FINN 1061 Introduction to Financial Economics WORKSHOP 2 2023-2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

WORKSHOP 2

Introduction to Financial Economics (FINN 1061)

2023-2024

Question 1

A profit-maximizing firm in a competitive market is currently producing 100 units of output. It has average revenue of £10, average total costs of £8 and fixed costs of £200. What is the firm’s:

a. Profit?

b. Marginal cost?

c. Average variable cost?

Solution 1

a. Profit equals total revenue minus total costs = £1000 - £800 = £200.

b. For a firmin perfect competition marginal revenue equals the average revenue. Since it is also a profit maximizer then marginal revenue equals marginal cost. The average revenue is £10 so the MR also = £10 and the marginal cost must also be £10.

c. The average variable cost is £6 since the average total cost is £8 and the average fixed cost is £2 and the ATC – AFC = AVC.

Question 2

The cost of producing smartphones has fallen over the past few years.

a. Use a supply and demand diagram to show the effect of falling production costs on the price and quantity of smartphones sold.

b. In your diagram, show what happens to consumer surplus and producer surplus.

c. Suppose the supply of smartphones is very price elastic. Who benefits most from falling production costs – consumers or producers of smartphones?

Solution 2

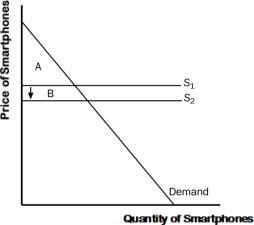

a. The effect of falling production costs in the market for smartphones results in a shift to the right in the supply curve, as shown in Figure 1. As a result, the equilibrium price of smartphones declines and the equilibrium quantity increases.

Figure 1

b. The decline in the price of smartphones increases consumer surplus from area A to A + B+ C + D, an increase of the amount B + C + D. Prior to the shift in supply, producer surplus was areas B + E (the area above the supply curve and below the price).

After the shift in supply, producer surplus is areas E + F + G. Therefore, producer surplus changes by the amount F + G – B, which maybe positive or negative. The increase in quantity increases producer surplus, while the decline in the price reduces producer surplus.

Since consumer surplus rises by B + C + D and producer surplus rises by F + G – B, total surplus rises by C + D + F + G.

c. If the supply of smartphones is very price elastic, then the shift of the supply curve benefits consumers most. To take the most dramatic case, suppose the supply curve were horizontal, as shown in Figure 2. Then there is no producer surplus at all.

Consumers capture all the benefits of falling production costs, with consumer surplus rising from area A to area A + B.

Figure 2

Question 3

The government decides to introduce a minimum wage legislation. Suppose that the labour market is perfectly competitive.

a. What is the impact on employment?

b. Analyse the welfare effects of the minimum wage legislation. Can you claim that the minimum wage policy is definitely beneficial for workers?

Solution 3

a. Notice that, in the labour market, we say that firms demand labour while workers supply labour. After the introduction of the minimum wage legislation, the quantity of labour demanded by the firms drops to L ′′ (Figure 3). However, at the minimum wage, the quantity of labour supplied by the workers is higher than the quantity demanded. This results in unemployment.

Figure 3

b. Before the introduction of the minimum wage, firms have a surplus of A + B + C since they are willing to pay workers more than the wage that they actually have to pay to the workers. Workers have a surplus of D + E + F, since they receive a wage that is higher than the one they are prepared to accept.

After the introduction of the minimum wage, firms’ surplus drops to A. On the other hand, the surplus that workers now get is B + D + F. While the change in surplus for the firms is negative (−B − C), for the workers is actually ambiguous (B − E). Therefore, the policy is definitely beneficial only for some workers (the ones who keep their job). Overall, the policy implies a deadweight loss in the market is equal to C + E.

Question 4

Minnie’s Mineral Springs,a single-price monopoly, faces the market demand schedule:

a. Find the total revenue function for Minnie’s Mineral Springs.

b. Find the marginal revenue function and draw a graph of the demand curve and the marginal revenue curve.

Minnie’s Mineral Springs faces the above total cost schedule.

c. Calculate Minnie’s profit-maximising output and price.

d. Calculate the economic profit and the producer surplus of the firm. Explain the relationship between the two.

