Macroeconomics 1012 SAMPLE MIDTERM II

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Macroeconomics 1012, 20XX

SAMPLE MIDTERM II

Questions 1-20 are multiple-choice. Please choose the best answer - the most complete and accurate answer.

|

1 |

2 |

3 |

4 |

5 |

|

6 |

7 |

8 |

9 |

10 |

|

11 |

12 |

13 |

14 |

15 |

|

16 |

17 |

18 |

19 |

20 |

1. Suppose investors believe that the next 4 or 5 years will be years of low profits. In this case, you might expect

a. investment to decrease, and the AD curve to shift left

b. investment to increase, and the AD curve to shift left

c. investment to decrease, and the AD curve to shift right

d. investment to increase, and the AD curve to shift right

2. The US government has a large amount of debt. If there is unexpectedly high inflation in the US then, in real terms,

a. people who lent to the US government would lose, and the US government would gain

b. people who lent to the US government would lose, and the US government would lose

c. people who lent to the US government would gain, and the US government would gain

d. people who lent to the US government would gain, and the US government would lose

3.A decrease in the price of labor will cause the short run aggregate supply curve to

a. shift inward (left), because lower wages increase costs

b. shift outward (right), because lower wages increase costs

c. shift outward (right), because lower wages decrease costs

d. do nothing, because it only depends on technology, inputs and wages.

4. An increase in the price level would shift

a. neither the AD nor SRAS. The curves represent the relationship between prices and real GDP, so the price level cannot affect the position of either curve.

b. the AD curve to the right, and the SRAS curve to the left.

c. the AD curve to the left, and the SRAS curve to the right.

d. the AD curve to the right, but does not affect the SRAS curve.

e. the SRAS curve to the right, but does not affect the AD curve.

5. On any bank balance sheet,

a. Bank capital should be reported under Liabilities

b. loans from the central bank should be reported under Assets

c. Assets exceed Liabilities

d. Liabilities exceed Assets

6. Disposable income can be defined as

a. GDP plus taxes minus government spending

b. GDP plus transfers minus government spending.

c. GDP plus transfers minus taxes

d. GDP plus taxes and transfers.

7. A decrease in transfers shift the

a. AD curve to the left.

b. AD curve to the right.

c. SRAS curve to the right.

d. SRAS curve to the left.

8. If the prices of all goods (including all inputs and outputs) decrease by x% then, according to the theories discussed in class,

a. the relative prices of all goods remain the same

b. real GDP decreases

c. real GDP increases

d. the real wage decreases.

9. The FED now pays interest rate on bank reserves. If the FED were to raise the interest rate it pays banks to hold reserves, you would expect that:

a. excess reserves would drop and the money supply would drop

b. excess reserves would rise and the money supply would drop

c. excess reserves would drop and the money supply would rise

d. excess reserves would rise and the money supply would rise

10. Fiscal policy can beenacted by changing taxes, transfers or government spending. Of these,

a. taxes and transfers affect AD, but government spending affects the SRAS curve

b. all three affect mainly the SRAS curve

c. all three affect mainly the LRAS curve

d. all three affect mainly the AD curve

11. Spending on new capital goods

a. is the largest component of aggregate demand

b. is added to GDP, along with the value of capital goods produced in earlier years

c. is less than spending on consumer goods

d. is never included in GDP

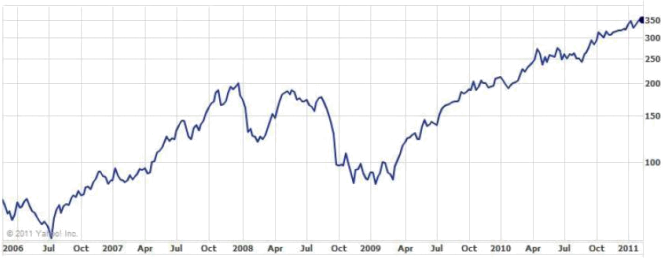

Figure 1: Value of a share of Apple Co., Feb 18, 2006-Feb 18, 2011. (Source: Yahoo! Inc.)

12. Figure 1 displays the share value of Apple Computer, a company whose shares trade on the stock market in New York. From Figure 1, you might conclude about Apple that

a. Since January 2009, wages have been increasing for the most part.

b. Since January 2009, production has been increasing for the most part.

c. Since January 2009, sales have been increasing for the most part.

d. Since January 2009, expected future profits have been increasing for the most part.

