MATH5816 Continuous Time Financial Modelling

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH5816 Continuous Time Financial Modelling

Assignment 2, 2021

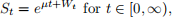

Exercise 1. Optimal Stopping. Let  where µ is a constant and W is a standard Brownian motion.

where µ is a constant and W is a standard Brownian motion.

1. Find all the values for µ such that (St) is a strict submartingale. In this case, show that

where the supremum is over all bounded stopping times.

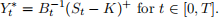

Exercise 2. American option. We consider the standard Black-Scholes model of the stock price. The discounted reward process  an American put option with a constant strike K and an expiration date T > 0 is defined by the equality

an American put option with a constant strike K and an expiration date T > 0 is defined by the equality

1. Show that

is a submartingale under

2. Argue that the price of an American call option is the same as an European call option.

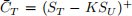

Exercise 3. Forward-start option. We assume the Black-Scholes model of the stock price. The forward-start call option has the payoff at expiry  where T is the expiry date and 0 ≤ U ≤ T is the strike determination date.

where T is the expiry date and 0 ≤ U ≤ T is the strike determination date.

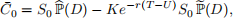

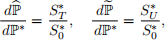

1. Show that the price at time 0 of the forward-start option can be represented as follows:

where

is the exercise event and the probability measures

and

are given on

by

where the process

follows a martingale under

2. Find the arbitrage price for the forward-start option at time 0.

2021-11-05