Solution 4

a. From the demand schedule, it can be observed that the demand function of Mineral Spring is p = 10 - 2q. As TR = p . q, thenTR (q) = (10 - 2q) q = 10q - 2q2.

b. As marginal revenue gives us the additional revenue from the sale of an additional bottle for any quantity, it can be found by differentiating the total revenue function with respect to q which gives MR(q) = 10 - 4q. Or, you can simply state that the marginal revenue function has the same intercept but twice the slope of the demand curve.

c. It can be verified that total costs satisfy the following equation: TC(q) = 1 + 2q. Therefore, marginal cost is equal to MC (q) = MC = 2. The firm maximises when MR = MC. Therefore, 10 - 4q = 2 which givesq = 2. The price can be found by substituting the optimal quantity into the demand function, which gives p = 6.

d. TC(2) = 5. Using the total revenue equation in (a), it can be calculated that TR (2) = 12. As π = TR - TC, then π (2) = 7. The surplus of afirm is the total revenues of the firm minus the total variable costs, whereas profits are the surplus of the firm net of the fixed cost. In this case: PS = TR (2) – TVC (2) = 12 – (2 . 2) = 8.

Question 5

Explain carefully how an economic recession can lead to the exit of a firm in a monopolistically competitive market. Suppose that the firm was making a profit before the recession.

d. Assume that the recession is demand-driven.

e. Assume that the recession is supply-driven (Hint: to be modelled as a fallin productivity).

Solution 5

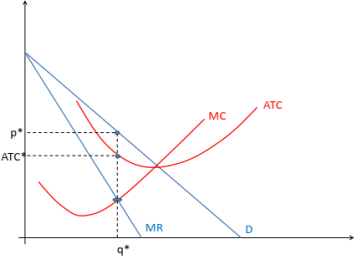

a. A demand-driven recession can be triggered by a fallin income (i.e. due to a crash in the stock market). As consumers are less wealthy, they buy less goods. This causes a shift to the left in the demand curve for the product of the firm under consideration. Figures 4 and 5 show the firm's choice before and after the fallin demand. As demand falls, the marginal revenue curve shifts inwards as well. But the profit-maximising quantity is where marginal revenue is equal to marginal cost. As marginal revenue falls, the quantity produced will fall so that marginal cost is equal to marginal revenue (marginal cost is increasing in the quantity). If the fallin demand is big enough, the price will be below the average total cost at the new quantity and the firm makes losses. As a consequence, the firm will exit the market.

Figure 4: A firm under monopolistic competition (Firm’s choice before the fallin Demand)

Figure 5: Demand-driven Recession (Firm’s choice after the fallin Demand)

b. A supply-driven recession can be triggered by a fallin productivity. Everything else equal, the firm can produce the same quantity at a higher cost if it is less productive. As marginal cost increases, marginal revenue will increase and the quantity produced will fall. If the shock to productivity is big enough, then the firm can end up making losses as Figure 6 shows.

Figure 6: Supply-driven Recession (Firm’s choice after the fallin Supply)

Question 6

A large share of the world’s supply of diamonds comes from Russia and South Africa. Suppose that the marginal cost of mining diamonds is constant at €1,000 per diamond, and the demand for diamonds is described by the following schedule:

a. If there were many suppliers of diamonds, what would be the price and quantity?

b. If there was only one supplier of diamonds, what would be the price and quantity?

c. If Russia and South Africa formed a cartel, what would be the price and quantity? If the countries split the market evenly, what would be South Africa’s production and profit? What would happen to South Africa’s profit if it increased its production by 1,000 while Russia stuck to the cartel agreement?

d. Use your answer to part (c) to explain why cartel agreements are often not successful.

Solution 6

a. If there were many suppliers of diamonds, price would equal marginal cost (€1,000), so the quantity would be 12,000.

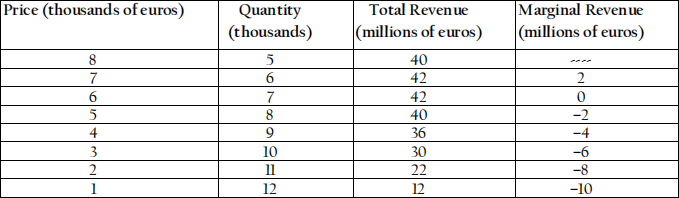

b. With only one supplier of diamonds, quantity would be set where marginal cost equals marginal revenue. The following table shows marginal revenue:

