33841 BSc Accounting and Finance

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MOCK Examinations Remit 2021-22

BSc Accounting and Finance

Foreign Exchange and International Finance

33841

Section A

1.

What are the two types of analysis traders use day to day when trading products?

a) Exponential & Tertiary

b) Primary & Secondary

c) Fundamental & Technical

d) Psychological & Human behavioural

2.

A technical level of resistance is which of the following?

a) A ceiling we believe price won’t go above

b) A ceiling we believe price won’t go below

c) A floor we believe price won’t go above

d) A floor we believe price won’t go below

3.

A technical level of support is which of the following?

a) A ceiling we believe price won’t go above

b) A ceiling we believe price won’t go below

c) A floor we believe price won’t go above

d) A floor we believe price won’t go below

4.

What happens when a level of support or resistance breaks?

a) The level breaks and we won’t see it again

b) It becomes completely useless for further analysis

c) We lose money

d) It reverses to become the opposite type of technical level

5.

Pivot Points are calculated using which method?

a) Estimating

b) Previous days price action

c) Studying trading psychology

d) Looking at future events

6.

Typically, how many different levels are there when using Pivot Points

a) 3

b) 4

c) 5

d) 7

7.

What does RSI stand for?

a) Really strong indices

b) Relatively stable index

c) Relative strength index

d) Really short inference

8.

What are the most common levels when using the RSI tool?

a) 50|50

b) 60|40

c) 70|30

d) 80|20

9.

What does RSI measure?

a) Speed & Strength

b) Time

c) Future length

d) Yesterday’s levels

10.

Which of the following currency pairs is considered the most defensive?

a) GBP/USD

b) JPY/USD

c) CAD/USD

d) NZD/USD

11.

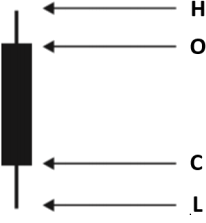

On the chart below, where does the RSI tool indicate a buy signal?

a. C

b. D

c. B

d. A

12.

What is the most common currency traded?

a) GBP

b) AUD

c) CAD

d) USD

13.

Why are most currencies denominated in USD?

a) It’s the most commonly traded

b) America invented trading currencies

c) Most traders in the world are in the US

d) America is the 4th largest country in the world

14.

Do international businesses Trade currencies?

a) Yes

b) No

15.

What data does the Moving Average technical tool use?

a) Tomorrow’s opening prices

b) Speed of price movement

c) Previous time periods closing prices

d) Intra day highs and lows

16.

Is a Moving Average a leading or lagging indicator?

a) Leading

b) Lagging

c) Both

17.

If you use more than one technical tool at a time then you can produce technical signals that are more reliable. True or False?

a) True

b) False

18.

You buy 5 million Euros at EUR/USD exchange rate 1.0615 and on a later date you buy a further 3 million Euros at exchange rate 1.0674 to give yourself a total position of long 8 million Euros. You then sell 10 million Euros at EUR/USD exchange rate 1.0658. If EUR/USD is currently trading at 1.0620, which one of the following statements most accurately describes your current position?

a. Short 2 million EUR/USD with a realized loss and unrealized gain

b. Short 2 million EUR/USD with a realized loss and unrealized loss

c. Short 2 million EUR/USD with a realized gain and unrealized gain

d. Short 2 million EUR/USD with a realized gain and unrealized loss

19.

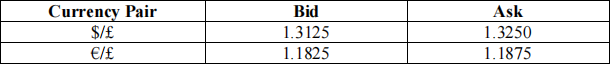

In the candlestick diagram below H = high, O = open, C = close, & L = low price. In this diagram the colour of the body of the candlestick has been blacked out. On a real candlestick chart what colour would you expect the body to be?

a. Green

b. Red

20.

Which of the follow would most likely have the largest impact on the US Dollar’s value?

a) Thanksgiving holiday

b) US CPI data release

c) BREXIT

d) OPEC meeting

Section B

Question 1 [25 marks]

a) Explain the benefits that multinational companies get from using foreign exchange markets. Even though multinational companies are believed to be beneficial for countries, why are some governments concerned with the growing importance of multinational companies? [4+4=8 marks]

b) Highlight the differences between spot exchange rate and forward exchange rate. Explain when these rates can be used by multinational companies. [5 marks]

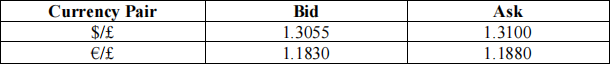

c) You are given following quotations by Bureau-de-Change A

i. What is the Bid and Ask price for £/€? [3 marks]

ii. What is the implicit cross exchange rate of one euro to the dollar, from the point of view of an investor in the UK? [3 marks]

iii. If Bureau-de-Change B is offering following quotations, calculate the amount of profit you can realize if you have £100,000 to invest. [6 marks]