13. If you move $100 from a savings account to a checking account, then

a. M2 rises and M1 falls

b. M2 remains the same and M1 falls.

c. M2 remains the same and M1 rises.

d. M2 falls and M1 remains the same

e. Both M1 and M2 remain constant.

14. Moving along the short-run aggregate supply curve, .

a. the real wage rate is constant

b. real GDP equals potential GDP

c. the money wage rate, the prices of other resources, and potential GDP remain constant

d. real GDP equals nominal GDP

15. Bank of America holds $6,000,000 in reserves, $14,000,000 in US government bonds, $40,000,000 in loans, and has $50,000,000 in checking deposits. It has no other assets or liabilities (except for bank capital). Which of the following is true?

a. It has $10,000,000 in bank capital.

b. It has $6,000,000 in bank capital.

c. Its reserve ratio is 1/6.

d. Its reserve ratio is 1/10.

16. Liquidity refers to

a. the rate at which money flows through the economy.

b. the ease with which an asset can be converted into cash.

c. the speed at which fiscal policy can respond to macroeconomic shocks.

d. the rate at which the price level increases.

e. the temperature at which fiat money turns into gold.

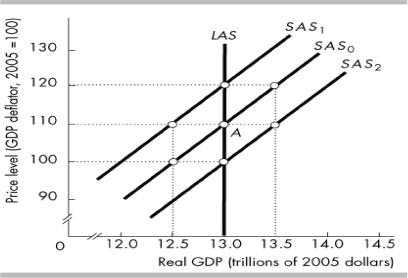

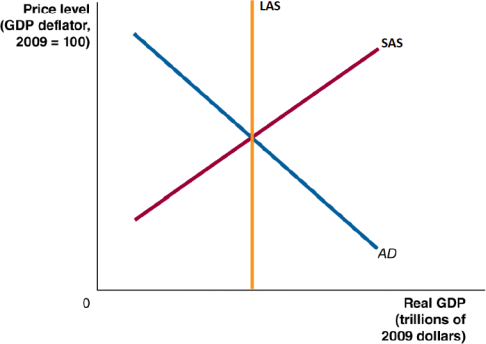

Figure 2: Long run and short run aggregate supply curves

17. In Figure 2 above, the economy is at point A. Then the price level falls to 90 while the money wage rate does not change. Firms will be willing to supply output equal to

a. less than $13.0 trillion

b. $13.0 trillion

c. more than $13.0 trillion

d. Without more information, it is impossible to determine which of the above answers is correct.

18. Suppose that the Fed lowers the interest rate it charges banks for loans (the discount rate). You would expect this to

a. lead banks to lend to less-profitable firms than before, because funds are cheap.

b. lead banks to lend to only very profitable firms, because funds are cheap.

c. lead banks to lend to less-profitable firms than before, because funds are expensive.

d. lead banks to lend to only very profitable firms, because funds are expensive.

19. In order for barter trade to occur between two people, there must be

a. purchasing power parity

b. commodity money

c. a double coincidence of wants

d. fiat money.

20. We distinguish between the long-run aggregate supply curve and the short-run aggregate supply curve. In the long run

a. technology is fixed but not in the short run.

b. the price level is constant but in the short run it fluctuates.

c. the aggregate supply curve is horizontal while in the short run it is upward sloping. d. real GDP equals potential GDP.

e. all of the above.

SHORT ANSWER QUESTIONS:

Please answer the following questions on the answer sheet, in the spaces provided.

Suppose that banks keep exactly their required reserves unless there is a financial crisis. State the impact of each of the following on the multiplier and also on the money supply (increase, decrease or no change):

21. An open market purchase

22. An increase in the required reserve ratio

23. A financial crisis

|

|

Multiplier |

Money supply |

|

21 |

|

|

|

22 |

|

|

|

23 |

|

|

24-25. A bank wants to make a loan. If the bank obtains funds to lend by selling bonds to the Fed, explain how this changes the monetary base and how it ends up changing the money supply. Explain also why the final change in the money supply is generally larger than the change in the monetary base, whereas the change in the monetary base is exactly the same as the bond sale.

