AcF 212: Principles of Financial Accounting 2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Department of Accounting and Finance

AcF 212: Principles of Financial Accounting

Course Outline - Lent Term 2024

1. Course Objectives

This 15-credit course is designed to extend students’ knowledge of the environment within which businesses, particularly companies, in the UK conduct their financial accounting and reporting, introduce selected issues relating to regulation and monitoring and consider aspects of the theory and practice relating to financial reporting. Whilst the course examines certain technical aspects of the accounting process, it also aims to broaden the course participants’ outlook to enable them to appreciate the principles guiding the regulation of financial reporting, and the role of external financial reporting in the efficient allocation of economic resources.

Forming part of the Department’s financial accounting stream, the course requires the prior study of introductory financial accounting (AcF 100 or AcF 111/261 at Lancaster or equivalent) and leads on to advanced courses such as AcF 301 and AcF 311. It is compulsory for the degrees in Accounting and Finance; Accounting and Management; Accounting and Economics; Accounting, Finance and Mathematics, and is optional for other degrees.

2. Learning Outcomes

After following the course students should, relating to the areas covered in the course:

. be aware of and understand relevant practitioner and academic literature on financial reporting;

. be aware of the accounting methods available in the areas studied;

. be able, using underlying concepts, to analyse why particular methods might be more

appropriate than the alternatives and thus be able to suggest appropriate reporting methods in particular reporting situations;

. be able to view accounting information in relation to the financial environment and financial markets in which companies operate, and to appreciate the limitations of such accounting information;

. be aware of the key requirements of the International Financial Reporting Standards (IFRS) relating to the specific issues covered in the course;

. know of and be able to utilise accounting reporting principles and accounting techniques appropriate to a range of specific situations examined in the course; and

. be able to present reasoned arguments relating to the above, both oral (in workshops or other discussions) and written (CWA and examination).

3. Reading

3.1 Course Textbook

The course text is: ‘International Financial Reporting: A Practical Guide’ by Alan Melville, 8th edition (2022) – Pearson (ISBN-13: 978-1-292-43942-6) (referred to in this outline as ‘Melville’). Apart from being the basis of much of the reading of the course, some of the workshop questions are from this book. Access to this text is therefore necessary and expected of those taking the course. Online access is provided by the library. Earlier versions of this book may also be relevant however may not include details of the latest changes in international accounting standards.

Additional readings (journal articles, book sections, etc.) for each lecture topic are given in Section 6 of this outline. As far as possible, the readings suggested are included in ‘My Resource List’ which is linked from the course Moodle page (see below).

3.2 Moodle

Lecture slides and recordings, practice and workshop questions, workshop solutions and other materials will be made available on the course Moodle site. Make sure you access Moodle at https://mle.lancs.ac.uk/and follow the link to AcF 212 before the first session of the course to confirm you are registered for it, and to receive course notices and gain access to all materials. You are responsible for accessing the Moodle course site at least twice a week during the course to check for announcements etc.

3.3 Background reading other useful links.

For background reading students are also expected to study the main features of Accounting / Financial Reporting Standards by reading the relevant sections from:

. IASB’s International Financial Reporting Standards (IFRS). The Department subscribes to

IFRS Digital subscription which provides online access to the IFRS and is a useful source of information about developments in financial reporting. Students should register for an account on the IFRS portal (https://www.ifrs.org/login/). Anyone registered with a “@lancaster.ac.uk” e-mail address should have their account automatically validated as part of our subscription. If you get an error message that a user account with your e-mail address already exists, you should reset the password using the ‘Forgotten password?’ option.

. International GAAP 2023 (Ernst & Young) which provides insights on how complex practical issues should be resolved in the real world of global financial reporting. Free to download here:International GAAP® 2023 - The global perspective on IFRS | EY - Global

Other useful links include:

. Accounting firms (UK sites)

. Deloittehttp://www.deloitte.com/view/en_GB/uk/index.htm.

. KPMG https://home.kpmg.com/uk/en/home.html.

