Microeconomics 1 ECON 1101

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Microeconomics 1

ECON 1101

Part A - 100 points Each question in this part is a True, False, or Uncertain question. For each question you must answer whether the statement in italics is True, False, or Uncertain, and justify your response. Each question in this part is worth a maximum of 10 points.

1. Public Schooling in Australia is an example of a public good as it is free to access for all students.

FALSE: Public goods are non-rival, non-excludable. Public schools are neither.

2. Firms hire labour because they gain an inherent benefit from providing jobs to work-ers.

FALSE: Demand for labour is derived demand. Firms need to hire labour, they don’t want to hire labour.

3. Disunited Fruit owns and rents a fleet of apple picking vehicles. Each vehicle is currently valued at $500,000, and depreciates at a rate of 10% per year. True, False, or Uncertain: If Disunited Fruit charged a rental price in excess of $50,000 per vehicle per year, no-one would rent their apple-picking vehicles.

FALSE/UNCERTAIN: Orchards are willing to pay more than $50,000 to hire the vehicle due to interest foregone. To buy (and sell) the vehicle would cost $500, 000∗i in foregone interest, and $50, 000 in depreciation costs, so Disunited Fruit could charge up to the sum of these.

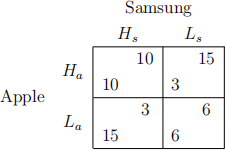

4. Apple and Samsung are competing as duopolists in the smartphone market, each releasing a new smartphone each year. Each year, Apple and Samsung can choose to charge a high price, or a low price, for their new phone. The profits for their choices are given in table below. There is a dominant strategy for each firm to charge a low price (you do not need to show this).

As both firms know this game will be played again every year, there is a way to maintain cooperation.

TRUE: Firms use grim trigger strategy. Students should explain the grim trigger strategy and why it will work.

5. Regardless of costs, a monopoly firm should never produce at a quantity where the price-elasticity of demand is greater than 1.

FALSE: The monopolist should never produce were

< 1. The monopolist will produce at some quantity where

> 1.

6. Students asking questions during lectures provides a benefit both to the student asking the question, but also to other students in the class. To improve overall welfare, lecturers should give rewards to those students who ask questions during class.

TRUE: Students should talk about positive externalities, Marginal Excess Benefit, and Social Marginal Benefit. Graphs are appropriate.

7. In a competitive market, the supply curve is the same as the marginal cost curve because firms are identical.

FALSE: The supply curve is the same as the marginal cost curve because this maximises profit for each firm.

8. In order to psychologically manipulate consumers into purchasing more expensive/profitable goods, shopkeepers may stock some products that they do not expect any consumers to actually purchase.

TRUE: Students should talk about the Assymetric Dominance effect and the Com-promise Effect. A small pseudo-example may be helpful.

9. Economists tend to like perfectly competitive markets because, assuming there are no externalities, because the competitive equilibrium is the efficient outcome.

TRUE: Students should explain why the competitive equilibrium is efficient. Stu-dents should describe efficiency in terms of MB = MC, and minimum ATC for each firm’s production.

10. While there are many possible arguments for restricting international trade, in most cases most economists would disagree with these arguments for restricting interna-tional trade.

TRUE/UNCERTAIN: Hard to mark. Students should describe some of the ar-guments against international trade, and why they are not generally accepted by most economists. Really good answers will also talk about possible situations where restricting trade can be beneficial.

Part B - 50 points This part contains three questions. You must answer TWO of THREE of the questions. Each question in this part is worth 25 points in total. Each question contains multiple sub-questions. As always, you must answer questions to the best of your ability, and justify all responses.