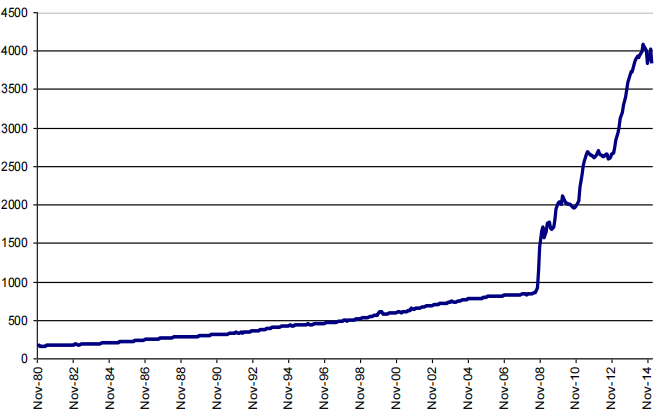

Figure 3: Monetary Base, billions of dollars. Source: Federal Reserve Bank of St Louis.

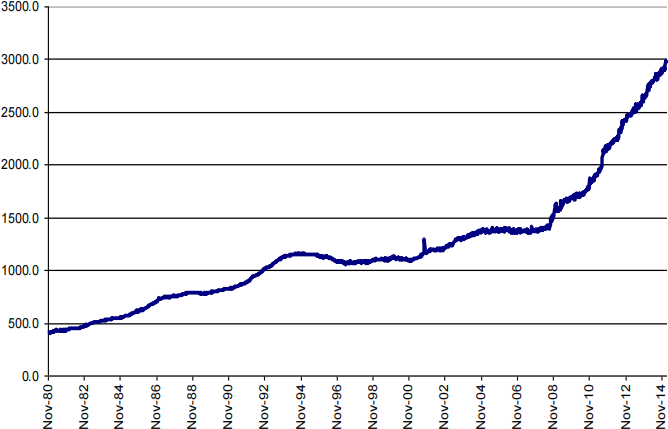

Figure 4: M1, billions of dollars. Source: Federal Reserve Bank of St Louis.

26-27. Look at Figures 3-4. What happened to the multiplier around November 2008? Explain how you can deduce this from the two figures. [HINT: which one changes by a greater proportion?]

28. Name two things that could have led the multiplier to behave in this way after 2008.

29-30. Consider a bank in Greece that holds $4000 in deposits, $400 in reserves and $4000 in loans. There are no other assets or liabilities other than bank capital. Arrange these items on the first balance sheet and compute bank capital. Please make sure you label all items.

|

Assets |

Liabilities |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

TOTAL: |

31-32. Suppose $600 of the loans are loans to the Greek government. Suppose we find out that the Greek government cannot pay back any of the loans at all. What would be the total liabilities of this bank now? What is its bank capital? Show this by filling out the second balance sheet. Please make sure you label all items.

|

Assets |

Liabilities |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

TOTAL: |

33-34. Suppose now that some organization (the IMF, the European Union, etc) says it will pay back HALF of the loans of Greece. How what does the balance sheet look like? Please make sure you label all items.

|

Assets |

Liabilities |

|

|

|

|

|

|

|

|

|

|

TOTAL: |

TOTAL: |

35. What feature of the labor market is responsible for the fact that the aggregate supply curve is not vertical in the short run? Explain how this feature leads the SRAS to have this shape.

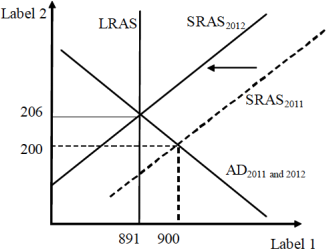

Figure 5: Macroeconomic Equilibrium for 2011 and 2012.

Questions 36-39 concern Figure 5:

36. What is the real GDP growth rate between 2011 and 2012?

37. What is the inflation rate between 2011 and 2012?

38. What are labels 1 and 2 (in words)?

39. What price must change to cause the shift in the SRAS between 2011 and 2012? Is it an increase or a decrease in that price?

40. Use the figure below to draw what would happen if the economy is at its long-run equilibrium and aggregate demand increases. Explain how you get the short-run equilibrium and how the economy adjusts to the long-run equilibrium.

2024-04-15