ISE 563 Spring 2024 Homework 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ISE 563 Spring 2024

Homework 1

Exercise 1.1 – Term Structure Construction

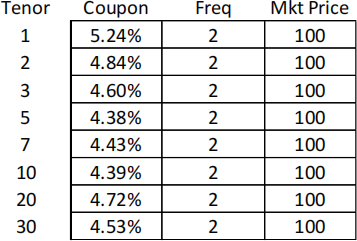

For the Treasury curve with the data given below.

a) Estimate the forward rates assuming they are piecewise constant.

b) Estimate the forward rates assuming they are linear continuous. Ending forward rate for interval equals the starting forward rate for next interval.

c) Plot the forward rates and discount factors for both methods.

Functional form of the forward rates are given below

Can use the Excel Solver function for this exercise.

Exercise 1.2 – Swaps

Assume the risk-free rates and discount curves calculated in Exercise 1 .

You have a swap with the following characteristics:

• Receive 3% fixed and pay float

• Fixed and Float pay semi-annual

• 10-year maturity

• Notional is $1,000,000

For the swap above,

a) What is the value of the swap?

b) What is the par swap rate?

c) What is the value of a forward starting swap starting in 5 years for 10-years (5x10) with a fixed coupon of 4%?

d) What is the par forward swap rate?

Exercise 1.3 – Binomial Model

Consider the following economic inputs:

S = 100; K=100; Rf = 3%; σ = 20%;

T = 2 Year Semi-annual time steps (4 Time Steps)

$2 Dividend paid in 6 months if S>100

$2.50 Dividend paid in 18 months if S>100

Calculate the following:

a) European and American Value of a Put option?

b) Options sensitivity to a 10% change in the stock, S = 110?

c) Options sensitivity to a 10% change in the risk-free rate Rf = 3.30%?

Next change the option type to the following. Put option that is knocked-out if the stock price rises above 130 or if the stock price falls below 70.

d) Calculate the American and European values?

Exercise 1.4 – Ito’s Lemma

The flat level of interest rates follow the following risk neutral process.

dT = a(T0 − T)dt + σdz

What is the stochastic processor a T-year zero coupon bond?

What is the expected return of the T-year bond?

2024-01-26