ACC 103 MANAGEMENT ACCOUNTING 2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

DIPLOMA IN MANAGEMENT STUDIES

ACC 103 MANAGEMENT ACCOUNTING (April - June 2024)

Individual Assignment

CA1 (50 marks; 30% of the overall weightage)

Question 1 (20 marks)

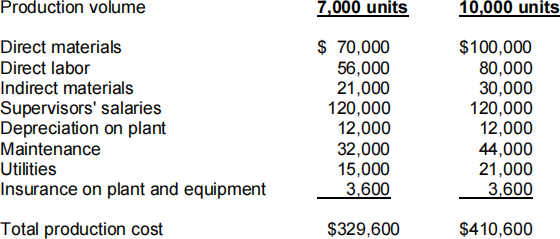

Ross Company manufactures and sells a basic low cost model of computer tablet.

It has recently generated the following information available regarding production costs at various levels of monthly production:

Required:

a) Classify each cost as fixed, variable or mixed, using production volume as the cost driver. (4 marks)

b) Use the high-low method to separate mixed costs into their fixed and variable components. (4 marks)

c) Develop an equation for total monthly production costs. If Ross Company

expects a production volume of 8000 tablets in the coming month, predict the total production cost. (6 marks)

d) Base on a sales price of $80 per tablet and a fixed selling and admin cost of $40,000, prepare a projected contribution income statement for a production of 12,000 tablets. (6 marks)

Question 2 (20 marks)

(This part is independent from part 1 a) to 1 d))

For the coming month, Ross company has plans to make and sell 3 other more expensive models of tablets. The price and variable cost and sales mix for each type is as follows. Total fixed cost related to the 3 new types of tablets is $60,000 per

month.

|

Model |

Price per unit |

Variable Cost |

Sales mix |

|

Pretty Pink |

$100 |

$25 |

8 units |

|

Wit White |

$180 |

$40 |

3 units |

|

Baby Blue |

$300 |

$120 |

1 units |

Required:

a) Calculate the break-even point in sales dollars for Pretty Pink, Wit White and Baby Blue tablets for the coming month. (6 marks)

b) If Ross Company has a target income for these 3 new products for the coming year of $300,000, how many Pretty Pink, Wit White and Baby Blue tablets will company have to sell? (4 marks)

c) What is the company’s margin of safety in dollar value for the year? ( 3 marks)

d) Why cost-volume-profit analysis can be useful to managers ? Give 2 reasons ( 4 marks)

e) Ross Company is thinking of acquiring a company. Base on their research, Company X and Company Y are similar except Company X’s costs are mainly variable whereas Company Y’s costs are mostly fixed.

When sales increase, which company will realize a higher increase in profits? Explain (3 marks)

Question 3 (10 marks)

(This part is independent from Question 1 and 2)

Ross Company uses a job-order costing system and a predetermined overhead rate based on machine hours.

At the beginning of the year, the company estimated manufacturing overhead for the year would be $240,000 and machine hours would be 8,000.

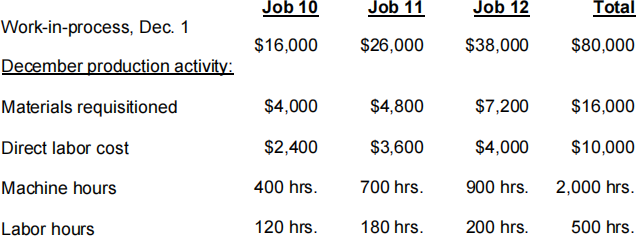

The following information pertains to December of the current year:

Actual manufacturing overhead cost incurred in December was $61,000.

Required:

a) Determine the total cost associated with each job. ( 6 marks)

b) For the month of December, Job 10 was completed and sold to customers for

$50,000 cash, what is the gross margin for Job 10? (2 marks)

c) How much was overhead over/underapplied? (2 marks)

2024-04-04