PhD Programme

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

PhD Programme

Pre-interview Assignment

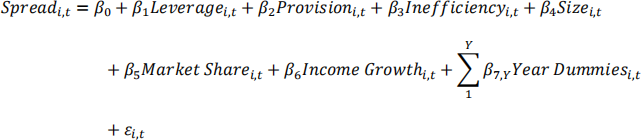

Ahead of our meeting we would like you to prepare the following assignment. This involves the estimation of the following regression using STATA:

Specifically, we would like you to

1) Generate all variables in the model (data sources are explained below; Spread and Income_Growth are readily provided in the dataset).

2) Winsorise all variables in the model (except year dummies) at 1% on each tail.

3) Adjust for seasonality for all bank-level variables in the model (if that is necessary).

4) Estimate the model using the fixed effects estimator and report robust standard errors for the following samples:

a. 2006-2011

b. 2006-2008

c. The least leveraged banks in the sample (i.e. banks in the first quartile of the leverage distribution).

Variables Description

|

Variables |

Description |

|

Spread |

(Interest Income / Average Earnings Assets) - (Interest Income / Average Interest- Bearing Liabilities). It is readily available in the dataset (Spread) |

|

Leverage |

The ratio of total liabilities (Total_Liabilities) to total equity capital (Total_Equity_Capital) |

|

Provision |

The ratio of loan loss provisions (LLP) to net loans (Net_Loans_Leases) |

|

Inefficiency |

The ratio of non-interest expense (NonInterest_Expense) to total operating income. Total operating income = net interest income (Net_Interest_Income) + total non-interest income (NII_total) |

|

Size |

Logarithm of total assets (Total_Assets). |

|

Market_Share |

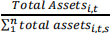

The state-level market share of each bank. For bank i at time t and state s the market

share is calculated as : |

|

Income growth |

State-level personal income growth; seasonally adjusted; obtained from Bureau of Economic Analysis (see below) |

To estimate the above, please, use the four excel files (US_BANK_DATA_1, …, US_BANK_DATA_4) which contain data for the US banking sector sourced from the SNL Financial. The data can be found in Sheet1. In Sheet2 you can find the list of variables contained in each file. The data contain 48 quarters from 2003:Q1 until 2014:Q4. Please, prepare the sample based on the following parameters:

. Limit the sample to 2006-2011 period.

. Banks with total assets between $100 million and $100 billion (total assets in the data files are expressed in $000)

. Exclude banks with missing total assets (Total_Assets) or deposits (Total_Deposits) or loans (Net_Loans_Leases) or with negative equity capital (Total_Equity_Capital).

The personal_income_growth_initial file contains data on the quarterly growth rate of personal income for all US states and districts for the period 2003:Q3-2014:Q4, which is sourced from the Bureau of Economic Analysis. Please merge this dataset with the bank-level dataset and name the variable Income_Growth.

The excel file state_abbrev contains abbreviations used for states (STATE) in your bank-level dataset.

2024-03-12

Pre-interview Assignment