EC209-2023 INTRODUCTION TO BEHAVIOURAL ECONOMICS MIDTERM ASSIGNMENT

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EC209-2023

MIDTERM ASSIGNMENT

INTRODUCTION TO BEHAVIOURAL ECONOMICS

This document contains the questions to be answered.

Copying or distributing all or parts of this assignment and its contents is not allowed without prior permission by Lisa Spantig.

This assignment consists of FIVE questions.

Candidates must answer ALL questions.

Answers need to be submitted via Qualtrics using the following link:

https://essex.eu.qualtrics.com/jfe/form/SV_25Jp5RJANyFBri6 Technical notes on Qualtrics are provided on the last page of this document.

The screenshot/photo of completion (last page of Qualtrics survey) needs to be uploaded to FASER. Please note: Answers not submitted via Qualtrics will not receive more than 50 marks (out of 100).

If necessary, round numbers to two decimal places, i.e. 3.14159 will be 3.14. Denote any losses by negative numbers.

1. Answer all parts (a) – (c) of this question (28 marks).

(a) [8 marks] What is the St. Petersburg Paradox? Briefly explain how expected utility theory can help solve the St. Petersburg Paradox.

(b) [6 marks] Consider an expected utility-maximizing student, who cares only about their income. Cheating on their exam adds a given amount to their income, whether or not they are caught. Suppose, however, that a student who is caught cheating is fined a given amount. It is observed that a 2% increase in the probability of being caught lowers the student’s expected utility of cheating by more than a 2% increase in the amount of the fine. What can you say about the risk preferences of this student? Explain.

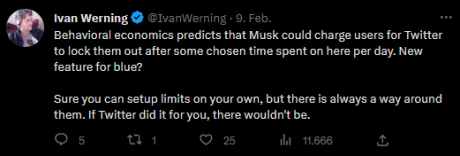

(c) Twitter is looking for new sources to generate income. In the following tweet, a new feature is proposed: lock users out of their account after they have spent a certain amount of time on Twitter. Users get to choose the amount of time after they will be locked out themselves.

(i) [10 marks] Briefly describe why someone might want to pay for this feature. Who would pay for this feature and who would not? Explain. Be as specific as possible, referring to models and using terms that you have learned about in the module.

(ii) [4 marks] What do the last two sentences of the tweet relate to?

2. Answer both parts (a) – (b) of this question (11 marks).

Consider an individual with the following utility function: U(x) = 2/1x2 . This individual can play the following gamble: win £4 with probability 4/1 or win £0 with probability 4/3.

(a) [7 marks] Calculate the expected value and the expected utility of this lottery for this individual. What can you say about the risk attitude?

(b) [4 marks] Calculate the certainty equivalent and the risk premium for this individual.

3. Answer all parts (a) – (e) of this question (36 marks).

Assume Person A is offered the following game: If they want to participate in the game, they will need to pay £5. If they participate, they can choose between Option A and Option B. Option A consists of spinning a roulette wheel with 37 different numbers (18 red, 18 black, and 1 green). If the outcome is red, the participant receives £10 and £0 otherwise. Option B is a fair coin flip that yields £5 when heads comes up and £10 when tails comes up.

(a) (i) [2 marks] What is the expected value of Option A?

(ii) [2 marks] What is the expected value of Option B?

(iii) [2 marks] What is the expected value of participating in the game and choosing Option A?

(iv) [2 marks] What is the expected value of participating in the game and choosing Option B?

(v) [2 marks] How much would the game need to cost to make it a fair game when you choose Option A?

(vi) [2 marks] How much would the game need to cost to make it a fair game when you choose Option B?

(b) [6 marks] Person A chooses to participate in the above described game. Which of the following options can be true regarding their risk preference and the shape of the utility function? You will only receive marks for this question if you tick all correct solutions and do not tick any wrong solutions.

