Econ 6001 Questions for Quiz 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Questions for Quiz 2

Econ 6001, Semester 2 2021

Note 1. For each question, choose as many choices as you think are correct. Marking scheme is just as in Quiz 1 and the Midterm — if the number of marked choices by you exceeds the number of correct answers, you earn negative points for the "extra" choices you make.

Note 2. Submit your answers by Midnight, Monday, 25 Oct. Just as you did with the previous Quiz, the answers must be submitted online.

Questions

1. y = F(x1; x2) units of a certain product are produced using two inputs at levels x1 and x2 respectively. If w1; w2 and p are the input and output prices, the optimal choice of input demand for input i must necessarily rise if

a. F is differentiable.

b. Profit displays increasing differences with respect to (p; xi) for each i = 1; 2.

c. F is concave.

d. F displays increasing differences in the two inputs.

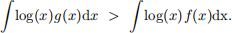

2. Income distribution in a certain economy is given by a cumulative probability distribution F. Suppose a policy is enacted such that the new distribution of income is given by G. It was then seen that the mean of the log of income went up. That is,

a. The above inequality shows that Average Poverty Gap has fallen.

b. The above inequality shows that Average Poverty Gap must rise.

c. Not enough information to conclude either of the above.

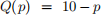

3. Suppose the demand for a certain good is

when the price is p. Suppose the firm produces at zero marginal cost and no fixed costs, so the profit. If the market is a monopoly, her profit is

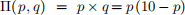

However, assume that there are two firms and they compete, through Bertrand Competition, however each firm can only select prices from the set Ai = {1; 2; 3; 4; 5}.

Express this as a strategic form game by filling in the matrix below with the corresponding payoffs to the two firms every strategy profile (p1; p2) ∈ A1 × A2:

If the game dominance solvable, enter the IEDS equilibrium prices

on Canvas. If the game is not dominance solvable, then enter "N" for the values of

and

on Canvas.

4. In the Second Price Auction studied in class,

a. Each player has a weakly dominant strategy.

b. Only the player with the highest valuation has a weakly dominant strategy.

c. Each player has a strongly dominant strategy.

d. None of the above.

5. Consider the following options:

Lottery A. Take $1 million for sure .

Lottery B. Get $5 million with probability 0.9 (and nothing otherwise).

Lottery C. Get $1 million with probability 0.1 (and nothing otherwise).

Lottery D. Get $5 million with probability 0.09 (and nothing otherwise).

(By the way, how do you rank A vs. B and C vs D if you are the Decision Maker?)

For the DM to be consistent with Expected utility hypothesis, we must have

a. A

C if and only if B

D.

b. A

B if and only if D

C.

c. A ~ B ~ C ~ D.

d. None of the above.

6. Tom satisfies the expected utility hypothesis and has a vNM utility function for wealth w is

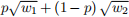

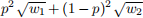

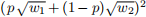

Consider a lottery which pays a $w1 > 0 in state 1 and $w2 > 0 in state 2. There only two states, accruing with probabilities p and 1 ¡ p respectively. The certainty equivalent is given by the formula

a.

b.

c.

d.

7. Which of the following statements are true? Throughout X = {x1; x2} are the two possible outcomes and p = (p1; p2); q = (q1; q2) etc. denote lotteries.

a. The representation

is consistent with the Expected Utility Hypoth-esis.

b.

and W(p) = p1log(x1) + p2 log(x2) represent the same preference relation on lotteries.

c. U(p) = p1 log(x1) + p2 x2 is consistent with the Expected Utility Hypothesis.

d. Part (c). Moreover, U(p) in Part (c) and W(p) = p1 log(x1) + p2 log(x2) represent the same preferences, since log(x2) is a positive monotone transform of x2.

e. None of the above.

8. Suppose the vNM utility function for money outcomes of a certain consumer is given by v(x) = a + b x + c log(

) for all x > 0, where a; b and c are some parameters. For the consumer to be strictly risk averse, we must have

a. c > 0 and b > 0

b. b > 0

c. c > 0.

d. None of the above.

9. The vNM utility is as in the previous question. For the strictly risk averse consumer to strictly prefer more money to less,

a. c = 0 and b > 0:

b. b > 0.

c. b > 0 and c = 0.

d. Impossible unless only sufficiently small amounts of money are involved in the lot-teries.

e. None of the above.

10. Consider the problem of demand for insurance set up in Lecture 8. Assume that the vNM utility is v(x) = log(x). Explicitly solve for the optimal

and, using your derivation, answer the following:

a. The demand for insurance

is increasing in wealth only when p > q.

b. The demand for insurance

is decreasing in wealth only when p < q.

c. Neither (a) nor (b) — how the wealth affects demand depends on how small the loss L is.

d. None of the above.

2021-10-29