4. Course Administration

Weekly structure

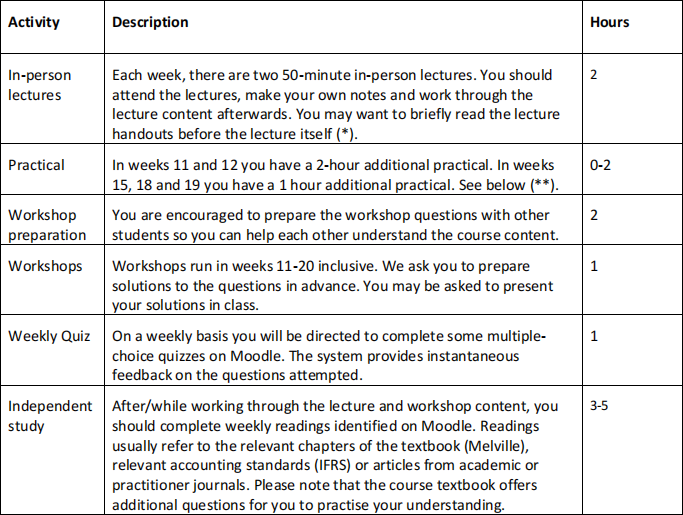

The course is a 15-credit module, which comprises of 150 learning hours. You will need around 30 hours to prepare for the exam and at least 10 hours for the coursework assignment, which leaves approximately 110 hours for the 10-week Lent Term or 11 hours a week. These 11 weekly hours, on average, will involve different types of tasks. Here is an example of the tasks you will need to complete each week:

(*) A note about lectures

If you have time, it is advisable to briefly read the lecture handouts before the lectures take place. Try thinking of lectures as a cycle of (i) familiarisation before the lecture, (ii) enhancement of knowledge during the lecture and (iii) consolidation of knowledge using other sources after the lecture. You won’t understand everything just from reading slides but it will help you understand the lectures themselves.

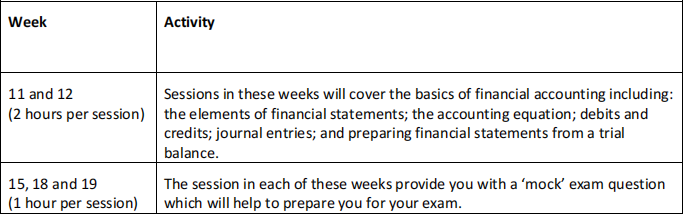

(**) Practical sessions

In five of the weeks of term you are required to attend compulsory additional practical classes. These sessions are designed to achieve two objectives being:

(i) Ensure you can remember some of the essential basics of financial accounting from Part I.

(ii) Provide you with ‘mock’ exam standard practice to help prepare you for your exam

The content is as follows:

Attendance

It is your responsibility to ensure you register your attendance in compulsory sessions on this course by checking into the i-Lancaster system during live sessions. Please ask if you are unsure how to register your attendance in a session.

You will be allocated to a workshop group and that will appear on your timetable. Attendance is compulsory and you will be expected to participate and collaborate on tasks during the workshop. Slides, workshop questions and solutions to the questions will be available on Moodle.

You must attend the group to which you have been allocated. If, in a given week, you believe that you have a valid reason for not attending your assigned workshop group, e.g., medical appointment, internship interview, you should contact the AcF undergraduate office before seeking to change the workshop group. Unauthorised attendance of a group other than the one to which you have been assigned will result in your attendance not being recorded and the problems that this entails.

5. Course Assessment

The overall assessment for the course will be made up of two components: coursework consisting of one piece of work to be submitted during the course (25%), and a final in-person examination in May/June 2024 (75%).

. The coursework is open book and takes place online.

. Your 9am lecture on Thursday 21st March will provide detailed instructions about the test which will then open on moodle after the lecture finishes at 10am.

. The test will then remain open until the end of the day.

. There is no need to attend your lecture at 3pm although you can come to the lecture theatre to start your test and a lecturer will be available in the lecture theatre to answer any questions.

The test is designed to ensure that you can demonstrate key skills relating to financial statements such as preparing financial statements and understanding the potential impact of accounting choices on company performance.

In setting examinations, it will be assumed that students have attended all classes and undertaken the tasks outlined during the course.

Note: The Department reserves the right to adjust coursework marks after coursework has been returned to students to ensure that the coursework marks have an appropriate distribution.

Special assessment arrangements will have to be made for students visiting Lancaster who are scheduled to leave prior to these final examinations. If you are in this category, it is your personal responsibility to contact the undergraduate office as soon as possible. Please note that there is no opportunity for reassessment in coursework tasks for visiting students failing to achieve the necessary pass mark for their home university; any re-sit opportunity offered to visiting students will be in the form of an examination.

6. Course Structure and Lecture Outline

Week 11

This week’s materials considers the first substantive topic, namely the regulation of financial reporting. In doing this, consideration is given to both theory and practice, the latter involving both the law and standards set by regulators. The second lecture will consider the development, purpose and status of the IASB Conceptual Framework (CF) and review content of specific CF chapters: Qualitative Characteristics; Elements and Recognition. At the end of the week, you should:

> Understand and be able to explain various theories concerning the regulation of financial reporting;

> Understand and be able to discuss the various sources of financial reporting regulation and the relationships between them.

> Understand the development, purpose and status of the IASB Conceptual Framework.