• risk averse, concave

• risk averse, convex

• risk neutral, flat

• risk neutral, linear

• risk loving, concave

• risk loving, convex

(c) [6 marks] Person B is offered the same game, but for a price of £6. They do not not want to participate in the game. Which of the following options can be true regarding their risk preference and the shape of the utility function? You will only receive marks for this question if you tick all correct solutions and do not tick any wrong solutions.

• risk averse, concave

• risk averse, convex

• risk neutral, flat

• risk neutral, linear

• risk loving, concave

• risk loving, convex

(d) [6 marks] Person C is offered the same game, for a price of £5. They decide to participate and choose Option A. Which of the following options can be true regarding their risk preference and the shape of the utility function? You will only receive marks for this question if you tick all correct solutions and do not tick any wrong solutions.

• risk averse, concave

• risk averse, convex

• risk neutral, flat

• risk neutral, linear

• risk loving, concave

• risk loving, convex

(e) [6 marks] Person D is offered the same game, for a price of £5. They decide to participate and choose Option B. Which of the following options can be true regarding their risk preference and the shape of the utility function? You will only receive marks for this question if you tick all correct solutions and do not tick any wrong solutions.

• risk averse, concave

• risk averse, convex

• risk neutral, flat

• risk neutral, linear

• risk loving, concave

• risk loving, convex

4. [14 marks] Answer all parts of this question.

Out of the following, select all the statements that apply.

For each correctly ticked box, you will receive +2 marks, for each incorrectly ticked box, you will receive -2 marks.

• In the βδ-model, small values of δ imply more discounting.

• The homo economicus can be characterised by well-defined preferences, accurate be- liefs,and self-interest.

• Behavioral economics tries to describe human decision-making.

• The Allais Paradox can be explained with certainty effects.

• The original version of Prospect Theory only allowed for the comparison of two options.

• Expected utility theory cannot account for discounting.

• Heuristics are systematic decision errors.

• Anchoring at the default can explain high rates of organ donors in countries with the opt-in model.

• Loss aversion can be modeled by a steeper slope of the value function in the loss domain.

• Sophistication is part of the βδ-model.

• Natural frequencies are easier to understand than probabilities.

• Individuals who are risk neutral do not discount the future.

• Present bias implies that an individual places too little weight on the present, as compared to the homo economicus.

• Small samples are less likely to have variance in their outcomes than large samples.

5. Answer all parts (a) – (d) of this question (11 marks).

Person A, Person B and Person C own stock in the same company. All of them are loss averse and have the same value function: v(x) = x for gains and v(x) = -2x for losses. The stock’s price is shown in the graph below

(a) [3 marks] Person A bought the stock in November and uses the purchase price as their reference point. Which price is their reference point? If you ask them, by how much would they say that their value changed in February?

(b) [2 marks] Person B also bought the stock in November, but they use the peak price as their reference point. Which price is their reference point? If you ask them, by how much would they say that their value changed in February?

(c) [2 marks] Person B knows all stock prices from October onward. Which month should Person B use as reference point in order to maximize their value?

(d) [4 marks] Person C bought the stock in January. They expect to derive a value of at least +5 in April as compared to their reference point of 80. What is the minimum price that the stock will need to have in April to fulfill C’s expectations?

Technical Notes on Qualtrics

You should only complete the form once. While you fill it in, you can move back and forth through the form. The last page will ask you to take the photo/screenshot.

In theory, you can pause your entry. This requires several things (see below). I therefore strongly recommend to fill the form in one go, so nothing can go wrong.

Qualtrics automatically saves your responses when you move to the next page. This means that only responses from previous pages can be recovered when you leave the survey (e.g. by closing the window). Qualtrics places a cookie on your browser to allow ‘save and continue’ . The next time you click the survey link, Qualtrics sees this cookie and knows to load your previous survey progress. Save and Continue only works if you return to the survey on the same computer and on the same web browser, and you have not cleared your browser cookies.

2024-01-27