ECS3350 Assessment -1 (Coursework) 2023-24

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECS3350

Assessment -1 (Coursework)

2023-24

Instructions for Coursework Submission:

1. Ensure your submission is completed by 5 pm on Wednesday, December 13, 2023 (GMT).

2. Type your answers on the provided coursework Word file, save the document, and submit it online via the Turnitin link.

3. Maintain anonymity in your submitted coursework.

4. Keep each answer brief. Feel free to express your points, but ensure they are concise and clear. The word limit for answering each sub-question (except Question 2e) is 200. The word limit forQuestion 2c is 350.

5. Pay attention to bold numbers in brackets, indicating the maximum marks for each question part. The total mark for the coursework is 50, contributing 50% to your final grade.

Question 1: Are the statements below true or false? Explain the reasons for your answers.

a. A country which decides to join a Monetary Union expeets a decreased ability to stabilize its output around the full employment level and keep inflation low compared with its initial ability under flexible exchange rates. (5 marks)

b. Suppose that the United States is on a bimetallic standard at $105 to one ounce of gold and $9 for one ounce of silver. If new silver mines open and flood the market with silver, the two metals will circulate as before in the US since citizens could exchange their gold currency for silver currency at any time. (5 marks)

a.

T/F 1 mark

Theory 2 marks

Explanation 2 marks

b.

T/F 1 mark

Theory 2 marks

Explanation 2 marks

Question 2: The graph below is the exchange rate of Turkish Lira over US dollar (TRY/USD) between January to September 2018. At the beginning of the year, the exchange rate was 3.774 lira per dollar. However, on 13t August Turkish Lira jumped to 6.9123 lira per dollar, a historic high against the dollar.

a. Was it an appreciation or depreciation of Turkish Lira (TRY) in 2018? Caleulate the percentagechange of TRY value when the exchange rate went from 3.774 to 6.9123.(4 marks)

b. What were the main reasons for the dramatic change of TRY in 2018?(6 marks)

c. What did the Turkish central bank do to try to stabilize their currency value? Do you think theirmeasures were successful in the long run and why? Explain the reasons for your answer.(10 marks)

a. Appreciation/depreciation, explanation 2 marks

Formula, calculation of Appreciation/Depreciation 2marks

b. 1 mark for each point (introduction + conclusion)

c. I. 0.5 mark for each point

II. 2 marks

III. 5 marks

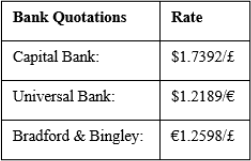

Question 3: Assume you are a trader in foreign currencies, and you look for arbitrage. From the quote screen on your computer terminal, you observe the exchange rate quotations below.

(Numbers should be rounded to at least 3 decimal places. Please note that your answers worth zero mark if they do not include currency symbols, f, $.€)

a. What is a condition that will give rise to a triangular arbitrage opportunity? What E/f price will eliminate triangular arbitrage?(3 marks)

b. How you can make a triangular arbitrage profit by trading at these prices, assume you have £1 with which to conduct the arbitrage? What is the profit? Explain and discuss your calculations.(7 marks)

a. Definition/condition 1 mark

Calculation of exchange rate and explanation 2 marks

b. I. Explain the process: how you can make arbitrage profit 2 marks

II. Profit calculation: show all the steps.

Step 1: 1.5 marks

Step 2: 1.5 marks

Step 3: profit =? 2 marks

Question 4: A fund manager uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. He gathers the financial information as follows:

A year ago, the spot rate between pound and dollar is $1.55/£. In the past year, US inflation is 3.2% and UK inflation is 4.3%. The current spot rate is $1.487/£.

(Numbers should be rounded to at least 3 decimal places. Please note that your answers worth zero mark if they do not include currency symbols $, £)

a. What is relative PPP? Calculate the current pound spot rate in dollar that would have been forecast by PPP?(4 marks)

b. Does the PPP hold in this case? Explain why it is hold or not hold.(2 marks)

c. What is IFE? If the expected US one-year interest rate is 1%, expected UK one-year interest rate is 1.25%, use IFE to predict the expected pound spot rate in dollar one year from now.(4 marks)

a. Definition and explanation 2 marks

Formula and calculation 2 marks

b. I. hold/not hold 1 mark.

II. Explanation 1 mark

C. Definition 1 mark

Formula, calculation, and explanation 3 marks

2024-01-26