ECOS3003 Problem set

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECOS3003 Problem set

Due 23:59, Tuesday 12 March

Please submit a pdf of your answers via the portal on Canvas.

Note – there is no simple extension available for this problem set.

1. Consider two workers 1 and 2 who simultaneously must choose between working on two projects, labelled A and B. The payoffs are as follows. If both 1 and 2 choose project A each worker gets 0. Similarly, if both workers choose B each gets 0. If worker 1 chooses B and worker 2 chooses A, each gets 10 and 3 (for worker 1 and 2) respectively. Finally, if 1 opts for A and worker 2 opts for B the payoffs to worker 1 and 2 are 8 and 7, respectively.

a. What are the Nash equilibria of the game? Is this game a realistic one for an organisation? Explain your answer. What might an organisation do if it found itself in a situation similar to the one represented by this game.

b. Now allow the game to be played sequentially. That is, allow worker 1 to make her choice first between projects A and B. Then, worker 1 choice is observed by worker 2 who then makes his choice. What are the subgame perfect equilibria of the game? Provide some intuition for your result. What does your say about the Coase theorem?

2. Consider a firm in which a boss and a worker each simultaneously get to choose their actions. The boss can choose between centralizing (C) or delegating (D). The worker can put in low effort (L) or high effort (H). The payoffs are 2 to the boss and 2 to the worker if the choices are C and L. If the boss chooses D and the worker L the payoffs are (1,6) to the boss and worker, respectively. If the actions chosen are C and H the payoff are (6, 1). Finally, if the actions are D and H, the payoffs are 4 apiece.

a. If the game is played once, what is the Nash equilibrium. Explain your answer. Could this represent an outcome in a real firm?

b. What if the worker and boss meet twice, in which in the first period both make their choice of action simultaneously. Following this, the outcome (and payoffs) is revealed and the game proceeds to the next and final period. In the second period, again the parties simultaneously choose their actions, the payoffs are revealed and the game ends. What outcome do we see in both periods in the subgame perfect equilibria and why?

c. Now assume that instead of meeting once or twice, the two players play the simultaneous-choice stage game an infinite number of times. In each period, the two players simultaneously make their choices, the outcome in that period is revealed to all and the players proceed to the next period. Each party discounts future periods by a discount factor δ, where 0 ≤ δ ≤ 1.

Assume that each party adopts a trigger strategy that involves: choose either D or H in the first period (depending on the player); in any subsequent period, choose either D or H if the outcome in every previous period was (D, H); if not, choose C or L (for the boss and worker respectively).

Can this trigger strategy support an outcome of (D, H) in every period? Recent research by Meagher and Wait (2020) found that if workers trust their managers that delegation of decision making is more likely and that workers tend to trust their managers less the longer the worker has been employed by a particular firm (that is, worker trust in their manager is decreasing the longer the worker’s tenure) Interpret these results in the context of the infinitely repeated game studied in class. What are some possible empirical issues related to interpreting these results?

3. Consider a firm wishing to use the services of a consultant. The marginal benefit for the firm is given by MB = 120 – q, where q is the quantity of services provided. The marginal cost of those services for the consultant is given by MC = 2q. The issue for the parties is that it is difficult to verify the actual quantity of consulting services provided. To help mitigate this the firm can hire an auditor at a cost of $100. Similarly, the consultant can use some recording keeping techniques that cost $200. Even with both of these actions, if the consultant provides less than 60 units of the service it will look like zero quantity was provided to a third party (like a court enforcing the contract). What is the total agency cost in this case? Using the help of a diagram, explain your answer. What if the auditing service instead cost the firm $1000 and the record keeping technology cost the consultant $1000 – what would the total agency cost be in this case? Explain your answer.

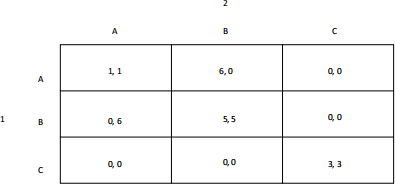

4. Consider the following simultaneous stage game that is play twice. That is, there are two periods, and in each period the two players choose their actions simultaneously. The outcome in the first period is revealed before the players make their choices in the second period. Outline how in a subgame perfect equilibrium, it is possible to get (B, B) as the choice made in the first period. Explain the relevance to trust in organisations.

5. What is the Basic Value Maximisation principle? What does this principle suggest about the way organizations operate? What does this mean for economists studying organisations?

6. Design and solve a one-period game with two players who each have two possible actions. Assume the players make their respective choices of actions simultaneously. Design your game so that there are three Nash equilibria (at least). After solving the Nash equilibria of the game, interpret your game in the context of corporate culture.

2024-03-07