ECO204 PROJECT 1: REVENUE MANAGEMENT THROUGH DYNAMIC PRICING AND YIELD MANAGEMENT 2023-2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Department of Economics (STG), ECO204, 2023-2024 (Ajaz’s Sections)

PROJECT 1: REVENUE MANAGEMENT THROUGH DYNAMIC PRICING AND YIELD MANAGEMENT

This individual (solo) project is worth 14% of your overall course grade.

Submission Deadline (paper & Excel model): 9 pm, Sunday, January 14th, 2024 through Quercus

“THE COMPANY”:

Based in Vancouver, The Canuck Container Shipping Company (“CCSC”) owns and operates the HMSNorthern Exposure, a Maersk Triple-E Class Ultra Large Container Vessel (pictured below):

In line with standard industry practice, the CCSC ferries cargo in 20’ and 40’ containers:

• A 20’ Container: Known as a Twenty-foot Equivalency Unit (“TEU”) with a maximum load of 24 tons/container.

• A 40’ Container: Equal to two TEUs (by volume) with a maximum load of 30 tons/container1.

“CURRENT OPERATIONAL AND REVENUE MANAGEMENT MODEL”:

Twice a year – once during the “low” season and again during the “high” season – the HMS Northern Exposure embarks on a voyage from Vancouver (sans cargo), with “stopovers” at the following 10 “port-of-calls” to pick up cargo forfinal delivery to Dubai, following which, the vessel returnins to Vancouver (sans cargo):

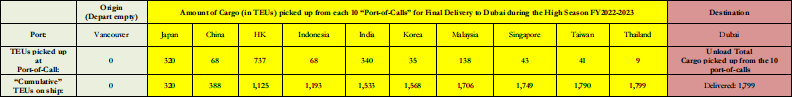

For example, during the “High Season” in FY2022-2023, the HMS Northern Exposure sailed from Vancouver (without cargo) à travelled to the 1st port of call, Japan, and loaded 320 TEUs destined for Dubai à travelled to the 2nd port of call, China, and loaded 68 TEUs destined for Dubai à … à travelled to the 10th port of call, Thailand, and loaded 9 TEUs destined for Dubai à travelled to the final destination Dubai to deliver 1,799 TEUs of cargo (the combined TEUs picked up from the 10 port-of-calls) à sailed back to Vancouver (without cargo):

The amount of cargo (“demand”) [TEUs] loaded at a port-of-call depends on CCSC’s “price” ($/TEU) and the “season”. For example, the following table contains CCSC’s FY2022-2023 “price” and “seasonal demands” for the 10 port-of-calls:

Notice that for any given port-of-call, CCSC charges a uniform “price” across both seasons (i.e. CCSC is not managing

revenues through dynamic pricing). This is where you come in -- you have been hired as a consultant to advise CCSC on (if

feasible) boosting revenues through dynamic pricing subject to newly imposed “yield management” constraints specified next2.

(Going Forward) Dynamic Price Mechanisms & Operational Plus Yield Management Specs:

CCSC’s managements wants you to explore the feasibility of boosting revenues through dynamic pricing (charging separate

prices in the Low vs. High Seasons) subject to the following “newly imposed” operational and yield management “constraints”:

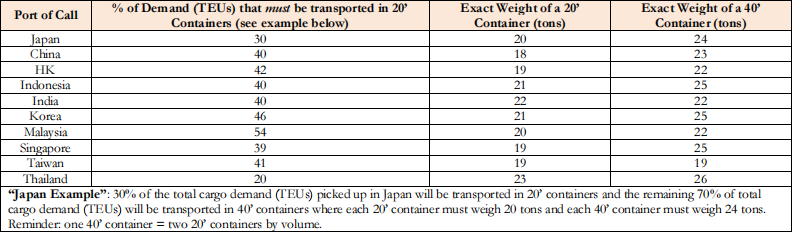

• [See the following table] For each-port-of-call, a pre-specified percentage of its total cargo destined for Dubai must be in 20’ containers (and the rest in 40’ containers) and the weight of 20’ and 40’ containers exactly as specified below:

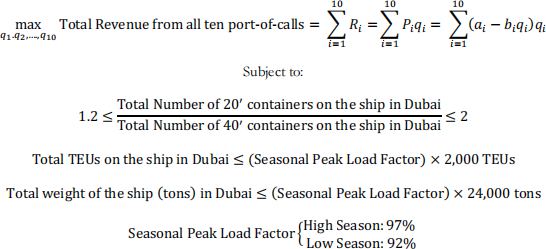

• Since 20’ containers are “denser” than 40’ containers, to thwart the ship from “becoming unbalanced and tipping over”, as well as to expedite the loading/unloading process, management stipulates that when the HMS Northern Exposure reaches its final destination Dubai:

• In order to accommodate “last minute orders from premium customers”, CCSC’s “yield-management-managers” insist on having a “buffer” (no different from airlines and hotels setting aside seats and rooms for “premium” customers) such that when the HMS Northern Exposure reaches its final destination Dubai:

The Mechanics of “Micro-Optimization”:

Do the following for the Low and High Seasons separately:

1. Use the FY2022-2023 info to calculate, for each port-of-call as well as the “grand total”: TEUs, Revenue, Ratio of

20’:40’ containers, Total weight, etc. You may want to comment on whether some “proposed” constraints are violated at the port/total level.

2. For dynamic pricing, you are going to “simulate-estimate”, the “demand-curve” at each port-of-call as follows:

a. Use the Excel command =rand() to generate a number between 0 and 1 à multiply this number by -1 à “label” it “Price Elasticity” E.

b. Assume that in FY2022-2023, each port-of-call’s “price” and “demand” resulted in every port-of-call having the price elasticity equal to E. For example, given Japan’s price and output in season X, its price elasticity was E, identical to the price elasticity of the other nine port-of-calls.

c. Assume each port-of-call has a linear demand curve. For example, the ith port-of-call demand curve is:

Here pi = Price $/TEU and qi = Total Demand (TEUs) for the ith port-of-call. From ECO101, recall that the point price elasticity is:

Now, since every port of call has the same value of E, and you know each port’s FY2022-2023 P, q figures à you can figure out each port-of-call’s linear demand curve parameters a‘ and b‘ .

3. Watch some (all?) ECO204 Excel Solver YouTube videos (see online math chapter). “Observe” how Solver requires a formula for the “objective” (in this case the grand total revenues across all 10 port-of-calls); in turn that requires you to pick – in this case – either price or quantity as the “decision variable”. What did you do in ECO101? Ever notice

how in that course you always “solved” for the “optimal quantity” (never the price) to maximize “profits/revenues” or minimize “cost per unit”? Why didn’t you “select” price as the decision variable in ECO101?

4. In Excel, create a table with the demand curve parameters for each port-of-call and make up a “trial” output value

(TEU)à feed into the port-of-call demand curve to generate the corresponding price ($/TEU) and revenue à

perform any additional calculations such as, for example, that 30% of Japanese total TEUs must be in 20’ containers; the overall ratio of 20’:40’ containers must be between 1.2 and 2; etc. à Bring up Solver à Your “objective” is to

maximize total revenues from all 10 port-of-calls à your “decision variables” are the ten port-of-call “demands”

(TEUs) à enter all constraints à “Solve” and request the “sensitivity report”.