> Explain the qualitative characteristics of financial information, define each of the main ele- ments of financial statements and explain the criteria which determine whether or not an element should be recognised.

Essential Reading

. Melville chapter 1

. Melville chapter 2 = pages 17-28.

. Baudot, L. 2013. Perspectives on the Role of and Need for Accounting Regulation. In: Van

Mourik, C., & Walton, P. The Routledge Companion to Accounting, Reporting and Regulation. Routledge, 207 – 227.

Supplementary reading

. IASB Framework for Financial Reporting, Chapters 1, 2, 4 and 5

http://eifrs.ifrs.org/eifrs/ViewContent?num=0&fn=CF2018_TI0002.html&collec- tion=2019_Issued_Standards

Week 12

This week’s materials continue to consider the contents of the CF. The first session will focus on guidance on the measurement of the elements in financial statements, evaluating a number of different measurement bases identified in the CF. The second session will explore the topic of Capital Maintenance, outlining the differences between financial and physical capital maintenance and rules relating to distributable profits.

At the end of the week, you should be able to:

> Explain the different measurement bases which are identified in the CF and the factors con- sidered when selecting a measurement bases.

> Distinguish between financial capital maintenance and physical capital maintenance.

> Understand the rules relating to capital maintenance and distributable profits.

Essential Reading

. Melville Chapters 2 => pages 28-33

. Melville Chapter 17

Supplementary reading

. IASB Framework for Financial Reporting, Chapters 6 and 8 http://eifrs.ifrs.org/eifrs/View- Content?num=0&fn=CF2018_TI0002.html&collection=2019_Issued_Standards

. IAS 29 - Financial Reporting in Hyperinflationary Economies

. Laux, C. and Leuz, C. (2010) “Did Fair-Value Accounting Contribute to the Financial Crisis?” Journal of Economic Perspectives Vol.24 No.1 Winter pp.93-118

Week 13

The next five weeks will take you on a “journey” through the statement of financial position. This week's materials start with the accounting rules for two usually significant asset positions in the statement of financial position. Specifically, we will talk about the accounting rules for property, plant and equipment (PPE) and intangible assets. At the end of the week, you should be able to:

> Apply the accounting rules for property, plant and equipment and intangibles, including the rules on subsequent measurement and the recognition of internally generated intangible assets.

> Evaluate the accounting rules for property, plant and equipment and intangibles, including their impact on comparability and information content of the financial statements.

Essential Reading

. Melville chapter 5 and 6

. IAS 16 – Property, Plant and Equipment

. IAS 38 – Intangible Assets

Supplementary reading

. Herrmann, D., Saudagaran, S. M. and Thomas, W. B. (2006). The quality of fair value measures for property, plant and equipment. Accounting Forum 30(1): 43-59.

. Lev, B. (2018). Ending the Accounting-for-intangibles Status Quo. European Accounting Review 28(4): 713-736.

Week 14

This week’s materials continue with the accounting rules for non-current assets and then start with our discussion of current assets. Specifically, we will look at impairments of assets (IMP), i.e., another form of subsequent measurement of non-current assets, and inventories, an often significant position among the current assets. At the end of the week, you should be able to:

> Conduct the impairment test according to IFRS and apply the accounting rules for inventories.

> Assess the consequences of discretion in applying accounting rules, for example, when determining whether an asset has to be impaired, and the consequences of accounting choices offered by accounting standards.

Essential Reading

. Melville chapter 7 and 10

. IAS 36 – Impairment of Assets

. IAS 2 – Inventories

Supplementary reading

. André, P., Dionysiou, D. and Tsalavoutas, I. (2018). Mandated disclosures under IAS 36

Impairment of Assets and IAS 38 Intangible Assets: Value relevance and impact on analysts’ forecasts. Applied Economics 50(7): 707-725.

Week 15

This week’s materials cover the recognition of revenues and associated receivables (REV), another significant position among the current assets, as well as provisions, which take us to the other side of the statement of financial position and in particular to current and non-current liabilities. At the end of the week, you should be able to:

> Apply the revenue recognition model under IFRS and the accounting rules for provisions, including the disclosure rules for obligations that do not qualify for recognition on the statement of financial position.

> Discuss the role of uncertainty in applying accounting rules, especially if uncertainty extends over several accounting periods as is the case for revenue recognition over time or future obligations to transfer economic resources.

Essential Reading

. Melville chapter 13 and 12

. IFRS15 – Revenue from Contracts with Customers

. IAS 37 – Provisions, Contingent Liabilities and Contingent Assets

Supplementary reading

. Wagenhofer, A. (2014). The role of revenue recognition in performance reporting. Accounting and Business Research 44(4): 349-379.