Table 4: Revenues in the Diamond Markets

With marginal cost of €1,000 per diamond, or €1 million per thousand diamonds, the monopoly will maximize profits at a price of €7,000 and a quantity of 6,000. Additional production beyond this point would lead to a situation where marginal revenue is lower than marginal cost.

c. If Russia and South Africa formed a cartel, they would set price and quantity like a monopolist, so the price would be €7,000 and the quantity would be 6,000. If they split the market evenly, they would share total revenue of €42 million and costs of €6 million, for a total profit of €36 million. So each would produce 3,000 diamonds and get a profit of €18 million. If Russia produced 3,000 diamonds and South Africa produced 4,000, the price would decline to €6,000. South Africa's revenue would rise to €24 million, costs would be €4 million, so profits would be €20 million, which is an increase of €2 million.

d. Cartel agreements are often not successful because one party has a strong incentive to cheat to make more profit. In this case, each could increase profit by €2 million by producing an extra thousand diamonds. However, if both countries did this, profits would decline for both of them.

Question 7

Please watch the videos:

1. Breaking the monopolies of Facebook, Google and Amazon.

2. The Amazon monopoly and the problem with Jeff Bezos’ business model. and read

3. The Monopoly-Busting Case against Google, Amazon, Uber and Facebook

Explain should Monopolies be hindered?

Solution 7

A pure monopoly is only one firmin the market who has 100% of the market share while a firm with greater than 25% of market share is known to have monopoly power. The monopiles shown in the videos and articles above convey how ‘big tech’ has come to dominate our lives and the power they have over us. Due to monopolies having so much of the market share they have minimal or no competition at all which allows them to control the prices and the market freely. This can be seen in the case of Uber who now dominated the market in 600 major cities around the world and could raise the pricing at any point. Monopolies could be seen as beneficial because it can provide economies of scale, dynamic efficiency, and benefits from the investments in innovation with any supernormal profits. However, these firms do not benefit from the dismantling of a monopoly because of the creation of competition in a market and the loss of abnormal profits, unless its smaller firms that may gain access to the market in the absence of a monopoly.

One of the reasons monopiles should be broken up consumers are better off when monopolies are broken up as prices are lowered. This is because monopolies are typically associated with higher prices than in competitive markets – Monopolies face inelastic demand and so can increase prices – giving consumers no alternative. For example, in the 1980s, Microsoft had a monopoly on PC software and charged a high price for Microsoft Office. Moreover, monopolies result in a decline in consumer surplus. Consumers pay higher prices and fewer consumers can afford to buy. This also leads to allocative inefficiency because the price is greater than marginal cost. Monopolies being broken up means that consumer surplus will increase as monopolies have high prices that exploits the consumer surplus. Consumer surplus is the difference between the maximum price a consumer is prepared to pay and the actual price they must pay. Moreover, it maybe better off to hinder these tech giants because they seek to continue to grow their market share, while there is still some competition within these industries as they grow, they are going to continue to buy other ‘starts up’ thus buying out their competition and any firms trying to innovate in the market. These companies have enough money to buy companies when they grow in popularity, this is seen in the case of Google and YouTube.

However, it maybe argued that consumers aren’t better off because monopolies can experience and exploit economies of scale. In an industry with high fixed costs, a single firm can gain lower long-run average costs – through exploiting economies of scale. This is particularly important for firms operating in a natural monopoly (e.g., rail infrastructure, gas network). For example, it would make no sense to have many small companies providing tap water because these small firms would be duplicating investment and infrastructure. The large-scale infrastructure makes it more efficient to just have one firm – a monopoly. A natural monopoly, like the water and sewage system (South-West water), can prevent the duplication of infrastructure and thus reduce potential costs to consumers. Natural monopolies that are run by non-profit organisations and local governments can afford to keep prices low enough to provide services to most of the public. When monopolies are privately owned by for- profit organisations, prices can become significantly higher than in a competitive market. As a result of higher prices, fewer consumers can afford the good or service, which can be detrimental in a rural or impoverished setting.

In summary, while only a few factors are mentioned above, the associated benefits may vary depending on the industry that has amonopoly. For example, we see in big tech some of the issues that have arisen from firms with large market control, however in the case of natural monopolies they maybe seen as beneficial. The government could regulate these markets to stop these firms having too much power, this may have made the market more contestable for other smaller firms. These firms are very difficult to regulate because the power they hold is so significant they can influence politics.

2024-02-25