lockdown. What he would do? Note: This is a multiple selection question. Choose all that apply. [4]

(A) Submit a buy market order.

(B) Submit a sell market order.

(C) Quote a higher bid-price.

(D) Quote a higher ask-price.

(E) Increase the bid-ask spread.

(F) Decrease the bid-ask spread.

(ii) The table below shows limit orders submitted to NYSE. This exchange uses a price-visibility-time precedence and the discriminatory pricing rule.

|

Submission Time |

Buy or Sell |

Limit Price |

Order Size |

Notes |

|

10:01:00 |

Sell |

103.00 |

300 |

|

|

10:02:00 |

Buy |

100.00 |

500 |

|

|

10:04:00 |

Buy |

102.00 |

400 |

|

|

10:06:00 |

Sell |

104.00 |

800 |

Hidden |

|

10:08:00 |

Sell |

103.00 |

100 |

|

|

10:09:00 |

Buy |

101.00 |

700 |

Hidden |

|

10:10:00 |

Sell |

104.00 |

300 |

|

|

10:12:00 |

Sell |

105.00 |

900 |

Hidden |

|

10:15:00 |

Buy |

99.00 |

500 |

|

|

10:16:00 |

Sell |

103.00 |

200 |

|

Tabulate the publicly available limit order book with the following columns: bid prices, bid sizes, cumulative bid sizes, ask prices, ask sizes, and cumulative ask sizes. [9]

(iii) According to the information in Question (ii), if a trader submits a market sell order with size 1200, what would be the average transaction price he expects to get from the market? [4]

(iv) For the order in Question (iii), compute the real average transaction price. [4]

(v) Compute the implicit costs of the sell order in Question (iii). [4]

2. The following questions are related to market observations and traders. [25]

(i) Which statement is true about volatility smile? Note: This is a multiple se- lection question. Choose all that apply. [4]

(A) It is a theoretical result about options.

(B) It is a fact observed in the market.

(C) It is about the relationship between strike price and spot price. (D) It is about the relationship between strike price and option price. (E) It is about the relationship between strike price and implied volatility.

(ii) Which statement is true about volatility clustering? Note: This is a multiple selection question. Choose all that apply. [4]

(A) It is a theoretical result about stock returns.

(B) It is a fact observed in the market.

(C) It can be modelled by GARCH(1,1).

(D) It can be modelled by Brownian motion.

(E) It can be modelled by Black-Scholes.

(iii) Ben is a trader working for a hedge fund. One day he finds the model used by his team is showing a buy signal for GOOGL, while at the same time he personally forecasts a drop in GOOGL price. What should Ben do? Why? [7]

(iv) Do you agree with the following statement about informed traders? Why? “Informed traders improve the market liquidity as they help with the price cor- rection.” [5]

(v) Do you agree with the following statement about high-frequency trading? Why? “High-frequency traders make prices corrections as they always react to arbitrage opportunities in a timely manner.” [5]

3. The following questions are related to the Kyle’s model. [25] You may need the following formula(s):

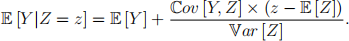

The Lemma 1 is

(i) Consider the current market price p0 , the intrinsic value vl , the informed traders’ order size x, the uninformed traders’ order size y. Which are constants and which are random variables? [4]

(ii) Use the notations in Question (i), formulate the two linear models: 1) market makers’ model of the next market clearing price pl ; 2) the informed traders’ model of their order size x. You may define your own notations if necessary. [5]

(iii) Solve market clearing price pl using the Lemma 1. You may define your own notations if necessary. [8]

(iv) Formulate the profits π of informed traders.

(v) Solve the informed traders’ order size x.

[3]

[5]

4. The following questions are related to Glosten-Milgrom model. [25]

(i) Which of the following statements is most accurate for the Glosten-Milgrom model? [3]

(A) It is a model to compute bid-ask spread.

(B) It is a model to compute clearing price.

(C) It is a model used by informed trader.

(D) It is a model used by market maker.

(ii) Suppose the probability of bad news is θ (%), the composition of informed trader is µ(%), draw the sequential trading model (it is in a tree structure). [5]

(iii) Compute the bid price and ask price based on the notations in Question (ii). [12]

(iv) Can you think of a limitation of this model and a method to improve it? [5]

2021-12-26