MGT 11A Understanding Financial Statements Assignment

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MGT 11A

Understanding Financial Statements Assignment

Background:

Choose a publicly traded company that you are interested in learning more about and review their most recent annual financial statements (Form 10-K). Ignore if they have a 10-K/A and select the most recent 10-K. (For context, a 10-K/A is an amended annual financial statement) Browse through the different sections of the financial statements to understand more about the company. The only company you can not choose is Tesla, given we have looked through their financial statements as a class already and I will use them as an example when explaining the assignment in class.

How to access financial statements:

All publicly traded companies are required to submit their financial statements to the Securities and Exchange Commission (SEC). The public is able to access any publicly traded financial statements by visiting the EDGAR tool on the SEC website.

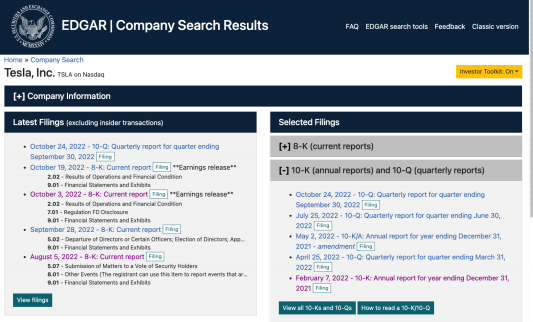

https://www.sec.gov/edgar/searchedgar/companysearch

Once you have opened the website you can search any company by their legal name or by searching their ticker symbol (trading symbol). For example, if you would like to search for Tesla you can either start typing in “Tesla, Inc.” or can search for them by the ticker symbol “TSLA”. Once you have successfully opened the page for the company you are interested in you will navigate to the “Selected Filings” section and select the “+” on the “10-K (annual reports) and 10-Q (quarterly reports)” section. If you do not see the most recent 10-K listed you can click on “ View all 10-K’s and 10-Q’s”. You will then click on the most recent for titled “10-K” and that will open up the financial statements for you.

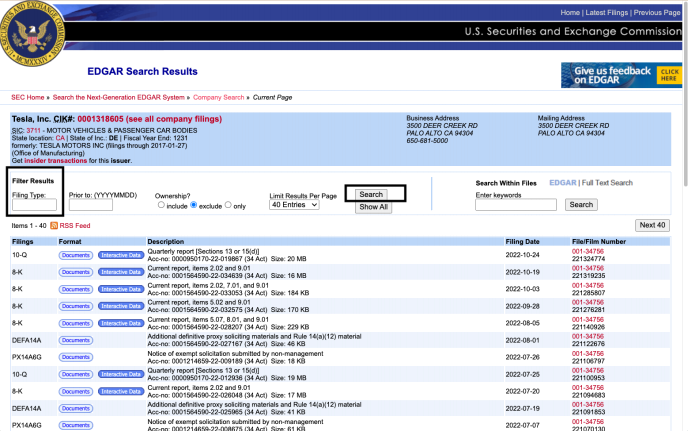

Note, occasionally the website will not be loading properly and the “classic version” of the SEC website will be the view you see. If this is the case, the filings will not be organized by type of filing so you might have to scroll to find the 10K. Or you can filter the results and in the “Filing Type:” box you can type in “10-K” and hit “search” and click on the most recent form 10-K.

Requirement:

After you have browsed through the financial statements for the company answer the following 19 questions. Please provide a screenshot of where in the financial statements you found each answer to receive full credit.

1. Please provide the website link to the SEC filing you are analyzing for this assignment. (1pt)

2. What is the company’s ticker symbol/trading symbol? (1pt)

3. When is the company’s year end? (1pt)

4. Who is the auditor for this company? (1pt)

5. Who signed the company’s financial statements? List the positions of those who signed the document not just their name. (1pt)

6. What is the date the financial statements were issued (date of signature)? (1pt)

7. What are some of the current assets the company has on its balance sheet? (1pt)

8. Does the company have more current liabilities or non-current liabilities on their balance sheet? (1pt)

9. What is the company’s current ratio? (Current Ratio = Current assets / Current liabilities) Please provide the numbers you used to calculate the ratio. (2pt)

10. What is the company’s debt-to-total assets ratio? (Debt to total assets ratio = Total

liabilities / Total assets) Please provide the numbers you used to calculate the ratio. (2pt)

11. Does the company have net income or net loss on the income statement (also referred to as statement of operations)? (1pt)

12. Did the company make more net income in the current year or the prior year? (1pt)

13. What were some of the investing activities the company participated in during the current year? Refer to the statement of cash flows. (1pt)

14. What were some of the financing activities the company participated in during the current year? Refer to the statement of cash flows. (1pt)

15. Does the company have a cash inflow or outflow in operating activities and what does this mean? Refer to the statement of cash flows. (2pts)

