MFIN 5400F, Winter 2024 Fixed Income Markets

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Fixed Income Markets

MFIN 5400F, Winter 2024

Individual Assignment #1

Due on February 11 at 11:59pm EST

Important:

Your assignment can be either typed or hand-written. Make sure your handwriting is legible if you submit a hand-written assignment.

You must explain your answers in detail and show all calculations. As for how much detail to provide, the rule of thumb is that someone else must be able to replicate your numbers by following your explanation. The posted solution to the selected textbook questions has plenty of examples of what you should do. In contrast, an example of what not to do is completing the problem entirely in a spreadsheet and then simply cutting and pasting it to your submitted assignment without any explanation. Although there is nothing wrong with using spreadsheets, you must fully explain your calculations in words and/or formulas. For repeated calculations (such as the pricing of three coupon bonds), it is acceptable to show detailed calculations for only one of them while just give the final answer for the others (i.e., omitting detailed calculations for them).

You must submit your completed assignment online by uploading it, in either pdf or word file, on Canvas via the “Assignments” tab. You may submit your assignment on Canvas at any time prior to the deadline on the due date of the assignment. If you did not finish your assignment by the deadline, you should submit the part you already completed via Canvas prior to the deadline. This part of the assignment will be accepted without penalty. You may submit the remainder of your assignment later, subject to penalty, as described below.

After the submission deadline, you will not be able to submit your assignment online via Canvas. In that case, your submission is considered overdue and late submission penalty applies. You must then email your completed assignment to my email address ([email protected]) as file attachments. I will use the time stamp of your email to determine the exact penalty. Penalty for late submission is a 20% loss of the total possible marks for each day past the deadline. Homework submitted one minute to 24 hours after the due date (stated above) is considered one day overdue. Late penalty will be waived if there are extenuating circumstances (e.g., illness with documented proof) at the instructor’s discretion.

Question 1 (18%)

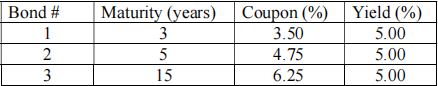

Consider three bonds with the following terms:

All bonds have $1,000 par and pay coupons semiannually. The yield curve is flat and all yields are 5% (APR, compounded semiannually). An investor plans to buy these bonds and hold them for three years. All received coupon payments will be reinvested immediately in a money-market account earning the same annual return as the flat yield on bonds.

a) (12%)

What is the investor’s realized rate of return for each bond over the three-year investment horizon (calculated as APR with semi-annual compounding), if all yields experience a 50-basis point increase every 6 months, just before the coupon payment?

b) (6%)

Consider the same scenario as in a) above except that all yields experience a 50-basis point decrease every 6 months, just before the coupon payment. What is the investor’s realized rate of return for each bond over the three-year investment horizon (calculated as APR with semi-annual compounding) then?

Question 2 (26%)

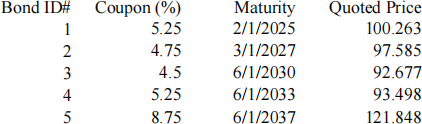

Today is November 7, 2023. The closing prices of five Canadian government bonds are listed in the following table:

Maturity dates are stated using the MM/DD/YYYY format. All bonds pay semi-annual coupons and accrued interest is based on actual/actual day count.

a) (4%)

Calculate yield to maturity for each of the five bonds (APR with semi-annual compounding).

b) (12%)

Calculate each bond’s Macaulay duration, modified duration and convexity.

c) (5%)

You plan to invest $100,000 in a portfolio of Bonds #2, #3 and #4 that has a Macaulay duration of 5.5 (years) and convexity of 40 (year2 ). What is the face value of each bond you should purchase in order to construct the portfolio?

d) (5%)

If yields on all bonds decrease by 25 basis points right after you purchase the portfolio (in c) above), what is the percentage increase in the value of your portfolio? Estimate the increase using both duration and convexity. How accurate is that estimate?

Question 3 (24%)

Suppose a bank just sold a 5-year, $100,000 annuity to a client. The client transferred $100,000 to the bank immediately while the bank promised to make semi-annual flat payments to the client, equivalent to a 5% yield (APR, semi-annually compounded) over the next five years. The first annuity payment is due in 6 months.

Assume that the yield curve is flat, with all yields equal to 5.5% (APR, semi-annually compounded) at the time of the bank-client transaction.

a) (4%)

In present value terms, how much profit is the bank expected to make from this transaction?

b) (20%)

After setting aside the upfront profit from the client’s $100,000 initial transfer, the bank keeps the remaining amount in a separate account and plans to implement an immunization strategy so that it can make the promised annuity payments over the next five years using funds from the account. The funds are immediately invested in two Canadian Treasury securities – a 30-year bond with 6% coupon and $1,000 par and a six-month T-bill with $1,000 par – such that the duration of the Treasury portfolio is matched exactly with the duration of the annuity initially and subsequently over the next five years. The bank plans to reevaluate the duration matching operation at six-month intervals (immediately after each annuity payment) and rebalance the portfolio in order to keep durations matched between the portfolio and the annuity. While the same Treasury bond (albeit with a shorter maturity as time goes by) will be kept in the portfolio, the matured T-bill will be replaced with a new 6-month T-bill.

Assume that the yield curve remains flat in the future but will, however, experience a parallel shift every 6 months subsequently, immediately before the coupon/annuity payment date. The interest rate shock will be a 25-basis point increase every 6 months in the first half of the five-year period (from month 6 to month 30) and a 25-basis point decrease every 6 months in the second half (from month 36 to month 60).

How does the duration matching strategy work out over the five-year period? Make sure that you show all calculations, including the calculation of the total balance in the account, both before and after the annuity payment/interest rate shock, duration matching, and portfolio rebalancing, allocation and holdings in each 6-month period.

Question 4 (17%)

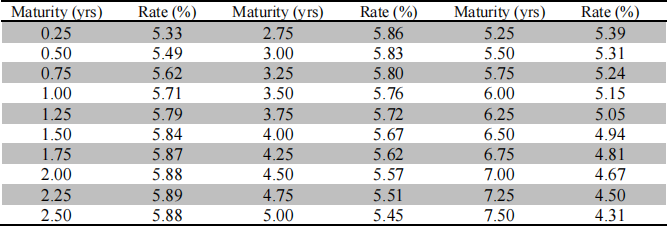

The following spot rates are extracted from Treasury bond prices (APR with semiannual compounding):

Use the spot rates in the table to determine the price of the following bonds (assuming $100 par for all bonds):

A 6-year coupon bond paying 5% semiannually (3%)

A 2.5-year coupon bond paying 6% quarterly (3%)

A 5.25-year coupon bond paying 4% annually (5%)

A 6-year coupon bond paying coupons semiannually, at the 4% rate in the next two years, 5% rate in years 3 and 4, and 6% rate in the final two years (6%)

Note that all coupon rates are quoted as APR, paid at the stated frequency per annum. In case of bonds with accrued interest, you should calculate both full price and quoted price.

Question 5 (15%)

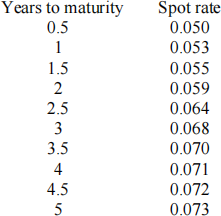

Consider the following Treasury spot rates (APR, compounded semiannually):

Calculate the nominal spread and Z-spread of a 9.5% coupon (paid annually), 5-year corporate bond, currently trading at $103.50 (per $100 par). Briefly discuss any differences between the two spread measures and why they exist.

2024-02-18