FINS 982 DERIVATIVE SECURITIES AND RISK MANAGEMENT

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINS 982

DERIVATIVE SECURITIES AND RISK MANAGEMENT

CASE STUDY 1

CASE STUDY 1 HEDGING WITH STOCK INDEX FUTURES

See data tables below: You hold 50 million shares of Fund A. To hedge against losses due to systematic risk (meaning setting target beta to 0), you plan to use stock index futures for hedging. The stock index futures under consideration are S&S 500 index futures and SUP 300 index futures, each point worth $250.

a. Write the formula for the optimal number of hedge contracts.

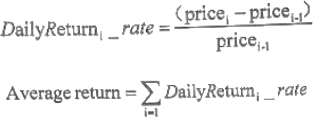

b. Calculate the daily average return of the three securities.

|

Average return of a |

Average return of s&s500 FUTURES |

Average return of s&s300 FUTURES |

|

0.020% |

0.0411% |

0.0353% |

c. Calculate the correlation of returns between the fund and futures, and select the appropriate futures (hint: choose the future with a higher correlation coefficient).

|

CORRELATION-S&S500 |

CORRELATION-S&S300 |

|

0.9665 |

0.9622 |

By comparing the correlation between the two, it is concluded that the more appropriate futures are the S&S500 futures.

Using the same data period from 24/10/22 to 30/5/23 as the other two futures makes it more reasonable.

d. Calculate the beta of Fund A.

|

COV OF A&500 |

VAR OF 500 |

BETA |

|

0.0001 |

0.00011 |

0.93006 |

The covariance of the market and the fund is calculated first, and then the variance of the futures index, which is the market index, is calculated.

e. Determine the number of futures contracts for optimal hedge.

f. Use the data from May to back-test the price movements of the hedged and unhedged portfolios.

This is a group work. Please form a group with no more than 2 students. Write your answer in a word document and hand in with a printed copy before 19:00, Jan-11-2024 (see page above, use it as the front cover). You can use Excel to do the calculation, but please attach the critical data (if not all) in the word document.

2024-01-16