Econ 305: Intermediate Macroeconomics Midterm 2 Fall 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Econ 305: Intermediate Macroeconomics

Midterm 2

Fall 2023

Instructions: The exam consists of 4 short answer questions. The use of the textbook, notebook, computer, cell phone, or tablet is not allowed and will result in a score of zero. You are allowed to use a simple calculator. All steps, calculations, and explanations justifying an answer must be explicit to receive full credit. All answers must be handwritten in the paper exam and inserted in the assigned space to be graded. The time allowed is 1:20 minutes.

Question 1 - 30pts

Consider the US economy Phillips Curve: π = πe – α(u – un), where α = 0.25.

a) If the Fed commits to having 2% inflation and the public believe it, how much inflation will result if the economy operates at the natural rate of unemployment. 5pts

π = πe – 0.25u + 0.25un = 2% - 0 = 2%

b) If the Fed commits to having 2% inflation and the public believe it, how much inflation will result from monetary policy decreasing the unemployment rate by 2 percentage points below the natural rate of unemployment. 7pts

π = 2% – 0.25u + 0.25un

π = 2% – 0.25(-2%)

π = 2.5%

The inflation will increase by 0.5 percentage points to a total of 2.5%.

c) After watching the news about inflation, the public stops believing the Fed and now assume expected inflation to be that of question b). How much inflation will result if the Fed tries to again decrease the unemployment rate by 2 percentage points below the natural rate of unemployment. 7pts

π = 2.5% – 0.25u + 0.25un

π = 2.5% – 0.25(-2%)

π = 3%

Inflation will be 3%.

d) Now assume that the Fed is not going to try to decrease unemployment anymore. What would the inflation rate be if the public expect the inflation from c)? What would the inflation be in the next periods? Explain. 7pts

π = 3% – 0.25u + 0.25un

π = 3% – 0.25(0)

π = 3%

Unemployment won’t change and inflation will remain at 3 percent in the next periods.

e) Explain the problem that the FED faces when the public stops believing that the target inflation will be met. 4pts

Lack of trust leads to persistent expected and actual inflation.

Question 2 - 30pts

International investors are deciding where to allocate their capital. The interest rate in the US has been approximately 1%, while the average interest rate in the Euro Zone is 2%. The current exchange rate is 0.8 Euros per US dollar.

a) What is the expected exchange rate for the next period? Use the Interest Parity Condition. 7pts

1+0.01 = 1+0.02 * 0.8/Ee

Ee = 0.808

b) The Fed recently announced that the US interest rate is expected rise to 2% and the interest rate in Europe is expected to remain 2%. How will international capitals flow? 8pts

As the interest rate in the US increases, investors will move their financial capital out of Europe and into the US, increasing the demand for US dollars.

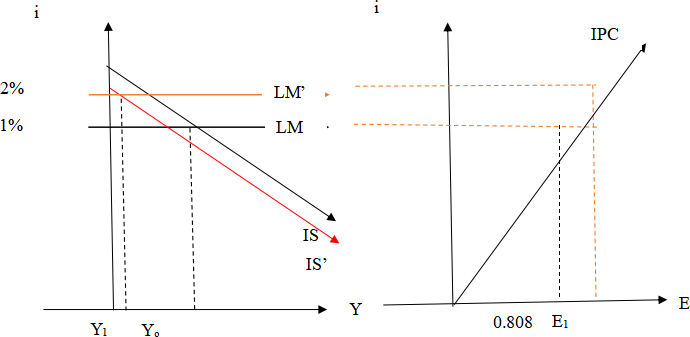

c) How will the exchange rate and domestic output change? Graph the IS-LM-IPC model and explain. 15pts

The domestic interest rate increases, so LM shifts up. The exchange rate will be higher (dollar appreciates) due to the capital inflows. At E1, IS will shift down because of a decrease in net exports. Final output will be lower at Y1.

Question 3 - 40pts

The Fed recently announced that the US interest rate is expected to continue to rise.

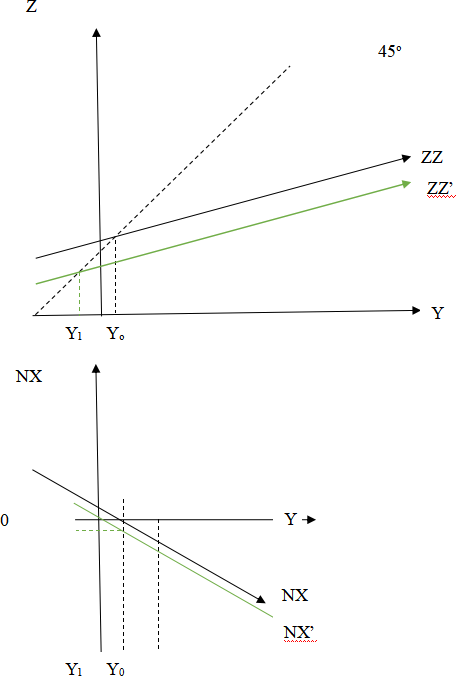

a) How will this change affect the demand for goods and the trade balance? Assume balanced trade as the initial condition. Graph using the aggregate demand and net exports model and explain. 20pts

Investment will be decreased at a higher interest rate and financial capitals will move to the US. The appreciation of the dollar will lead to a deterioration of the trade balance. The Aggregate demand will shift down, leading to a lower level of production. The net export curve will also shift down and at the lower level of production, Y1, leading to an ambiguous effect on the trade balance (lower Y decreases imports, improving net exports, and the net exports curve shifts down).

b) Now assume that the government is considering implementing fiscal policy to return to the initial level of output and avoid entering a recession. What would be the final output and trade balance? You can use your graph from a) to explain. 10pts

The aggregate demand will shift up back to the original level leading to the original level of production. The economy will have a higher trade deficit as imports increase with Y.

c) How does this announcement from the Fed affect countries that have their exchange rate pegged to the US dollar? 10pts

Countries with their exchange rate pegged to the US dollar will also increase their interest rates, attracting foreign financial capital that will deteriorate their trade balance, decrease their investment, and lower their GDP.

2024-01-17