Week 16

This week’s materials provide an introduction to one of the most complex areas of accounting, financial instruments. Please do not be worried by the complex nature of accounting for financial instruments – the topic is fascinating and the calculations use basic techniques you will already be comfortable with. You will continue to study financial instruments further in ACF311 in your final year.

Financial instruments appear both on the asset and the equity/liability sections of the statement of financial position; likewise, they can be current or non-current in nature. We will discuss accounting treatments for most of these types. Accounting for some financial instruments requires you to understand fair values so we will also be covering a separate accounting standard which covers fair values.

Please note that we will continue to discuss financial instruments in the first lecture of week 7. At the end of the week, you should be able to:

> Understand and explain the differences between financial assets, equity and financial liabilities and be aware of the relevant accounting standard for each.

> Explain what is meant by ‘fair value’ and how this is applied to accounting for financial instruments.

> Apply the accounting rules of IAS 32 and IFRS 9 to correctly show financial instruments in the statement of financial position and the notes to the financial statements.

> Discuss recent changes in the accounting treatment of financial instruments, such as the move to more fair value measurement and the introduction of an expected loss model in assessing impairments of financial assets.

Essential Reading

. Melville chapter 11

. IAS 32 – Financial Instruments: Presentation

. IFRS 9 – Financial Instruments

. IFRS 13 – Fair Value Measurement

Supplementary reading

> Fargher, N., Sidhu, B. K., Tarca, A. and van Zyl, W. (2019). Accounting for financial

instruments with the characteristics of debt and equity: finding a way forward. Accounting & Finance 59 (1), 7-58. Wiley online library.

Week 17

The first lecture of this week will finish off the topic from week 6 covering financial instruments. We then move onto materials Earnings Per Share (EPS) and the published accounts of companies.

EPS is one of the fundamental numbers used in financial analysis and so is subject to a specific accounting standard. At the end of the week, you should be able to:

> Explain why EPS is important, how to calculate ‘basic’ EPS in a variety of settings, and how to calculate ‘diluted EPS’ in various situations.

> Know the source international disclosure rules for published accounts and be able to apply these rules correctly.

Essential Reading

. Melville chapter 23 => pages 404-410 and 413-420

. IAS 33 – Earnings Per Share

. IAS 1 – Presentation of financial statements

Supplementary reading

. Almeida, H. (2019) Is It Time to Get Rid of Earnings-per-Share (EPS)? The Review of Corporate Finance Studies 8 (1), 174-206.

Week 18

The first lecture of this week will finish off the topic from week 7 covering diluted earnings per share. The rest of this week’s materials approaches one of the central figures of the financial statements, financial performance or earnings, from different perspectives. In particular we focus on something referred to as earnings management, which is the ways in which humans influence accounting numbers by (un)intentionally exploiting discretion in accounting rules. At the end of the week, you should be able to:

> Explain the IASB’s understanding of financial performance.

> Elaborate on the notion of ‘earnings management’ and its two sides.

> Appraise existing incentives for earnings management and options to reduce these incentives.

Essential Reading

. IAS 1 – Presentation of Financial Statements

. Dechow, P. M. and Skinner, D. J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons 14(2): 235-250.

Week 19

This week’s materials provide an introduction to accounting for groups of companies, a topic that is explored in much more depth in AcF 301 in your final year. On AcF 212 we will consider the basic concepts and techniques in the area, looking at both the statement of financial position and statement of profit or loss aspects. At the end of the week, you should be able to:

> Understand the purpose of consolidated accounting;

> Be familiar with, and able to utilise, the terminology used in the area;

> Complete basic numerical problems involving the statement of financial position for groups, both at the time of subsidiary acquisition and at a reporting date. This will include calculating goodwill at acquisition and the value of the non-controlling interest;

> Complete basic numerical problems involving the statement of profit or loss for groups, both at the time of subsidiary acquisition and at a reporting date;

> Complete elementary numerical problems involving the unrealised profits in the context of groups of companies.

Essential Reading

. Melville chapter 18 Groups of companies (1) => pages 303-313 and 317-318 only.

. Melville chapter 19 Groups of Companies (2) => pages 328-334 only.

. IFRS 10 – Consolidated Financial Statements

. IFRS 3 – Business Combinations

Supplementary reading

. Suzuki, R. (2022) Business Combinations — Disclosures, Goodwill and Impairment. Available atIFRS link.

. Amel-Zadeh, A., Meeks, G. and Meeks, J. G. (2016). Historical perspectives on accounting for M&A. Accounting and Business Research 46 (5), 501-524. Taylor and Francis Online.

Week 20

This week your Thursday 9am lecture will introduce your coursework which you will complete and submit by the end of the day.

Sayjda Talib and Andrew Smerdon

01/2024

2024-03-13