16. If the company has property, plant and equipment, what are the estimated useful lives they use for each category of these assets? Also, what is the amount of accumulated depreciation for the current year? Note, this information will be in the footnotes. (2pts)

17. Does the company sell inventory? If so, read through their footnote on inventory. Discuss one thing you learned. If the company does not have a footnote about inventory, pick any other footnote to read and summarize what you learned. (1pt)

18. In the management’s discussion and analysis section, read through the comparison of the current year and prior year revenue. Tell me what you learned. (2pts)

19. Explain a few things that you learned about this company while navigating through the various disclosures in their annual financial statements. Is there anything you were hoping to learn but didn’t? (2 pts)

Submitting the assignment:

This assignment will be submitted via canvas. Please copy and paste the questions above into a word document and include your answer to each when submitting via canvas. This assignment is due by Sunday March 3rd at 11:59 PM.

Grading:

This assignment is worth 25 points and no late submissions will be accepted. You will have to complete every question to receive the full 25 points. For most questions one sentence is sufficient, but for questions 15-20 more than one sentence will be needed to receive full credit. Please provide a screenshot of where in the financial st atements you found each answer to receive full credit. Some of these questions do not have a right or wrong answer, they are asking for what you have learned and therefore are subjective in nature.

Additional Context:

For additional context, I have provided a summary of what information you can find in the different sections of financial statements. Note this is a summary and does not include all of the rules as stated by the SEC for the applicable sections.

Part I

. Item 1.Business

o This section typically goes into depth on the business and what product/service they offer. If a company breaks up their organization into different revenue streams (segments) they will disclose this here. The Company will also include information about their workforce, customers, customer success, competition, sales and marketing strategies, research and development (if applicable), and other required disclosures.

. Item 1A. Risk Factors

o This section is typically owned by the legal team and outlines a comprehensive list of risks that the company faces or could face. This is typically a very lengthy portion of the document.

. Item 1B.Unresolved Staff Comments

o The SEC does periodic reviews of Company’s financial statements to ensure they are properly following US GAAP rules. If they have questions, they will send the company “comment letters”. If at the point of filing the financial statements there are still unresolved comments with the SEC the Company would disclose them here.

. Item 2. Properties

o This section includes a summary of the property that the company leases or owns. This would include offices and warehouses around the globe if applicable.

. Item 3. Legal Proceedings

o Companies will from time to time be subject to legal proceedings and claims that arise in the ordinary course of business. These items would be disclosed here.

. Item 4.Mine Safety Disclosures

o If the company operates in mines there is additional disclosure requirement here. This is not applicable for most companies.

Part II

. Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

o This section includes information about the Company’s stock.

. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

o This section includes a more detailed dive into how the company is operating and what they are focusing on in the future. It typically has a section on items they want to highlight, results of operations (deeper dive into the items on the income statement), details on liquidity, details about cash flows, and other disclosures.

. Item 7A. Quantitative and Qualitative Disclosures About Market Risk

o This section typically discloses any foreign currency or interest rate risk among other things.

. Item 8. Financial Statements and Supplementary Data

o This section will include the auditor’s report, balance sheet, statement of operations (income statement), statement of comprehensive income (loss) (note this is a statement we haven’t discussed), statement of equity, statement of cash flows, and the footnotes.

. Item 9.Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

o If applicable the Company will add a disclosure here but it is not common.

. Item 9A. Controls and Procedures

o Management will disclose that they believe the controls the Company has in place are designed effectively and operated effectively. Or they will explain why they believe the controls were not effective.

. Item 9B. Other Information

o Other required information may be disclosed here.

. Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

o If applicable, Companies will add a disclosure here.

Part III

. Item 10. Directors, Executive Officers and Corporate Governance

o Company’s file a proxy statement, which is an in depth filing about the directors and executives of the Company. Typically, in this section you refer readers to your most recent proxy statement.

. Item 11. Executive Compensation

o Typically, in this section you refer readers your most recent proxy statement.

. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

o Typically, in this section you refer readers your most recent proxy statement.

. Item 13. Certain Relationships and Related Transactions and Director Independence

o Typically, in this section you refer readers your most recent proxy statement.

. Item 14. Principal Accounting Fees and Services

o Typically, in this section you refer readers your most recent proxy statement.

Part IV

. Item 15. Exhibits, Financial Statement Schedules

o Any required documents that need to be linked with your Form 10K will be included here.

. Item 16. Form 10-K Summary

o Companies have the option to summarize their 10-K filing here but typically a company will not do this given all the information is included throughout the document.

. Signatures

o The financial statements are typically signed by the Principal Executive Officer, Principal Financial Officer, Principal Accounting Officer and Board of Directors. They sign the financials to certify that the financial statements comply with the requirements of the SEC and fairly presents, in all material respects, the financial condition and results of operations of the Company.

2024-03-07