1. The federal government is concerned about rising gas prices for residential consumers due to lower international transport costs driving increased exports. To reduce the domestic price paid by consumers of natural gas, the government is considering three policy options to effect exports: (i) a quota on the amount of gas that can be exported, (ii) a tax applied to all exported gas, and (iii) a consumer subsidy where domestic consumers are subsidised for each unit of gas they consume.

a) Draw a demand-supply diagram showing the autarky, and free trade equilib-rium outcomes prior to government intervention.

b) Show that the desired fall in domestic price paid by consumers can be achieved by (i) an appropriate quota on the amount of gas that can be exported, (ii) an appropriate tax on exported gas, and (iii) an appropriate subsidy paid to consumers for each MJ consumed. Illustrate your solutions with diagrams as needed.

c) Perform a qualitative Welfare Analysis for the introduction of (i) an appropriate quota on the amount of gas that can be exported, (ii) an appropriate tax on exported gas, and (iii) an appropriate subsidy paid to consumers for each MJ consumed. That is, for each policy intervention, describe and show the qualitative change in Consumer Surplus, Producer Surplus, Government Tax Receipts, Total Surplus, and any Deadweight Loss.

d) Using your results from part (c), compare the various policy interventions in terms of their welfare effects.

All policies increase CS in the same way, as consumers face a lower effective price, and purchase more of the good. Policy (ii) is worst for producers, as they sell less and receive a lower price per unit sold due to the tax. Policy (i) is bad for producers as they export less than they would like. Policy (i) is not too bad for producers, as local producers still sell internationally at the higher price. This is different from the impact for imports. Policy (ii) has government tax receipts, while policy (iii) has government expenditures.

e) For each policy proposal, describe the cause of each component of Deadweight Loss caused by the policy intervention.

In each case, DW L1 is caused by domestic consumers with relatively low MB using the gas, rather than having the gas be exported and used by foreign con-sumers with higher MB. In policy (i) and (ii), DW L2 is caused by producers wanting to produce (for export) but not being able to due to the trade restric-tions.

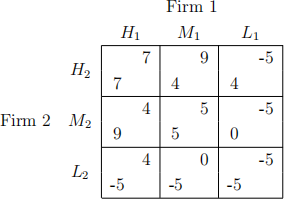

2. Two electricity firms, Firm 1 and Firm 2, are competing in the National Electricity Market by choosing the price to charge for each unit of power they produce. They can each choose to charge a high price (H), a medium price (M), or a low price (L).

a) Find all Nash Equilibria for this simultaneous game. Explain why each is a Nash Equilibrium and briefly explain why there are no other Nash Equilibria.

(M1, M2) is the only Nash Equilibrium. It is a NE because no-one has an incentive to deviate. All other strategies have incentive to deviate.

b) Suppose that, instead of acting simultaneously, Firm 1 sets prices first, and Firm 2 chooses it’s price only after seeing the price of Firm 1. Draw the game tree for this sequential game.

c) For the sequential game in part (b), find the unique Subgame Perfect Nash Equilibrium.

The unique SPNE is (M1,(M2, M2, H2). This is found by backward induction.

d) For the sequential game in part (b), explain why the alternative strategy profile (H1,(M2, L2, L2)) (that is, the profile where Firm 1 sets a high price and Firm 2 sets a medium price if Firm 1 sets a high price, and sets a low price otherwise) is a Nash Equilibrium. Describe the non-credible threat being used in this strategy profile.

The non-credible threat is that Firm 2 will play low when Firm 1 plays medium. This is non-credible because once Firm 1 has played M1, then Firm 2 will want to play M2.

e) Returning to the simultaneous game of parts (a) and (b); suppose the firms are not purely strategic players, but are level-k thinkers instead. Recall that a level-0 thinker would choose an action at random. What would be the action of a level-1 player, and why? What would be the action of a level-2 player, and why?

Level-1 players play High as, if my opponent is playing randomly then u(H) = (7 + 4 + 4)/3 = 5, u(M) = (9 + 5 + 0)/3 = 42/3, and u(L) = −5. Students are not expected to write their answer in this way. A Level-2 player think their opponent is Level-1 and playing High, therefore the level-2 player should play Medium.

2021-11-06