ECON7530 ONLINE QUIZ 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON7530 ONLINE QUIZ 2

INTERNATIONAL TRADE & INVESTMENT

Instruction:

● Use the Blackboard submission link provided.

● Please submit using only Word, .pdf, or image (.jpg, .png) formats.

● You can either type or write and scan your answer.

● Show all workings.

● Give your numerical answers to two decimal places.

PART A: MULTIPLE CHOICE QUESTIONS

Each Question is worth 2 marks (40 Marks Total)

1. When one applies the Heckscher-Ohlin model of trade to the issue of trade-related income redistributions, one must conclude that free trade between China and Japan

A. is likely to hurt low-skilled workers in China.

B. is likely to help highly skilled workers in China.

C. is likely to hurt high-skilled workers in Japan.

D. is likely to hurt low-skilled workers in Japan.

E. must help low-skilled workers on both countries.

2. Suppose country A currently produces widgets. Then it establishes a preferential trading agreement with country B. Following the formation of a free trade area between A and B, country A no longer produces widgets and imports widgets from country B. What has occurred?

A. There is trade diversion and a welfare gain for both country A and country B.

B. There is trade diversion, a welfare gain for country B, and a welfare loss for country A.

C. There is trade creation and a welfare gain for both country A and country B.

D. There is trade creation, a welfare gain for country B, and a welfare loss for country A.

E. There is trade diversion and a welfare loss for both country A and country B.

3. For most developing countries

A. productivity is high among domestic workers.

B. saving and investment levels are high.

C. agricultural goods and raw materials constitute a small proportion of domestic output.

D. pollution emissions are relatively low.

E. None of the above

4. In the presence of external economies of scale, trade

A. will unambiguously improve welfare in both countries.

B. will unambiguously worsen welfare in the exporting country and improve welfare in the importing country.

C. will unambiguously improve welfare in the exporting country and worsen welfare in the importing country.

D. will unambiguously worsen welfare in both countries.

E. may or may not improve welfare in both countries.

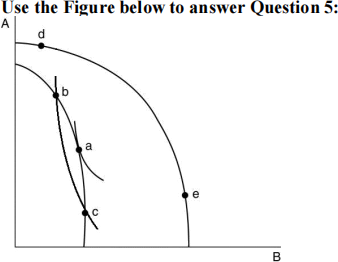

5. The figure above shows a country's possible production possibility frontiers and indifference curves. If the country is producing at ________, then moving to ________ will cause utility to ________.

A. point a; point b; increase

B. point a; point b; decrease

C. point c; point b; increase

D. point c; point b; decrease

E. point a; point c; remain unchanged

6. The HPAE (High Performance Asian Economies) countries

A. have all maintained openness to international trade.

B. have all consistently supported free trade policies.

C. have all consistently maintained import-substitution policies.

D. have all consistently maintained non-biased efficient free capital markets.

E. have all outperformed the U.S.

7. Suppose that Australia is a large country, and it wishes to impose optimal tariffs on its imports of rice, wheat, and barley. The export supply elasticities of rice, wheat, and barley are 105, 5, and 0.5, respectively. Which of the following ranks the products on the basis of their optimal tariffs from lowest to highest tariff?

A. barley, wheat, rice

B. rice, barley, wheat

C. wheat, rice, barley

D. rice, wheat, and barley

E. Not enough information to answer

8. The median voter model ______________.

A. tends to result in biased tariff rates

B. does not work well in the area of trade policy

C. works well in the area of trade policy

D. is not widely practiced in the United State

E. is not intuitively reasonable

9. International trade based on external scale economies in both countries is likely to be carried out by

A. a large number of oligopolists in each country.

B. a relatively small number of imperfect competitors.

C. a relatively small number of price competing firms.

D. a relatively large number of price competing firms.

E. monopolists in each country.

10. Finland requires 2 hours of labor to mine a ton of ore and 5 hours of labor to produce 100 board feet of lumber. In Norway, 5 hours of labor are required to mine a ton of ore and 8 hours of labor to produce 100 board feet of lumber. Which country has a comparative advantage in the production of lumber?

A. Norway

B. Finland

C. Neither

D. Both

E. Not enough information to answer the question

11. Which of the following statements is(are) FALSE?

I. Trade creation is always bad for countries.

II. Trade diversion is always good for countries.

III. Regional trade agreements always cause welfare losses.

A. I

B. II

C. III

D. I, II

E. I, II, and III

12. Suppose that there are 100 firms in a monopolistically competitive industry in India and 30 firms in the same monopolistically competitive industry in Bangladesh. If India and Bangladesh engage in international trade, we expect that the total number of firms in this industry:

A. will increase.

B. will decrease.

C. will remain unchanged.

D. will first decrease, then increase.

E. will first increase, then decrease.

13. Compared with a tariff, welfare losses will _______ when voluntary export restraints are used to reduce imports.

A. first increase, then decrease

B. first decrease, then increase

C. decrease

D. increase

E. not change

14. Assume that two countries (Home and Foreign) each produce two goods (corn and wheat) under constant cost production. Home produces 1 ton of corn or 2 tons of wheat with a day of labor. Foreign produces 4 tons of corn and 2 tons of wheat. Without trade (in autarky), Home's daily production is 40 tons of wheat and 20 tons of corn. At which international price will Home's gains from trade be largest?