For your convenience, here is the complete problem stated in maths:

5. In your report and Excel model, be sure to compare your solution with the “status quo” and don’t forget to interpret and “utilize” the Lagrange multipliers in the sensitivity report.

|

It’s possible that the “Total Revenues from Solver” may be lower than the status quo Total Revenues. If so, you should be able to use ECO101 logic to explain why (in any case, you should provide insights and intuitive explanations for why your Solver model revenues are higher/lower than the status quo. |

Deliverables

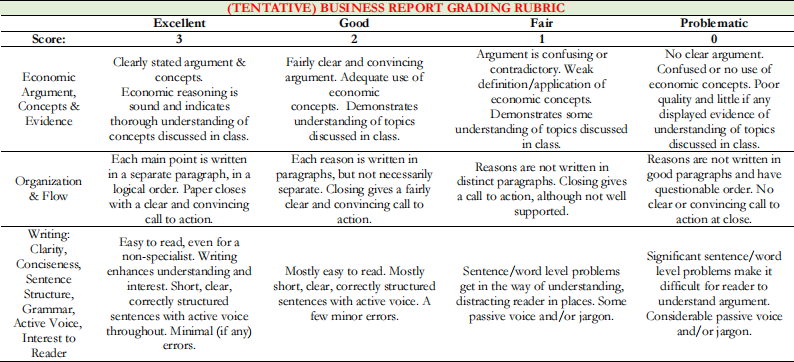

• You will “analyze and solve” this case in Excel and then write up your analysis/findings/recommendations in a (max) five to six page Business Report “addressed” to CCSC’s “management”. The report should have a cover page (with your name but not your Student ID #) and a (max) one-page executive summary (the cover page and executive summary do not count towards the page requirement.)

• If you wish, you can “attach” a technical appendix to your Business Report (no page limit on the appendix).

• There are no specific restrictions/requirements on fonts, font size, margins, etc. You’re an adult – show us your creative side!

• IMPORTANT: Remember you are writing a business-report not an academic paper. In your business report: avoid

“technical jargon”, “fluffy/flowery prose”, “overly-verbose” sentences, “staid” grammar, “equations/math”. Write simple, clear, direct sentences, in an active voice (take a look at Warren Buffet’s Annual Shareholder Letters). Clear thinking is

clear writing and clear writing is clear thinking.

• Make judicious use of graphs, tables, Excel screenshots, and pictures in the business report – don’t be that “scribe” who crams reports with “filler/decorative” graphs, tables, etc. Do you have a “technical” graph which doesn’t “fit” in the

Business Report? Put it in the technical appendix (which has “no page limit” within common reason).

• The Excel file should be properly formatted and labelled. For example: are the top rows “frozen”? Did you adjust column widths to auto-fit data? Are the numbers formatted to the same number of decimal places? Are the axes labelled? “Set up” the Excel file to make it easy for your “client/audience” to use your model with different input/parameter values (why not shade the “input/parameters” yellow and the Solver cells green etc.?). We highly recommend “soft coding” formulas and “naming variables” making it easier for your client/audience to change the parameters, re-solve the problem, and view the “analysis” and “recommendations” .

“Submitting Project 1”

The business-report must be submitted in pdf format titled “LastName_FirstName_Last-5-Digits-Student ID.pdf ” and

the Excel file must be in either “xlsx” or “xslm” format titled “LastName_FirstName_Last-5-Digits-Student ID.xlsx/xlsm”

Please submit the business-report and Excel file through the Quercus Project 1 Tabs (one for Excel and another for the Business Report) by 9 pm, Sunday, January 14th, 2024.

Penalty for submitting any component of Project 1 past the deadline: 50% of maximum project score per day that any project component is overdue.

Please review the policy on using Quercus to submit, grade, and detect plagiarism in course assessments: Normally, students will be required to submit their course essays to the University’s plagiarism detection tool for a review of textual similarity and

detection of possible plagiarism. In doing so, students will allow their essays to be included as source documents in the tool’s reference database, where they will be used solely for the purpose of detecting plagiarism. The terms that apply to the

University’s use of this tool are described on the Centre for Teaching Support & Innovation web sitehttps://uoft.me/pdt-faq ”

“Academic Code of Conduct”

It is your responsibility to read and abide by the Student Academic Code of Conduct. Please note that any attempt to “collaborate”, “receive/provide help” to any other individual/organization is a serious violation of the academic code of conduct.

2024-01-23