MATH5816 - Continuous Time Financial Modelling

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH5816 - Continuous Time Financial Modelling

School of Mathematics and Statistics

Midterm Assessment, 2021

Black Scholes Model

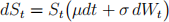

All questions below are to be answered within the Black-Scholes framework. That is the stock price S is governed, under the real-world measure P, by the Black-Scholes stochastic differential equation

where σ > 0 is a constant volatility and r > 0 is a constant short-term interest rate and  Also recall that under the martingale measure

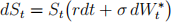

Also recall that under the martingale measure  (for the discounted stock S/B) the dynamic of the stock price satisfies

(for the discounted stock S/B) the dynamic of the stock price satisfies

where  is a Brownian motion under

is a Brownian motion under  .

.

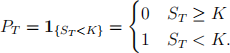

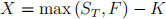

1. The digital put option with strike K at time T has payoff

(a) Compute the Black Scholes price for the digital put with strike K.

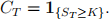

(b) Derive the put-call parity relationship for digital options. Recall that for the call we have

2. Consider the European contingent claim which settles at time T and has the payoff given by the following expression

where F and K are constants satisfying K > F.

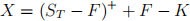

(a) Show that X admits the following representation

(b) Find an explicit formula, in terms of the Black-Scholes call price, for the arbitrage price of X at any date t ∈ [0, T].

(c) Let us fix the date t ∈ [0, T] and let us assume that K is given as an Ft-measurable random variable. Find the level of K for which the arbitrage price of X at time t is equal to zero.

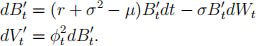

3. Instead of discounting using the bank account

one can discount using the underlying stock S. Let us consider the discount portfolio V′ = V/S where

is a self-financing strategy.

(a) Show that the dynamic of the discounted wealth process V′ = V/S and B′ = B/S under the real-world measure P are given by

(b) Show that there exist a unique probability measure Q equivalent to P so that the discounted wealth process V′ is a Q (local) martingale. State the associated

density process.

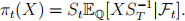

(c) Suppose X is an bounded replicable claim, argue that for a Q-admissible strategies

that the risk-neutral pricing formula for X under Q is given by

2021-11-06