IB3J80: Banks and Financial Systems Summer 2019

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

IB3J80: Banks and Financial Systems

Summer 2019

Part I:Multiple choice questions [5 points each question,40 points in total]

One and only one statement is correct for each question.Please check it and mark your answer grid accordingly.

Question 1: Which of the following statements is wrong for the Holmstrom-Tirole (1997) model?

A.The model shows that the moral hazard problem can lead to credit rationing.

B.The model explains why small firms tend to rely on bank loans for financing.

C.The model explains why debt financing involves less agency cost as compared to

equity financing

D.The model suggests that banks can reduce credit rationing via monitoring.

|

Question 2: Regarding liquidity provision,which of the following statements is wrong? A.Diamond-Dybvig(1983)model explains how banks provide liquidity to households. B.Holmstrom-Tirole(1998)model explains how banks provide liquidity to corporates. C.Banks can provide liquidity via term loans. D.Banks can provide liquidity via credit lines. |

|

Question 3: In the Diamond-Dybvig(1983)model,why would taking a deposit contract from a bank provide better insurance against liquidity risk than trading long-term asset directly in a spot market? A.Because the demand and supply do not equal in the financial market. B.Because the market suffers adverse selection problem. C.Because the market cannot deal with the systematic risk in the economy. D.None of the above is correct. |

|

Question 4: Securitization in the US before the subprime crisis leaves us many lessons about how to develop a healthy market for securitization.Which of the following is incorrect? A.We should regulate complex and opaque securities. B.We should avoid regulatory arbitrage in leverage. C.We should strengthen the reliance credit ratings. D.We should ring-fence traditional banking sector. |

Question 5: While the traditional originate-and-hold business model of banking and the

much more recent originate-and-distribute model of banking (shadow banking)differ

significantly.They also share a good number of similarities.Which of the following is incorrect?

A.Both are subject to credit risk

B.Both involve liquidity transformation and mismatch.

C.Both should be protected by financial safety nets such as deposit insurance.

D.Shadow banks are outside of regulatory perimeter.

|

Question 6: Micro-prudential regulation focuses on the resilience of individual financial institutions.Which of the following is beyond the scope of micro-prudential regulations? A.Limiting bank credit risk B.Limiting bank operational risk C.Mitigating the co-movement of business cycle and credit cycle D.None of the above. |

|

Question 7:Well-designed deposit insurance schemes can,in theory,eliminate the risk of runs by retail depositors.But in the real world,certain features of deposit insurance also encourage risk-taking.Such features would NOT include: A.Risk-sensitive deposit insurance premium B.Government back-stop C.Comprehensive coverage that includes foreign and interbank deposit D.None of the above |

|

Question 8:Which one of the following is NOT among the three pillars of Basel Ⅱ regulatory framework? A.Capital requirement B.Liquidity requirement C.Supervisory review D.Market discipline |

Part II:Please answer the questions based on the provided graph and table.

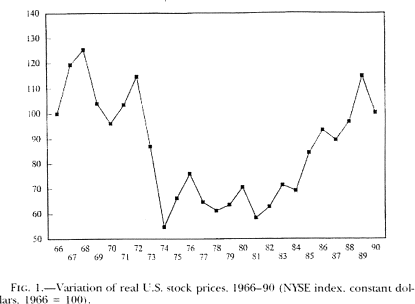

The graph below shows the performance of NYSE index from 1966 to 1990.The stock market plunged upon the oil crisis in 70s and recovered in 80s.

Question 9:Please explain the difference between idiosyncratic and systematic risks,and explain whether the graph reflects an idiosyncratic risk or a systematic risk of the financial market.[6 points]

|

Question 10: Given that direct equity holding constitutes a substantial fraction of American household wealth,what is the welfare implication of the stock market volatility?[6 points] |

|

Question 11:Please explain intuitively how a financial institution of long investment horizon could help households to deal with the market volatility.[6 points] |

|

Question 12: Diamond-Dybvig(1983)model sees the bank runs as a panic-driven event. Please explain why the model has two equilibria and one of them can be considered as a bank run caused by depositors'pessimistic beliefs and coordination failure.[8 points] |

Question 13: The table below shows the periods of bank runs in the national banking era of the U.S.Would you consider the empirical observation consistent with the theory that treats bank runs as panic-driven events?[4 points]

Part II:Please solve the following example of Diamond-Dybvig model.

Question 14

Consider the investment decision of a continuum of investors of mass 1.The economy has three dates,t=0,1,2.The investors are assumed to have a utility function U(C)=-1/C.

Each of them faces the following liquidity risk:with probability 1/4,he or she becomes impatient and only values t=1 consumption.Otherwise,the investor is patient and is indifferent between consuming on date 1 or date 2.There is no aggregate uncertainty in the economy,and it is always the case that a quarter of investors become impatient and three quarters are patient.Each investor has one unit of endowment at the initial date 0 and chooses between holding cash and a long-term asset.The long-term asset yields a gross return R = 1.21 if it matures at t=2,but generates a liquidation value l =0.8 if it is liquidated at t=1.

a.Denote by Ci and Cz the consumption that maximizes the expected utility of the investors.We know that Ci and Cz must satisfy MU(Ci)=R×MU(C2),where MU(C)denotes an investor marginal utility for consumption C.Explain intuitively why the equality must hold.[6 points]

b.Please calculate the value of Ci and C2 and verify 1<Ci<C2<1.21.[6 points]

c.Show how banks can help to achieve the most desired consumption levels by issuing demand deposits.Describe the deposit contract and discuss why investors would be willing to accept it.[6 points]

d.Please calculate the portfolio that the bank needs to hold to meet provide consumption Ci and Cz.[6 points]

e.We know that the demand deposit contract would expose the bank to the risk of runs.

Please discuss what the bank and the regulator can do to reduce the risk of runs?[6 points]

2024-06-14