MATH3510: Actuarial Mathematics 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH3510: Actuarial Mathematics 1 (Year 2021/22)

MATH3510 Coursework Assignment

All numerical values in the report should be quoted to THREE decimal places.

1. (a) Under a Gompertz model, the survival function is given by

(i) In your spreadsheet calculate

for all integer from the Start Age to the End Age (see your Parameter Sheet for these values and also the values of B and c).

(ii) Using the values from (i), calculate

in your spreadsheet for each integer value of x from Start Age to End Age-1.

(iii) Consider a population of 100,000 independent lives at the Start Age. Add to your spreadsheet values of

under the Gompertz model from Start Age to End Age-1. Assume that

(iv) Finally, calculate

and

for all ages from Start Age to End Age (where this is defined).

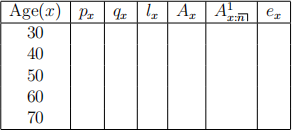

(v) Construct and complete a table like the one below using the values you have calculated for the Gompertz model.

(b) The template spreadsheet contains a life table from the UK in 1983 (Sourced from the ONS). Using this calculate

for x = 20 up to and including x = 99 using the life table values. In your spreadsheet create a chart which compares the

values you have just calculated with those from the Gompertz model (in part (a)) and those from de Moivre’s model where the limiting age is

= End Age. The chart should plot

for the three models for ages 25-90.

(c) Using your chart from part (b) (and any other data you have calculated), explain whether you think either of the Gompertz model or the de Moirve’s model would be appropriate for the population described by the life table.

All numerical values in the report should be quoted to THREE decimal places.

2. In this question you will work with de Moivre’s model with the limiting age,

, given in the parameter sheet. The population of interest has 200,000 independent lives aged 0 at the start.

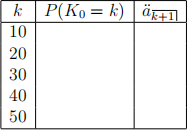

(a) In your spreadsheet, calculate the following quantities for a life aged 0 (i.e. a newborn) and for k = 0, 1, 2, ..., 100.

(i) Prob(

).

(ii)

(iii) Use your calculations from (i) and (ii) to construct and complete a table like the one below.

(iv) Next, let P(y) = Prob(

> y). Use your answers to part (iii) to calculate P(y) for y = 5, 10, 15 and 20.

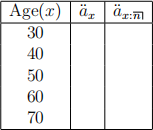

(b) Add to your spreadsheet a calculation of

(for x in the range 0-99) and

(for values of x where this is defined). The value for n is given in your parameter sheet. Construct and complete the table below.

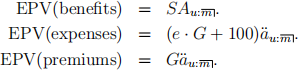

3. An insurance company offers an m-year endowment insurance is issued to a life aged u. A benefit S is paid at the end of year of death within the policy term or at time m if the policy holder survives. The policy holder pays an insurance premium, G, at the start of each year of the policy. The insurance company has administrative expenses which are

plus e% of G to be paid at the start of each year of the policy.

The expected present value of: benefits, premiums and expenses for the policy are

All numerical values in the report should be quoted to THREE decimal places.

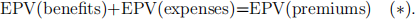

(a) As we will see later in the module, we can calculate G by requiring that:

Apply this formula to calculate the value of G and the annual expense the insurance company must pay.

(b) A new piece of legislation designed to cut the cost of insurance will come into effect soon. The impact on the policy described in part (a), is that premiums will have to reduce by z%, i.e. the new premium, H, must be H = (1 − z%)G. The difference between the EPV of premiums calculated in (a) and

rep-resents an additional cost to the insurer. The board of directors has determined that the policy will be withdrawn if the additional cost is 40% or more of the value of the EPV of expenses in part (a). Will the policy be withdrawn?

(c) What adjustment to the policy described in (a) could be made to ensure that (*) remains valid? Why might the board of directors be unwilling to make this change?

2021-11-17