MATH 262 Financial Mathematics Second semester 2023-2024 Exercises Sheet 3

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Financial Mathematics

Second semester 2023-2024

Module : MATH 262

Exercises Sheet 3

Exercise 1

Let S be a share of a risky asset, the price of S at time 0 is S0 = 100 GBP. We know that in 2 years the price of S in GBP is given by

We also consider a European call option on one share of the risky asset with strike K = 130 and maturity T = 2. The annual interest rate is r = 10%.

(1) Calculate the expectation of the payoff

of the call option.

(2) Calculate the expectation of the discounted payoff of the call option.

Exercise 2

Let L be a loss. We suppose that P(L = 2) = 0.1, P(L = 4) = 0.3, P(L = 7) = 0.2, P(L = 3) = 0.35, P(L = 9) = 0.05. What is the expectation of the loss L? What is the variance of the loss L?

Exercise 3

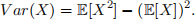

Let X be a real random variable. Prove that

Exercise 4

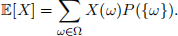

Let Ω = {ω1, . . . , ωn} and X be a real random variable.

(1) Prove that

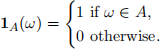

(2) Let A ⊂ Ω, we suppose that P(A) = 1/2. The indicator function of A denoted 1A is defined as follows. For any ω ∈ Ω,

(a) Calculate E[1A].

(b) Give a formula for E[X1A].

2024-03-21