EC9900 Topics in Applied Macroeconomics Summer Examinations 2022/23

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EC9900

Summer Examinations 2022/23

Topics in Applied Macroeconomics

Section A: Answer the ONE question

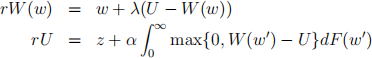

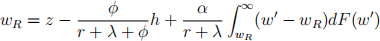

1. (a) Consider the partial equilibrium search model with exogenous job destruction studied in the lectures. The Bellman equations for a worker are given by:

where:

– W(w) is the value of being employed at wage w

– U is the value of being unemployed

– w is the flow wage

– z is the flow utility or income during unemployment

– r is the discount rate

– λ is the job-separation rate

– α is the rate at which an unemployed worker meets a job

– F(.) is the cdf of offered wages

(i) Explain what is meant by a reservation wage in this model. Explain why the worker’s problem is characterized by a unique reservation wage. (4 marks)

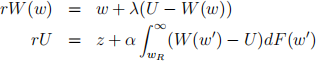

Given the reservation wage, the Bellman equations can be rewritten as:

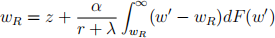

We have seen in the lecture that the worker’s reservation wage, wR, is the solution to the equation:

(ii) Consider an increase in the discount rate, r. Show analytically how this affects the reservation wage. Explain intuitively. (7 marks)

(iii) Given your answer above, show how an increase in r affects job-finding rate, average duration of unemployment and the steady-state unemployment rate. (6 marks)

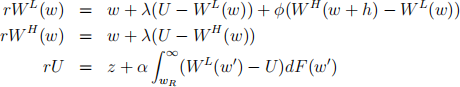

Consider an extension of this model in which, once employed, a worker can get a promotion. Let w L denote the initial wage the worker gets upon becoming employed. During employment, at rate φ they get a promotion, upon which their wage becomes wH = wL + h. Suppose that a worker can get a promotion only once per employment spell. Further, suppose that workers who become unemployed lose their promotion status. Let WL (w) denote the value function of an employed worker prior to promotion, and WH(w) denote her value function after promotion. The Bellman equations of the extended model are:

It turns out that the reservation wage of an unemployed worker can be written as:

(iv) How does the reservation wage of the worker depend on φ? Does the value of being unemployed depend on the likelihood of being promoted while employed? Show analytically and explain your intuition. (8 marks)

(b) Suppose that you have monthly data on the total stock of unemployed workers, ut

, employed workers, et

, and short-term unemployed workers,  (those who are unemployed at the time of measurement, t, but were employed one month ago, t − 1). Assuming that a worker can only experience up to one transition between employment and unemployment within a month, explain how the job-finding and job-separation probabilities can be estimated. Discuss possible problems with measuring transition probabilities in this way. (10 marks)

(those who are unemployed at the time of measurement, t, but were employed one month ago, t − 1). Assuming that a worker can only experience up to one transition between employment and unemployment within a month, explain how the job-finding and job-separation probabilities can be estimated. Discuss possible problems with measuring transition probabilities in this way. (10 marks)

(c) Some commentators argue that the differences in the long-term evolution of unemployment rates across countries is best explained by the different evolution of labour-market institutions across time within different countries. How does this narrative compare to the one in Ljungqvist and Sargent (1998)? With reference to empirical evidence, critically evaluate the statement. (15 marks)

Section B: Answer the ONE question

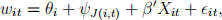

2. (a) Consider the following AKM-style empirical log wage specification:

where:

- wit denotes log wages of individual i at time t

- θi is an individual fixed effect

- ψJ(i,t) is a firm fixed effect

- J(i, t) is the function assigning individual i to firm J at time t

- Xit denote time-varying characteristics of individual i

-  it is an error term

it is an error term

(i) What kind of factors are captured by the right-hand-side components θi , ψJ(i,t) and Xit? Give specific examples of variables that could lead to variation in these components. (6 marks)

(ii) Suppose you use data on firm movers to estimate the above regression equation. What assumptions do you need to make to get unbiased estimates of the worker and firm effects? What kind of evidence could support these assumptions? (9 marks)

(iii) Briefly outline the economic rationale for estimating a model like the above. Relate your answer to potential dimensions of inequality in the labour market. (5 marks)

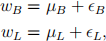

(b) Consider a simple occupational self-selection model with two occupations: bankers and lawyers. Bankers are indexed by B, Lawyers are indexed by L. The gross earnings of individuals in the two occupations are given by:

where µB and µL are the mean population earnings in occupations B and L, respectively, and  j ~ N(0, σj

2

), where j ∈ {B, L}, is a random individual component. We omit individual subscripts for simplicity. Assume that in order to become a lawyer, individuals need to pay a licensing fee F. There is no fee to become a banker. Suppose an individual is deciding whether to become a lawyer or a banker based on net earnings. Assume that the individual knows F, µB, µL and their own draw of

j ~ N(0, σj

2

), where j ∈ {B, L}, is a random individual component. We omit individual subscripts for simplicity. Assume that in order to become a lawyer, individuals need to pay a licensing fee F. There is no fee to become a banker. Suppose an individual is deciding whether to become a lawyer or a banker based on net earnings. Assume that the individual knows F, µB, µL and their own draw of  B,

B,  L.

L.

(i) Write out the condition on error term differences that needs to be satisfied for the individual to become a lawyer. (3 marks)

(ii) Denote the difference in error terms by ν =  L −

L −  B. Derive the probability of a randomly chosen individual to become a lawyer. Show how this probability changes as the fee for a licence to become a lawyer F increases. How is the probability of becoming a lawyer affected by an increase in µB? Provide an intuition for both effects. (10 marks)

B. Derive the probability of a randomly chosen individual to become a lawyer. Show how this probability changes as the fee for a licence to become a lawyer F increases. How is the probability of becoming a lawyer affected by an increase in µB? Provide an intuition for both effects. (10 marks)

(iii) Briefly outline what the above model can teach us about the estimation of the returns to occupations. (5 marks)

(c) What do we mean by Routine-Biased Technical Change (RBTC) and how can this phenomenon be explained? Discuss the origins of the RBTC hypothesis and the empirical evidence that supports it. (12 marks)

2024-03-17