Question 2 [25 marks]

a) Explain the main features of the gold standard system of exchange rates with example. What were the main problems inherent in the classical gold standard system? [5+5=10 marks]

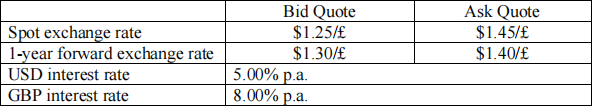

b) Dylan is considering making investment of US$4,000,000 and he has collected thefollowing information about the foreign exchange market:

Required

i. Is Dylan better off making the dollar denominated or pound denominated investment? Show calculations. [7 marks]

ii. Let’s suppose Dylan is allowed to borrow or lend up to £4,000,000 at the dollar interest rate and/or pound interest rate. Given the data above, is there any opportunity to make riskless profit using covered interest rate arbitrage? If yes, how much is the net profit? Show calculations. [8 marks]

Question 3 [25 marks]

a) Mr Bruce Banner heads the finance division of Shield Plc, a UK based large multinational company that supplies major polyethylene resin worldwide. The firm has a receivable worth US$45,675,125 due in the next three months’ time. The current spot rate between dollar and pound ($/£) is 1.1800 and Mr Banner strongly believes that the pound will be stronger compared to the dollar in the next three months’ time and will reach at least 1.3000.

Mr Steven Rogers heads the finance division of Stark Plc, a large US based multinational company that supplies petrochemical and gasoline products worldwide. The firm has a payable worth £30 million due in the next three months’ time. However, due to the uncertain economic condition, Mr Rogers is unsure how the exchange rate between $ and £ will move in the next three months.

Required:

i. Explain, with reasons, which hedging techniques should Mr Bruce Banner use to hedge his receivables. How should he set up his hedge? [5+5=10 marks]

ii. Explain with reasons which hedging techniques should Mr Steven Rogers use to hedge his payables. How should he set up his hedge? [5+5=10 marks]

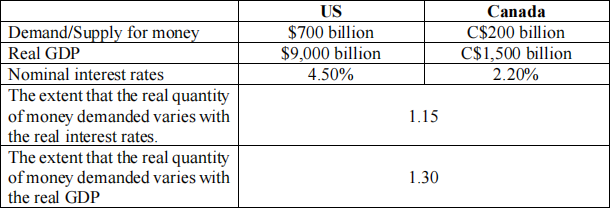

b) Assume that the Purchasing Power Parity (PPP) holds, and you are given following information:

Required:

i. What exchange rate (C$/$) is implied by the monetary theory of exchange rates? [2 marks]

ii. Ceteris paribus, what happens to the exchange rate if the Canadian Money Supply increases from C$1,600 to C$1,760? How does it compare to the percentage change in the Canadian money supply? [3 marks]

Question 4 [25 marks]

a) You are an expert foreign exchange trader who is looking an opportunity to make an arbitrage profit. You find following information on different quotes offered by FX traders:

Required

i. Do you see an arbitrage opportunity here? Show calculations. [3 marks]

ii. If you start with USD 1million, how would you go about undertaking the arbitrage? [7 marks]

b) Discuss the differences between a triangular arbitrage and a covered interest arbitrage. [5 marks]

c) What is foreign exchange risk exposure? Describe the different types of foreign exchange risk exposure that a company may face and also discuss the activities of a company that may cause the exposure. [10 marks]

Question 5 [25 marks]

a) In order to hedge its foreign exchange exposure, Raymond plc entered into a currency swap contract with a swap dealer some years ago. Under the contract, the company agreed to swap pound sterling for €5 million at the exchange rate of €1.1875/£, i.e., the company will pay euro and receive sterling.

Under the terms of the currency swap, the company agreed to receive a fixed rate of interest in pound sterling from the swap dealer and pay a fixed rate of interest in euro to the swap dealer. The contract was based on the following fixed rates of interest:

The company further agreed with the swap dealer that the €5 million principal of the swap contract will be exchanged to pound sterling at the spot exchange rate on the market at the end of the contract period or whenever the contract is to be cancelled.

Now, assume that the remaining life of the swap contract is exactly four years and that Brum plc has decided to cancel the contract today. Also assume that the current interest rate on the euro is 3.35% per annum, the corresponding interest rate on the pound sterling is 4.20% and the spot exchange rate of the pound to the euro (i.e., €/£) is €1.1775/£.

Required

i. Use the information above to calculate the value of the swap contract to the company as at today. [20 marks]

ii. Explain why the value of the swap contract is positive or negative. [2 marks]

iii. How does value of swap contract in part (ii) relate to the risks faced by swap contract? [3 marks]

2021-12-24

Foreign Exchange and International Finance