ECON2070 INTRODUCTION TO STRATEGIC THINKING TUTORIAL EXERCISE 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON2070 INTRODUCTION TO STRATEGIC THINKING

TUTORIAL EXERCISE 1

METIN UYANIK

Note: Level C questions are merely for your interests. They are optional, and don’t feel bad if you find them hard.

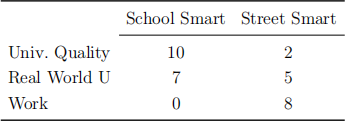

1. Alice is a young lady deciding on the next stage of her life. She can either go to the University of Quality or Real World University, both of which are located in her hometown. Alternatively, she can start working and gain some working experience. She is not very sure of her ability, though. There are two states of the world to her: that she is school smart, or that she is street smart. Alice’s state-contingent payoffs are as follows:

(a) (Level A) Does Alice has any (strongly or weakly) dominant choice?

(b) (Level A) Does Alice has any (strongly or weakly) dominated choice(s)?

(c) (Level A) Suppose Alice assigns probability 0.4 to her being School Smart, and probability 0.6 to her being Street Smart. Calculate the expected utility from each of her choices. Which choice will she pick?

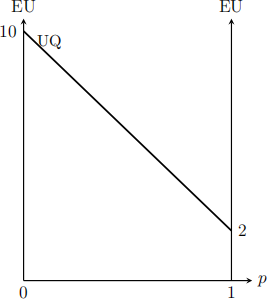

(d) (Level C) In general, let p be the probability Alice assigns to her being Street Smart. Plot the expected utility from each of her choices as a function of p in the same graph. To help you get started, the expected utility from Univ. Quality is given by the expression:

EU [Univ. Quality] = 2p + 10(1 − p).

Plotting it gives Figure 1. Fill in the other two lines.

(e) (Level C) Using your plot in (d), argue that each of Alice’s choices can be an expected utility maximizer for some values of p.

Figure 1. Expected Utility Plot for Alice

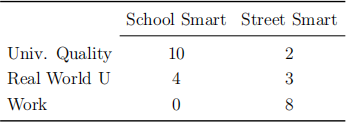

Alice’s friend, Bob, faces the same choices as Alice. However, Bob assigns different payoffs to attending Real World University. In particular, Bob’s state-contingent payoffs are as follows:

(f) (Level C) Repeat part (d) for Bob. Using your plot, argue that the choice “Real World U” can never be an expected utility maximizer regardless of the value of p.

(g) (Level B) Consider the following choice for Bob: He will flip a fair coin. If the coin comes up head he will enrol in Univ. Quality. If the coin comes up tail he will work. Add a row in Bob’s payoff table above for this choice. (For instance, if he is School Smart, then with probability half he will get 10 and probability half he will get 0. Calculate the expected payoff from this and enter in the relevant cell.)

(h) (Level B) Look at the table after you have added the new row. Does Bob has a dominated strategy now?

2. An oil drilling company must decide whether or not to engage in a new drilling venture before regulators pass a law that bans drilling on that site. The cost of drilling is $1 million. The company will learn whether or not there is oil on the site only after drilling has been completed and all drilling costs have been incurred. If there is oil, operating profits are estimated at $4 million. If there is no oil, there will be no future profits. The new regulation is also introduce with probability 0.5 a 50% tax on the operating profits from drilling. Let p denote the likelihood that drilling results in oil and assume the company has the von Neuman Morgenstern utility function.

(a) (Level A) The company estimates that p = 0.6. What is the expected utility of drilling? Should the company go ahead and drill?

(b) (Level B) To be on the safe side, the company hires a specialist to come up with a more accurate estimate of p. What is the minimum value of p for which it would be the company’s best response to go ahead and drill?

3. (Level C) Show that if a relation is complete, transitive and satisfies the indepen-dence axiom, then it satisfies the monotonicity property.

2024-03-09