BHMH2101 Financial Accounting 2023/24 Semester 2 Assignment 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

BHMH2101 Financial Accounting

2023/24 Semester 2

Assignment 1

Total Marks: 100 marks

Question 1 (70 marks)

Star Immigration Consulting Company (“the Company”) provides immigration consulting services for people planning to emigrate. The Company organizes immigration seminars. Customers have to pay the Company in advance to attend the seminars and the Company credits its “Unearned consulting fees” account.

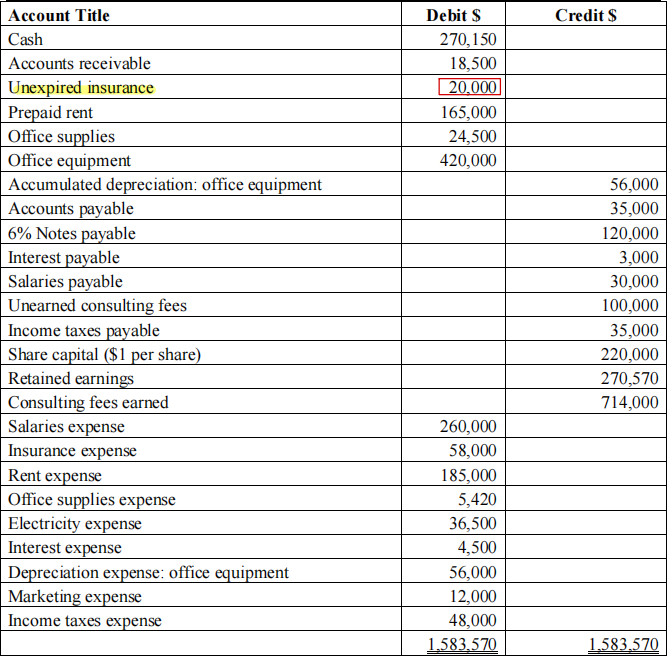

Adjusting entries are normally performed on a monthly basis. Closing entries are performed annually on 31 December. Below is the Company’s unadjusted trial balance as at 31 December 2023.

Star Immigration Consulting Company

Unadjusted Trial Balance

31 December 2023

Information on adjusting entries:

(1) Records show that 90% of unearned consulting fees had been earned as of 31 December 2023.

(2) Salaries earned by the Company’s employees for December 2023 that have not been paid nor recorded amount to $25,000.

(3) Office supplies on hand at year end was $17,500.

(4) On 1 October 2023, the Company paid medical insurance premium for its employees six months in advance.

(5) The Company borrowed $120,000 by signing a 5-year notes payable with annual interest rate of 6% on 1 July 2023. Note interest is paid semi-annually at 31 December and 30 June. No entries were made for (i) the accrued interest for December 2023 and (ii) the payment of the interest for 2023.

(6) The office equipment was bought on 1 April 2023 with useful life of 5 years and no residual value. The Company adopts straight-line method for depreciation.

(7) In December 2023, the Company organized a seminar to be held early next year. Admission fees received in advance totaled $35,000 in December. No entry was made.

(8) On 31 December 2023, the Company declared a dividend of $0.2 per share to be payable early next year. No entry was made.

(9) In December 2023, the Company successfully arranged for an U.K. immigration visa for a customer, Mr. Smith. The related fees of $9,500 has not been billed to Mr. Smith and cash is not yet received.

(10) Estimated income taxes expense for the entire year totals $58,000. Taxes are due in the first quarter of the upcoming year.

Required:

(a) Prepare the necessary adjusting journal entries on 31 December 2023 to bring the financial records of Star Immigration Consulting Company up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Show your workings. Explanations are NOT required. (21 marks)

(b) Prepare the income statement for the year ended 31 December 2023, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes, Profit after Taxes. (13 marks)

(c) Prepare the statement of financial position as of 31 December 2023, showing breakdown of items under the captions of Total Assets, Total Liabilities, Total Shareholders’ Equity and Total Liabilities & Shareholders’ Equity. (20 marks)

(d) Record its year-end closing journal entries. Explanations are NOT required. (16 marks)

Question 2 (30 marks)

Felix Company normally adjusts its books monthly. The company’s accountant made some recording errors in July 2023 below:

(1) On 1 July 2023, the Company borrowed a six-month 8% bank loan of $120,000. The entire loan and accrued interest is due on 31 December 2023. None of the interest accrued is recorded.

(2) On 31 July 2023, the Company received $10,000 in advance for a one-year rental contract. It was credited to account “Rental revenue”.

(3) On 31 July 2023, the Director of the Company declared a dividend of $50,000 payable in September 2023. The transaction is not recorded.

(4) On 1 July 2023, the Company purchased a $72,000 equipment by cash and debited to account “Repair expense” by mistake. The equipment has a useful life of 60 months using straight-line method for depreciation.

(5) In July, the Company paid ABC Travel Ltd. $80,000, being fees for a tour joined by Felix, the owner and his family members. It was debited to account “Travel expense”.

Required:

Copy the table on your answer sheet. Transactions (1) to (5) above are independent events. Assume other than the entries mentioned in the question were recorded, no other adjusting entries were made by the end of July 2023. Indicate the effects of such error have on Felix’s book as at 31 July 2023, if any. State O = overstated (with $ amount), U = understated (with $ amount) and NE = no effect

For example: There is a $500 accrued and unrecorded fees earned by Felix Company in July 2023. If no adjusting entry is made in July, the effect on the book is:

2024-03-07