A. 1 ton of wheat per ton of corn

B. 1.5 ton of wheat per ton of corn

C. 2 tons of wheat per ton of corn

D. 2.5 tons of wheat per ton of corn

E. 3 tons of wheat per ton of corn

15. A policy of tariff reduction in the clothing industry in New Zealand is

A. not in the interest of New Zealand as a whole but in the interests of foreign cloth producers.

B. in the interest of New Zealand as a whole and in the interest of cloth producers of the country.

C. in the interest of New Zealand as a whole but not in the interest of cloth producers of the country.

D. not in the interest of New Zealand as a whole but in the interests of cloth producers of the country.

E. not in the interest of New Zealand as a whole and not in the interests of cloth consumers.

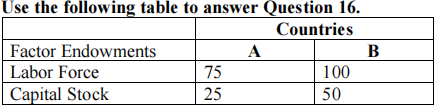

16. If good T is capital intensive, then following the Heckscher-Ohlin Theory

A. country B will export good T.

B. country A will export good T.

C. both countries will export good T.

D. both countries will import good T

E. trade will not occur between these two countries.

17. Under the model of monopolistic competition, a(an) ________ in the number of firms in the industry will cause ________ to ________.

A. increase; average cost; decrease

B. increase; average price; increase

C. increase; average price; decrease

D. decrease; markup; decrease

E. increase; marginal cost; decrease

18. A small nation's export subsidy ________ importing countries' terms of trade; a large nation's export subsidy _________ importing countries' terms of trade.

A. improves; worsens

B. worsens; improves

C. improves; improves

D. improves; does not affect

E. does not affect; improves

19. If a firm in monopolistic competition lowers its price, what will happen to the quantity of products it sells?

A. The quantity of products sold will increase and sales revenue will decrease.

B. The quantity of products sold will decrease because this is not perfect competition.

C. The quantity of products sold will increase slightly—and in some cases not at all.

D. The quantity of products sold will not change and sales revenues will decrease.

E. The quantity of products sold will increase and sales revenue will increase.

20. A monopolistically competitive firm faces demand given by this equation: P = 60 – 3Q. It has no fixed costs and its marginal cost is $30 per unit. What quantity will the firm produce when it is maximizing its profits?

A. 5

B. 10

C. 15

D. 20

E. 25

PART B: SHORT-ANSWER QUESTION (60 MARKS)

● Answer ALL questions in Part B.

● Please show all workings. Round your answers to two decimal places.

● Fully label your graphs, if you are required to draw one.

● Questions in Part B carry marks as indicated.

B1. (24 marks)

Suppose that fixed costs for a firm in the air-conditioning manufacturing industry (start-up costs of factories, automation chain, etc.) are $6.9 billion, and that variable costs are $15,000 per finished air-con. Suppose that the air-con market is monopolistically competitive, and firms are identical. More firms increase competition, and so the market price falls as more firms enter the market, making the market price to be P = 15,000 + 200/n, where n represents the number of firms in the market. Assume that there are three countries in the world: Ascalonia, Bretonnia, and Carlia, with the market size being 400 million, 550 million, and 200 million, respectively.

a. (2 marks) Calculate the equilibrium number of firms in Ascalonia air-con markets in autarky.

b. (2 marks) What is the equilibrium price of automobiles in Ascalonia if there is no international trade?

c. (7 marks) Now suppose that the three countries join to form a free trade area, and assume no transportation costs. How many firms will there be in the combined market? What will be the new equilibrium price, and average cost for each air-con?

d. (7 marks) Suppose instead that a revolution now closed Carlia off from the rest of the world, so that the free trade area now only consists of Ascalonia and Bretonnia. Calculate the number of firms, the equilibrium price, and average cost for each air-con in this combined market.

e. (6 marks) Compare the number of firms, and the price that Ascalonian consumers pay for each air-con between the scenarios in (b), (c) and (d). In which scenario would Ascalonian consumers benefit the most, and explain why.

B2. (24 marks)

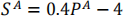

Suppose there are three countries in the world: Australia, New Zealand, and Vietnam. Australia’s domestic demand for headphone follows

while its domestic supply of headphone follows

where  ,

,  refer to Quantities Demanded and Supplied in Australia at the domestic price

refer to Quantities Demanded and Supplied in Australia at the domestic price  , respectively. The unit cost of headphone production in Vietnam is $30, while it is $40 in New Zealand. Currently, there is a 100% tariff on headphone imports into Australia.

, respectively. The unit cost of headphone production in Vietnam is $30, while it is $40 in New Zealand. Currently, there is a 100% tariff on headphone imports into Australia.

a. (4 marks) What is the price of headphone in Australia? How many headphones will Australia import, and how much tariff revenue will the Australian government collect?

Suppose now that Australia signs a free trade agreement (FTA) with New Zealand.

b. (4 marks) How many headphones will Australia import, and from which country?

c. (4 marks) Is this the case of trade creation or trade diversion as a result of Australia forming an FTA with New Zealand? Explain why.

d. (6 marks) Calculate the amount of trade diversion loss/trade creation gain from the Australia-New Zealand FTA.

e. (6 marks) Calculate the total welfare gain/loss to Australia as a result of the Australia-New Zealand FTA.

B3. (12 marks)

a. (4 marks) Explain, using the gravity model of trade, why the volume of trade between the U.S and the European Union may be higher than the volume of trade between the U.S. and Canada, even though the U.S. and Canada share a border.

b. (4 marks) According to the Heckscher-Ohlin model, free trade would lead to an equalization of wage rate internationally. Explain why we do not observe that result in the real world, where, for instance, there is great discrepancy in wage rate between developed and developing countries.

c. (4 marks) Why do countries persist in using protectionism even though most economists believe that tariffs and quotas yield welfare losses to consumers?

2021-11-01

INTERNATIONAL TRADE & INVESTMENT